Dollarcost averaging has flaws but can be a good option for nervous investor

Post on: 12 Май, 2015 No Comment

Now for the hard part.

Fleeing the market a few months ago might have seemed an easy decision potentially painful, yes, but easy, because your gut told you to stop losing money fast. Now many investors are in the confusing state that comes after a mass exodus from stocks.

The question: How and when do you get back into the market?

Andrew Flamm is among those struggling with it. An empty-nester in his early-50s, he recently wrote me: Fortunately, my wife and I moved some of our assets from stocks to cash before the market fell, though in hindsight we wish we had moved more. Now, we feel we should move some of the cash back into stocks, but are unsure how much.

Most Read Stories

Many financial planners try to head off the perplexing question by persuading clients not to budge from the stock market in downturns. They put investors in a mixture of stocks and bonds designed to be a keeper whether the stock market is cruel or benevolent.

For example, a 50-year-old might be encouraged to keep 60 percent in stocks and 40 percent in bonds. For a nervous 50-year-old, a 50-50 mixture might be more palatable.

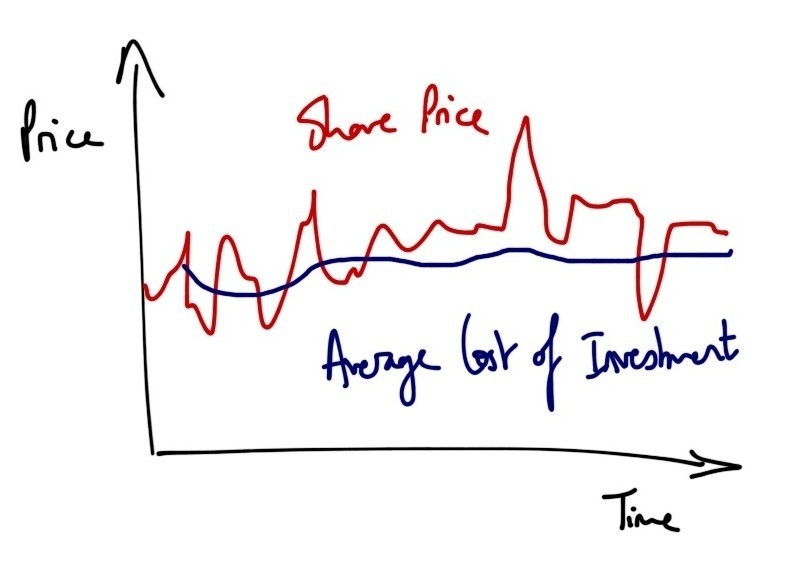

But for those investors who have fled and want to return to stocks, financial planners often suggest dollar-cost averaging.

Under this system, investors move cash back into stocks slowly so they are not unnerved by another downturn. Perhaps the person has $70,000 in a savings account and intends to move $60,000 back into stocks. The thought of putting $60,000 into the market on a single day is frightening: What if the market turns vicious again?

With dollar-cost averaging, the investor might take six months to put the money back into the market moving $10,000 on the same day each month into stock funds.

The theory is that if stocks go up, the investor makes money. If stocks fall while the money is being put to work, the investor is buying more shares at a cheaper price to take advantage of a later upturn.

It sounds promising. But there are no guarantees with dollar-cost averaging.

Investors can still hit a downturn, though, historically, the stock market has climbed more than it has fallen. Studies dating to research by academic George Constantinides in 1979 suggest no solid ground for dollar-cost averaging. Rather, they have suggested that investors do better investing a large lump sum on a single day.

An exception came during the market crash last year. With a $10,000 lump-sum investment in the stock market at the beginning of the year, you would have ended the year with $6,160. With dollar-cost averaging, it would have been $7,440. For more information, plug Moneychimp calculator does dollar cost averaging work into an Internet search engine.

In any market, its difficult to predict what will happen. For a sense of that, an investor need not look any further than the period between March and through June this year. A portfolio of 60 percent stocks and 40 percent bonds rose 14 percent, according to Ibbotson Associates research, while the Standard & Poors 500 index climbed an unexpected 26 percent, including dividends.

Dartmouth College finance professor Kenneth French notes that, because you cant predict the ups and downs, my best guess is that my ideal portfolio next month, next year or 10 years from now is also my ideal portfolio today. Given that, he said, why wait by using dollar-cost averaging?

Yet, there is one solid reason for dollar-cost averaging: your emotions.

Santa Clara University finance professor Meir Statman notes that investors suffer from regret if they invest money and then take a quick loss in the stock market. Even if they are likely to make money in the long term, the loss can be too difficult to bear. The risk is that they pull out of the market after suffering the loss. By spreading contributions out, the investor might hit some better periods in the market and avoid the worst. But even if they dont, dollar-cost averaging salves their emotions.

Dollar-cost averaging involves a strict rule that specifies amounts to be invested at particular points of time, Statman said. Consequently, it helps people with self-control and prevents regret.