Don t Count Small Caps Out of Your Portfolio US News

Post on: 25 Июль, 2015 No Comment

Small-cap stocks can improve your returns, but they add volatility to your portfolio.

Small-cap stocks have been underperforming the rest of the market as of late, but that doesn’t mean they should be banished from your portfolio. Small companies, usually defined as those with a market capitalization of $2.5 billion or less, hold an important place in every investor’s portfolio. They offer diversification, higher (if more volatile) long-term returns and a way to invest in emerging markets growth.

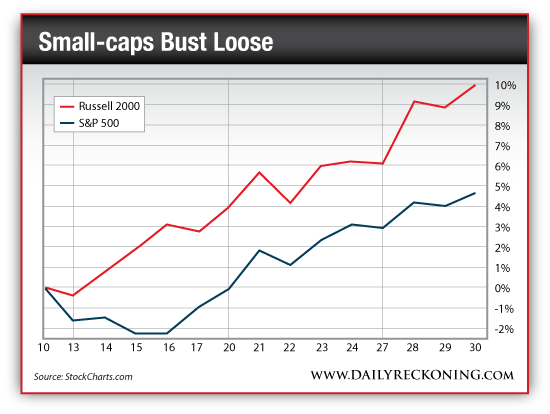

So far this year, the small-cap landscape has been undoubtedly weak. From January 2 to May 20, the Russell 2000 index, which consists of the smallest 2000 companies in the Russell 3000 index, fell 4.5 percent. Meanwhile, the Standard & Poor’s 500 index rose 2.2 percent during the same period. Small caps in the biotechnology sector in particular have lagged. “There was rapid growth in biotech, but it started to be second-guessed and triggered the beginning of a small-cap downdraft since February to mid-May,” says Jim Russell, senior equity strategist at U.S. Bank Wealth Management. “By nature, small caps are higher-volatility areas of the stock market disproportionately affected by the whims of the domestic economy.”

Still, it’s good to have modest exposure to small caps over the long term, he says. U.S. Bank Wealth Management research shows that from Dec. 29, 2000 to Dec. 27, 2013, the Russell 2000 index vastly outperformed the Russell 1000, an index of the highest- ranking 1,000 stocks in the Russell 3000 Index. Investing $1 million in the Russell 1000 during that period would have left an investor with $1.3 million by the end of 2013, but the same investment in the smaller stocks of the Russell 2000 would have yielded $2.4 million.

“That is a compelling total return story for investing in small caps, but we’re seeing the downside of that volatility now,” Russell says.

Tim Courtney, chief investment officer at Exencial Wealth Advisors, says it isn’t likely that small caps will trade at the same price-to-book ratio or price-to-earnings ratio as large caps any time soon. For those who don’t know, the price-to-book ratio compares the market’s valuation of a company with the sum of the company’s assets (subtracting liabilities). Small caps are the most vulnerable when they are start trading at parity with large caps on price-to-book basis. Not yet. Few times have they traded at parity with large caps at a price-to-book basis and when they did, they performed badly for three to five years, Courtney says.

Daniel S. Kern, chartered financial analyst, president and chief investment officer of Advisor Partners, says his firm reduced allocation to small caps by about one-third. Kern says his firm has been using exchange-traded funds such as the iShares Russell 2000 ETF and iShares S&P Small-Cap Fund, but he has also been impressed by the Royce Value Fund.

“I like the value orientation of the stocks. They’re looking for companies trading at a discount to what the intrinsic value of the company is. It’s almost like a private equity investor. There’s a lot of consensus thinking these days and Jay [Kaplan, manager of the fund] is not afraid to be different,” Kern says.

In the long term, small-cap stocks have a performance advantage over large-cap stocks. Small caps returned an average of 7.2 percent over large caps from 1927 to 2013, according to journalist Joe Tomlinson’s analysis in Advisor Perspectives, a collection of investment-related newsletters and databases. Volatility is higher, however, with annual returns for small-cap value stocks swinging from a 53 percent decline to a 125 percent gain over that period (large-cap stock returns ranged from a 39 percent loss to a 54 percent gain).

In a 2011 paper, Rick Ferri, a chartered financial analyst and the author of six investment books, noted that between 1981 and 2010, an equity portfolio composed of one-third small-cap value stocks saw higher returns compared with portfolios containing smaller allocations to small caps. Ferri cautioned that investors should take this approach only if they are capable of long-term investing and can sit through a period of losses.

Bank of America Merrill Lynch released an analysis on small caps in March, predicting headwinds to come after companies gave less-optimistic earnings guidance for 2014. “Estimates have been cut, and the revision ratio has fallen quite dramatically over the past month. The big cuts have occurred in consumer discretionary, energy and health care,” according to the Bank of America Merrill Lynch Global Research report.

Although small caps have underperformed in general, financial small-caps have been performing well. Bank of America Merrill Lynch remains market weight on financials, or in other words, rates them as hold. Bank of America Merrill Lynch is underweight in the staples and utilities sectors and overweight in technology and industrial stocks.