DollarCost Averagers How to Invest in ETFs

Post on: 6 Июнь, 2015 No Comment

Dollar-Cost Averagers: How to Invest in ETFs

By: Jeff Brown

Exchange-traded funds have been soaring in popularity, except with one group: people who invest small sums in strategies using dollar-cost averaging. Now that’s changing, as Fidelity Investments joins Charles Schwab (Stock Quote: SCHW ) in offering commission-free trading on some ETFs, eliminating a sizeable cost for small investors.

On Feb. 3, Fidelity began offering commission-free trading on 25 iShares ETFs. Last November, Schwab announced a commission-free policy for eight of the firm’s own ETFs .

It’s a welcome development, but dollar-cost averagers need not limit themselves to the handful of commission-free ETFs. It’s easy to set up a program for using any ETF in a routine-investment program without incurring excessive fees.

ETFs are like mutual funds, except they are traded like stocks. That has long meant incurring a broker’s commission with every purchase or sale. Even with a deep discount broker charging a typical rate of $13 a trade, commissions can chew into an account if you invest only $100 or $200 at a time. For anyone investing $25 or $50 at a time, a $13-per-trade commission would make ETFs very unattractive.

That’s too bad, given that ETFs typically offer rock-bottom expense ratios and great tax efficiency .

Commissions aren’t a problem with no-load mutual funds bought and sold directly with the fund company, as there are no sales changes. Some brokers offer commission-free mutual fund trades as well.

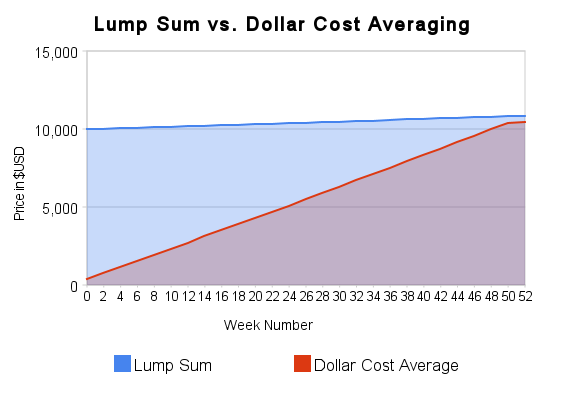

Dollar-cost averaging means investing a specific sum at regular intervals, such as once a week, month or quarter. The fixed amount buys more shares when prices are down, fewer when prices are up. That helps minimize the average cost of purchasing shares. And the regular investing schedule imposes discipline, helping the investor overcome the temptation to time the market.

Most 401(k) investors use dollar-cost averaging, even if they don’t know the term. For investors using IRAs or taxable accounts, many mutual fund companies and brokerages will set up an automatic investing program, sweeping money into a fund from a money market or bank account.

No-commission trading from Schwab and Fidelity eliminates the biggest obstacle to investors who want to buy ETFs in small chunks. But what if you want to invest in any of the more than 900 ETFs that still require commissions?

One obvious option is to look for comparable mutual funds. Since most ETFs are index-style investments that track specific market sectors, most have mutual fund cousins.

But if you really want the low costs and tax efficiency offered by most ETFs, while still investing only a small sum at any given time, the solution is to create a cash way station. Have a sum automatically put into a money market account at the fund company or brokerage every week or month. Then draw from that account for ETF purchases at a longer interval, such as every three or six months.

If you invested $100 in an ETF every week, paying a $13 commission each time, commissions would equal 13% of your investment — perhaps one or two years’ worth of investment growth. If you instead invested $1,300 a quarter, commissions would total $52 a year instead of $676. Commissions would then equal only 1% of your annual investments.

There is a downside: Your money is sitting in a cash account earning virtually nothing for as long as three months, and you’d miss any gains your ETF could provide during that time.

But in the long run it’s likely the commission savings would more than offset the gains missed during the quarter. After all, if you put money aside every week, half of the cash awaiting the quarterly ETF investment would wait for only half a quarter, just six weeks.

For more ways to save, spend, invest and borrow. visit MainStreet.com.