DOLLAR COST AVERAGING VS VALUE AVERAGING

Post on: 25 Апрель, 2015 No Comment

Dollar Cost Averaging vs Value Averaging

Sponsored links:

Many have heard about dollar cost averaging as a means of buying more stock when prices are low and less when prices are high, but few have heard of value averaging which has the potential to increase investment returns. Read this article to understand the difference between the two investment techniques.

Stories similar to Dollar Cost Averaging vs Value Averaging :

Additional information on Dollar Cost Averaging vs Value Averaging :

- As the title suggests, this paper compares two “formula” or mechanical investment techniques, dollar cost averaging and a relatively new proposal, value .

- Oct 30, 2012 . @Financial Independence: I think you are talking about dollar -cost averaging where you invest the same amount each month. With value .

- Praise for Value Averaging. Dollar cost averaging is making a comeback, and Mike Edlesons value averaging approach is dollar cost averaging on steroids.

- Jun 22, 2011 . However, the question definitely got me thinking about my own personal finances. whether dollar cost or dollar value averaging is better, and .

- Mar 15, 2013 . Instead of investing equal dollar sums into the market each month (as with dollar cost averaging ) value averaging investors mechanically sell .

- These are two investing practices that seek to counter our natural inclination toward market timing by canceling out some of the risk.

- Dec 12, 2012 . Also, Value Averaging closely resembles dollar cost averaging but differs in that the investor selects a target growth rate or amount on his or her .

- In contrast to dollar cost averaging which mandates that a fixed amount of money be invested at each period, the value averaging investor may actually be .

Related links about Dollar Cost Averaging vs Value Averaging :

1. Choosing Between Dollar -Cost And Value Averaging — Investopedia

2. Value averaging — Wikipedia, the free encyclopedia

3. a statistical comparison of value averaging vs. dollar . — StudyFinance

4. Michael James on Money: Value Averaging Doesnt Work

5. Value Averaging. The Safe and Easy Strategy for Higher Investment .

Just as dollar cost averaging is a retirement fund’s friend, reverse dollar cost averaging is its nemesis. You can take steps, though, to minimize the effects of reverse dollar cost averaging in retirement withdrawals and not feel its impact later in your golden years.

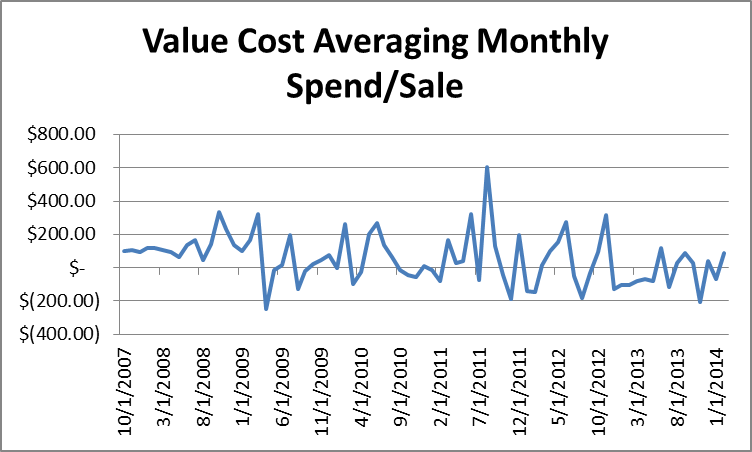

Value averaging uses similar concepts as dollar cost averaging but is less well known by investors. This is a shame since value averaging is a powerful technique that will typically provide better investment returns.

ShareBuilder was founded in 1996 (as NetStock) to provide both online financial information and the opportunity to participate in direct stock purchase plans and dividend reinvestment plans. In 1999, its new CEO launched a more expansive online investment site called the ShareBuilder Plan, based on dollar-cost averaging (the regular purchases of a set amount of securities on a consistent basis). ING Direct acquired the company in 2007 for $220 million.

Despite the schizophrenic nature of the American stock market today, there are plenty of easy stock tips to help beat the market every time. The first and possibly the most critical tip is risk assessment. Every investor must be prepared to lose some or all of their money. However, the likelihood of such a disastrous situation can be mitigated in several ways.

There are companies that pay dividends to their shareholders from the portion of their profits and this is the reason why some investors earn passive income through their dividends coming from their investments. These companies pay dividends to their shareholders monthly, quarterly, half-yearly or annually. The dividends that the shareholders receive are separate from their earnings when they sell or trade stocks from these companies. Some investors invest solely in dividend paying stocks because they want to have an additional income to their investment portfolios.