Don t Buy Too Much Company Stock

Post on: 24 Апрель, 2015 No Comment

I went to lunch with a couple former coworkers the other day and we discussed the current issues at my former company. I never mentioned it when I was looking for a new job. but my former company was having financial difficulties. Those problems have recently intensified, and in the last 12 months the companys stock has dropped over 75%. That is an extreme amount and it is putting the future of the company in doubt. I am happy I am no longer employed by them, but I am not happy for the situation some of my friends and former coworkers are in.

Dont put all your eggs in one basket

One of the things I try to do with my investment portfolio is diversify my holdings among several different investments. I primarily invest in index funds because they have the lowest fees and generally cover a wide range of options. One thing I stay away from is investing in my companys stock.

Its not hard to find examples of people who lost their lifes savings after investing heavily in their company only to watch it go belly up. Prime examples include Enron, WorldCom, and dozens of DOTcoms that had inflated prices before the world realized they were only speculations and the bottom fell out.

Another reason is that your job is probably your main source of income, so it already represents a huge portion of your total income producing assets (remember, you can consider your ability to create income as an asset ). In high school my Dad told me the reason he didnt invest in his company stock was that if the company was doing well, chances are he would have a job that would be going well. He chose instead to invest in index funds and similar holdings which has done well for him.

What about company matching?

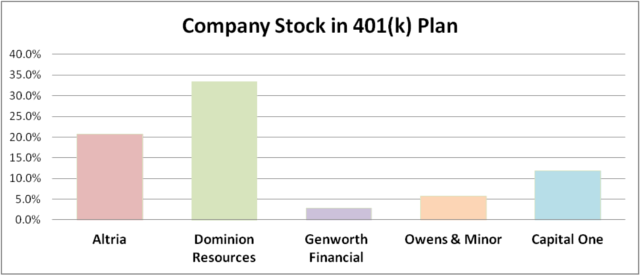

Sometimes companies give matching 401(k) funds as stock, or they fund pensions with company stock. If that is your only choice, then you should probably take it. After all, it is free money, right? But you should be careful that the amount of company stock you own doesnt become too heavily weighted based on your total portfolio. You might look into selling some of it when possible to maintain a balanced portfolio jsut beware of possible tax implications.

What about company discounts?

Some companies offer Employee Stock Purchase Plans that allow their employees to buy stocks at a discount. Sometimes this can be a good deal. If you know your company and think it is well valued (and you arent trading on insider information), then making a stock purchase can be a good thing. Just remember not to own too much company stock relative to your total holdings.

However, you should only buy your companys stock based on its intrinsic value and not only because you are getting a discount. After all, a 10% discount on something that is over-valued means you might be breaking even at best, or at worst losing money.

Owning company stock isnt bad its all about balance

Just like everything else, balance is the key. Your career is already heavily invested in your company, so focus your other investments in places that will give you the best return. The last thing you would want to happen to your company is another Enron type situation.