Dollar Cost Averaging Versus Lump Sum Investing

Post on: 25 Апрель, 2015 No Comment

Summary

- Dollar cost averaging is a process, where the same amount of funds is allocated to preset investment/s at regular intervals of time.

- In this article I compare results of investing a lump sum at once versus dollar cost averaging.

- In reality, few investors have a lump sum to put to work at once. Hence dollar cost averaging works best in real life.

Dollar cost averaging is a process where the same amount of funds is allocated to preset investment/s at regular intervals of time. It is widely believed that investors who choose to systemically allocate funds towards their investments are reducing their risk of investing their whole amount at the top of the price range.

Most individuals use dollar cost averaging to purchase investments. The reason behind these actions is the fact that most individuals are able to allocate funds for investing once a month or every two weeks for example, depending on the frequency with which they are able to save money. If our investor is able to save 15% of their illustrative $1000 monthly salary, which is paid every two weeks or twice/month, they would be able to allocate anywhere between $150 — $225 every month towards their retirement investments. The $225/month is derived for the situation where a person who is paid bi-weekly ends up receiving three paychecks instead of three. Either way, the typical 401(k) investor would purchase the same funds whenever they get paid. The typical dividend investor would likely accumulate new contributions with any distributions from their portfolios, before they make their stock investments. Depending on portfolio sizes, minimum amount of purchases and amount of distributions per month, dividend investors end up purchasing different dividend stocks on a regular basis, which closely mimics the practice of dollar cost averaging.

Unfortunately, few investors have large amounts of cash simply sitting around. that they need to dollar cost average. For those lucky enough to have this happen to them, dollar cost averaging can be a tool to minimize risk of purchasing at the top. It would also help them in gaining more experience in the markets, particularly if they had none whatsoever previously. For lottery winners or those lucky individuals who happen to obtain a lump sum of cash, dollar cost averaging might be a great way to handle the bounty.

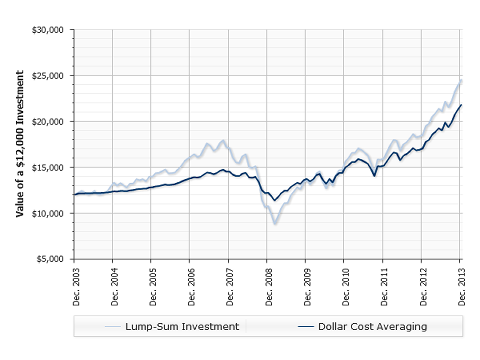

In order to test whether dollar cost averaging gives investors an advantage over lump sum investing, I obtained monthly data for the Vanguard S&P 500 mutual fund (MUTF:VFINX ) between 1987 and 2012. An investor can also make a similar calculation using S&P 500 SPDR ETF (NYSEARCA:SPY ) or a company like Coca-Cola (NYSE:KO ) or Procter & Gamble (NYSE:PG ). In order to calculate dollar cost averaging results for a given year, I would put $100 in investment every month beginning in the last day of the last month of the previous year, up until the last day of November for the next year. For lump-sum amounts, I would put a theoretical $1200 investment either at the closing prices for the previous year. I would then multiply the number of shares accumulated for both dollar cost averaging and lump sum investing times the ending prices by the end of the current year. Next, I would then compare which strategy delivered better results for the given year.