Don t Invest in China s Stock Market Slowing Growth and Massive Debt Raise Risk

Post on: 19 Июнь, 2015 No Comment

NEW YORK (TheStreet ) — The outlook for investing in China ETFs and mutual funds seems darker than the smog above Beijing.

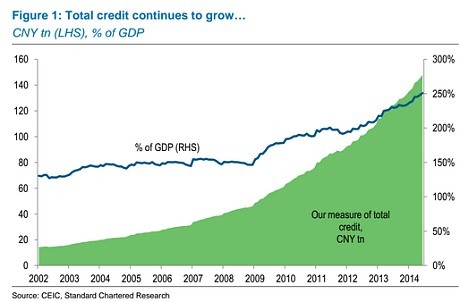

Investors must accept that China’s epic growth the past 25 years has to cool considering the country has already overbuilt, resulting in stratospheric corporate and government debt loads. Investing in China is growing ever riskier amid weakening real estate values and slowing economic growth. At the same time, escalating manufacturing costs have inspired foreign contractors to go to other countries, and a strong currency makes exports less competitive.

The Chinese economy is ultimately headed for some kind of economic crisis, and it just might be getting into real trouble in 2015, the Jerome Levy Forecasting Center wrote in a February 13 report. China’s economy has emitted some disturbing signs of weakness, such as its January merchandise trade report, reports of less travel and spending by Chinese tourists, a broad pattern of weakening Chinese orders at international capital goods manufacturers, and falling home prices in most major cities.

Volatility Rising in the Stock Market

Volatility in China’s stock market shot up in the new year as regulators cracked down on brokers for not following margin rules. Margin trading in China amounts to 2.4% of the stock market’s total market capitalization and is among the highest on the planet. A modest correction could lead to a flood of margin calls that gives way to an onslaught of selling and losses for heavily leveraged investors.

An ETF with exposure to the stock market that mainlanders trade, Deutsche X-tracks Harvest CSI 300 China A-Shares ETF (ASHR ). slipped 6% year to date after flying 56% the prior 12 months, thanks in part to heavy margin borrowing.

iShares China Large-Cap ETF (FXI ) — the flagship ETF tracking China — fell less than 1% so far in 2015 through March 6. It’s up 20% in the trailing year, Morningstar data shows. It outpaced its benchmark by a wide margin. iShares MSCI Emerging Markets ETF (EEM ) has flat-lined this year and is also flat for the trailing year.

In January, U.S. domiciled mutual funds investing in Chinese stocks had no net inflows, after having in December $200 million in net outflows, according to data from Lipper Inc. China ETFs saw $272 million in net inflows the first month of the year, a sharp rebound after experiencing $242 million in outflows in December.

Weakening Economic Growth

In March, the People’s Republic lowered its economic growth projection for 2015 to 7% — the slowest rate in 25 years — after growing by 7.5% in 2014. Growth projections for money supply and consumer inflation were lowered to 12% and 3%, respectively. That’s a slowdown from the 13% and 5.5% growth seen in 2014. Economic growth will taper even more next year to 6.8%, Bank of America Merrill Lynch ‘s (BAC ) economists forecast. This year’s budget deficit was revised higher to 2.7% of gross domestic product (up from 2.3% of GDP) as government spending must be boosted to support economic expansion.