Don t Invest in International Stocks Without Reading This

Post on: 11 Май, 2015 No Comment

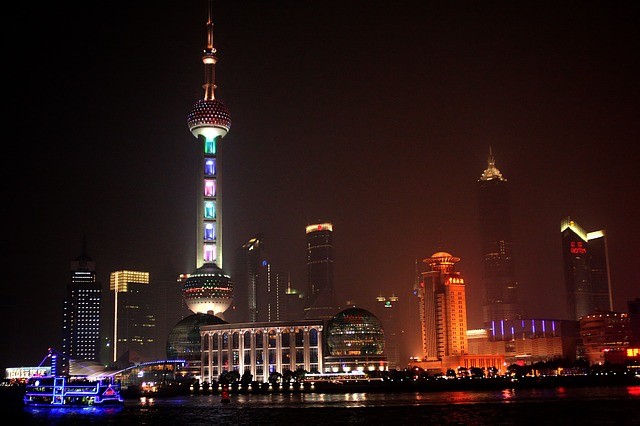

Since the year 2000, the amount of money that US investors have put into international stocks has nearly doubled. This is hardly surprising especially since we are seeing double and sometimes even triple digit gains in many emerging market stock indexes while there have been little if any gains in the Dow. Since the beginning of 2006, countries like Russia and China have seen rallies in the range of 20 to 30 percent while stock markets in countries like Peru are up 70 percent. Opportunities abroad seem more attractive than ever with Canadian and Australian stocks benefiting significantly from the rise in commodity prices. Hong Kong and China are also reaping the benefits from the mainlands solid growth these opportunities are becoming too attractive to ignore at a time when high US interest rates have sent the Dow tumbling. However, as compelling as it may be to immediately send your money overseas in hopes of ending the year higher in your investment portfolios, there are few risks that you must consider before investing abroad.

1. Currency Valuations

The potential fluctuation of the countrys currency that you are investing in is extremely important to consider when making your investment decision. They can easily exacerbate or eradicate your investment gains and losses. If you invested in a Japanese stock for example and the stock remained unchanged, but the Japanese Yen fell 10 percent in value, you would have to make at least 10 percent on the stock to just breakeven on the investment. If the Japanese Yen rallies by 10 percent, then you would have already made 10 percent on your investment even if the stock did not move one penny.

If you are an US investor looking to invest abroad, currency investments impact you in that any delays in your investment decision could easily hurt or benefit you. If the US dollar increases 10 percent in value, the international stock that you wanted to buy becomes 10 percent cheaper. In contrast if the US dollar falls 10 percent in value, the stock becomes 10 percent more expensive.Unlike investments in stocks back at home, investing in international stocks introduces a new risk that US traders may not have previously considered. When investing abroad you need to not only do your homework on where the stock will be headed, but also on where the currency will be headed as well.

2. Political Risk

Aside from currency valuations, political risk is also extremely important when you invest abroad. It was not too long ago that faulty policies of certain countries around the world has forced international investors to deal with the 1994 Mexican devaluation, the 1997 Asian currency crisis and the 1998 Russian debt default. All of these events caused huge losses for foreign investors who lost out on both their equity market investment and the value of the currencies that they were holding. Between the summer of 1997 and the end of that year, the Nikkei fell 30 percent while the Japanese Yen fell 20 percent against the US dollar. This caused any US investor in the Nikkei at the time to lose not 30 percent but nearly 50 percent of their investment money. Although these may seem like one off unlikely and unpredictable events, they are not. In 2006, political turmoil has also caused large fluctuations in the currency market. The Turkish Lira fell close to 20 percent against the US dollar in one month on concerns about inflation and the countrys growing trade deficit. Over in Iceland, between February and April, the Icelandic Krona fell over 25 percent on concerns about the deficit. Anyone investing in those markets would have faced the double blow of equity market fluctuations and as well as currency market fluctuations. Sometimes it works to the benefit of investors, but when it comes to political risks, it usually does not.

3. Lack of Publicly Available Information

Finally, international exchanges also have different regulations in terms of listing and financial reporting. The New York Stock Exchange has one of the most stringent listing rules while many emerging market exchanges do not. This means that scandals or questionable finances may be overlooked more easily than for companies listed on US exchanges. Also, some exchanges may only require reporting of financial results on a semiannual or annual basis and may require the release of less information than you would normally be use to seeing in a 10Q or a 10K. Less regulation raises the risk of corporate scandals which then poses a big risk for the stock itself.

What can you do about it?

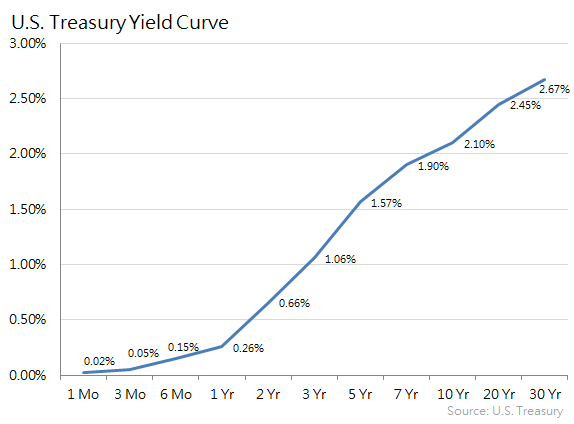

The best way to avoid or minimize these risks is to do your homework! Keep on top of currency movements and invest only in countries whose currency has the possibility of appreciating either because of more promising growth prospects or interest rate hikes. If the outlook for a currency is unclear, then hedging the currency risk through the spot market or an FX spot option may also be a good bet. In terms of political risks and the lack of publicly available information, invest only in the best names in the designated country and only in safe countries such as Switzerland, Canada, and the UK.