Don’t fight the Fed

Post on: 5 Май, 2015 No Comment

MichaelSincere

MIAMI (MarketWatch) — Now that the Washington debt and shutdown drama is behind us — at least for now — let’s consider a potentially more dire situation: the Fed’s next move.

Do you remember the Fed? Just last month everyone was expecting Ben Bernanke to cut back on quantitative easing (i.e. taper). The high-speed traders had their fat fingers on the keyboard, ready to sell. Would the Dow Jones Industrial Average DJIA, +1.47% drop 200 points or 300? It was the easiest trade in the world.

Shutdown snarls Feds tapering plans

Blame it on the shutdown: The disruptions to government economic data will muddy the Feds assessment of the economys health for months and likely delay plans to taper its bond-buying program. Jon Hilsenrath reports. Photo: Getty Images.

And then, Benny and the Feds surprised nearly everyone by not tapering! The market loved it, and responded with a 200-point rally. It was beautiful. The Dow sailed well past 15,000 and there was blue sky as far as the eye could see. Unfortunately, the next day the market sold off, but it was a fun day while it lasted.

A few economists mumbled that quantitative easing was going on too long, and that if it didn’t stop soon it could cause real damage to the economy. What? Take away the punch bowl? Do you have any idea how the market would react? No, QE must sail on.

And to anyone who thinks that QE could create an asset bubble, St. Louis Fed President James Bullard has an answer. Last month he said that the Fed didn’t see any bubbles. “At least right now,” Bullard noted, “you don’t have anything of that magnitude going on.”

Bubbles are funny things. During the Dutch tulipmania bubble (1634-1637), beautiful tulips were bought and sold for $200,000 each at today’s prices. At the time, few realized they were in a bubble, but who cares? You could make a fortune by buying and selling the tulip without even owning it. Many people got rich before they went broke.

During the Internet bubble (1995-2001), people thought the good times would continue indefinitely; 1999 was a particularly fun year for investors as certain Internet stocks such as pets.com and others with a dot-com name went up by a gazillion points. And during the housing bubble (2007-2009), flipping houses was all the rage. But at the time it didn’t seem like a bubble.

The year of the Fed bubble

If the Fed continues with QE (i.e. excessive monetary liquidity), and it most likely will, the market could rally right into Christmas and beyond. On the other hand, if the Fed even whispers the word, “taper,” the market might convulse. And no one wants that.

One might wonder if we’re now in the middle of a Fed-induced bubble (2009-?). As the market climbs higher because the Fed is reluctant to taper, the bubble might get bigger. Like other bubbles, few will know we’re in one until it pops. That’s the strange thing about bubbles: they can go on for years. Meanwhile, the damage is being done, but no one sees until it’s too late.

If you try to warn people that the market might be rising a bit too fast and too far, they protest. “Don’t fight the Fed,” has been the mantra since the last Fed bubble popped. That’s what they always say.

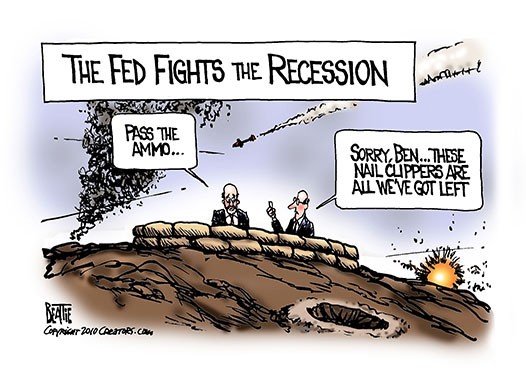

Yes, it’s true, you don’t fight the Fed — at first. But the Fed is only human, and if it makes a mistake (which it’s prone to do on occasion), anything is possible. The Fed has got itself into a pickle this time. If it continues with QE indefinitely, it could cause economic damage. If it cuts QE, the market will protest.

What to do? Keep your eye on the bond market. If the yield on the 10-year Treasury rises above 3%, that could spell trouble for stocks.

If the stock market is in a Fed-induced bubble (we’ll know after it’s over), it won’t be easy to deflate. The Fed will try to reduce QE slowly, which would be an amazing feat. Bubbles cannot be controlled so easily. In a worst-case scenario, that popping sound you hear is not a Champagne bottle.

Michael Sincere is the author of “Understanding Options,” “All About Market Indicators,” and “Understanding Stocks.” His website lists signals from the most useful market indicators.