Dollar Rises After Election as Haven Play; Euro Declines Bloomberg Business

Post on: 11 Июль, 2015 No Comment

The dollar traded at $1.2812 per euro as of 8:18 a.m. in Tokyo from $1.2814 at the close yesterday, when it reached $1.2764, the strongest since Sept. 11. Photographer: Kiyoshi Ota/Bloomberg

Nov. 7 (Bloomberg) — The Dollar Index rose to a two-month high as investors sought safety amid concern President Barack Obama will struggle to convince Congress to avert the so-called fiscal cliff after his historic re-election.

The euro fell to its weakest in two months versus the dollar before Greek Prime Minister Antonis Samaras secured support from a majority of lawmakers for austerity measures needed to unlock an international bailout. The U.S. currency declined against the yen as Obama defeated Republican challenger Mitt Romney, who disagreed with current Federal Reserve policy of monetary stimulus. U.S. stocks fell the most in a year as Obama faces the fiscal cliff, $600 billion in tax increases and spending cuts set to be implemented in 2013, which may push the U.S. back into recession.

“It’s still the same problem and there is no magic solution, and that is a big part of the selloff,” said Greg Anderson, the North American head of Group of 10 currency strategy at Citigroup Inc. in New York. “We’re skeptical of the ability of Congress plus the president to pass some grand bargain, at least before Dec. 31.”

The dollar rose 0.3 percent to $1.2771 per euro at 5 p.m. in New York after earlier touching $1.2737, strongest since Sept. 7. The U.S. currency depreciated 0.4 percent to 80 yen after declining to 79.76, weakest since Nov. 1. The euro slipped 0.8 percent to 102.16 yen.

The Dollar Index, which tracks the greenback against the currencies of six major trading partners, rose 0.2 percent to 80.78 after touching 80.92, highest since Sept. 7.

Peso, Zloty

Mexico’s peso fell against all but one of its major counterparts as stocks and commodities declined globally. It weakened 0.9 percent to 13.0711 per dollar.

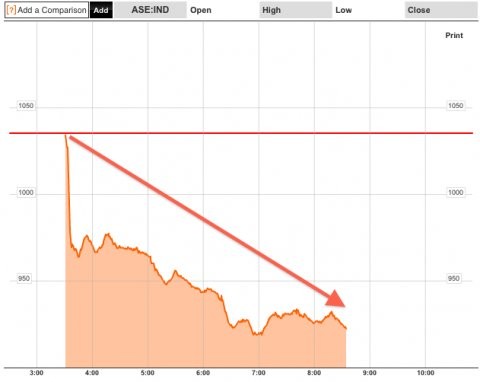

The Standard & Poor’s 500 Index fell 2.4 percent after declining as much as 2.8 percent, the most since Nov. 9, 2011. MSCI World Index of stocks retreated 1.7 percent and the Standard & Poor’s GSCI Index of 24 raw materials lost 2.5 percent.

Poland’s zloty declined as the nation’s central bank Governor Marek Belka signaled he will cut borrowing costs further after the first reduction since 2009 today. The 25 basis point reduction marks the start of “the monetary easing cycle,” Belka said in Warsaw.

The zloty retreated 0.6 percent to 4.1412 per euro. It fell 0.9 percent to 3.2422 per U.S. dollar.

The Czech koruna declined the most in more than a month after the European Commission cut the growth forecast for the euro region, the biggest buyer of Czech exports.

The Czech currency dropped 0.6 percent to 25.398 per euro after touching 25.435, the weakest level since July 26. It slid 0.9 percent to 19.8871 per dollar.

Obama Victory

The extra yield investors demand to hold two-year U.S. Treasuries instead of similar-maturity Japanese government bonds shrank to 16 basis points, the least since Oct. 16, curbing the allure of the dollar over the yen.

Romney had said he disagreed with the Fed’s measures to stimulate the economy and would replace Chairman Ben S. Bernanke at the end of the latter’s term in January 2014. U.S. policy makers unveiled a plan in September to buy $40 billion of mortgage-backed securities every month in a third round of so-called quantitative easing after $2.3 trillion purchases of bonds from December 2008 and June 2011.

That compares to the Bank of Japan, which added 11 trillion yen ($137 billion) to its monetary stimulus last week, to bolster growth through lower borrowing costs.

‘Risks Persist’

Action from the central banks has driven three-month implied volatility for major currencies to the lowest in five years, according to a JPMorgan Chase & Co. index. The gauge, which signals the expected pace of swings in currency pairs for Group of Seven nations fell as low as 7.36 percent, the lowest since October 2007.

“Key macroeconomic and event risks persist, including the ability of U.S. policy makers to effectively address the looming U.S. fiscal cliff and the unrelenting negative news-flow emanating from the euro zone’s sovereign-debt crisis — these may prove to be supportive of the greenback as investors stay cautious,” Samarjit Shankar, a managing director for the foreign-exchange group in Boston at Bank of New York Mellon wrote to clients.

The dollar was the strongest net-purchased currency today, according to BNY Mellon client data.

Greek Agreement

The euro pared losses after Greek lawmakers voted to approve a bill on pension, wage and benefit cuts in the 300-seat Parliament today. The voting was televised on state-run TV as more than 50,000 protesters ringed Parliament.

Approval of the legislation, which raises the retirement age by two years to 67 and cuts wages and pensions a second time this year, is the first of the votes required by Nov. 12 to get a 31 billion-euro ($40 billion) aid tranche and avert a financial collapse that may drive the country from the euro. Parliament will convene again on Nov. 11 to vote on the 2013 budget, a day before euro area finance ministers meet to discuss whether to unlock the funds.

The euro declined 1.5 percent over the past month, according to Bloomberg Correlation-Weighted Indexes, which track 10 developed-nation currencies. The dollar rose 1 percent and the yen fell 0.9 percent.

To contact the reporter on this story: Allison Bennett in New York at abennett23@bloomberg.net

To contact the editor responsible for this story: Dave Liedtka at dliedtka@bloomberg.net