Dollar Cost Averaging Investing in Turbulent Markets

Post on: 5 Май, 2015 No Comment

If youve been following the financial markets at all recently, you know that things have been turbulent. For many people, all this turbulence is scary. After all, how do you know when to put your money in the market and when to pull it back out?

The good news is that you dont actually have to know when to put money in and pull it out if you consider using an investing strategy called dollar cost averaging. Its a strategy that works for long term wealth building using the stock market.

What is Dollar Cost Averaging?

Quite simply, dollar cost averaging requires you to invest a regular amount of money, at regular intervals. Many people choose to invest a set amount of money each month. A good example of this is automatic investing through your Thrift Savings Plan . 401k, or other allotments.

Most investments, whether individual stocks or funds, will allow you to buy partial shares. So, if you have $300 each month that you want to invest in an index fund with a price of $126 a share, you would be able to purchase 2.38 shares.

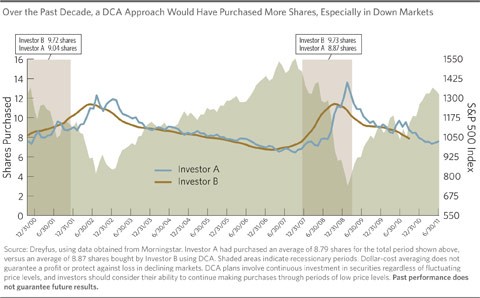

Every month, you invest that $300 (usually the help with automation), and you purchase as many shares as your money will buy on the day the order goes through. So, if the share price goes up to $150 a share, you will buy two shares. However, if the price falls to $100 a share, your investment will purchase three shares. The benefit is that you arent buying as many shares when the price is high, and you are buying more shares when the price is lower (remember, the goal is to buy low, sell high).

The idea behind dollar cost averaging is that, eventually, it all evens out in terms of overall cost. Sometimes you will pay less for your shares, and sometimes more, depending on the market. The important thing with dollar cost averaging is investing consistently.

Why Should You Consider Dollar Cost Averaging?

The reason that dollar cost averaging is so effective is due to the fact that you can get started fairly easily, and with a small amount of money, and consistently invest over time. You dont need a huge amount of capital to get started. You can start a TSP account of 401k plan with as low as 1% of your salary, and some plans even allow you to begin investing with less than that. For example, many online brokers will let you get started with an initial deposit of between $25 and $100, and a monthly investment of between $25 and $50. You can set it up so that your investment comes out of your bank account automatically, each month, on a certain day. Most brokerages will also allow you to make a recurring investment, so your investing is totally automated.

Throughout all this time, you are investing consistently. Even when the market is down (more shares for your money!), you continue to invest. Historically, the market rises over time. With a buy and hold strategy that involves an index fund or a very carefully chosen stock (consider a dividend aristocrat; many online brokerages will automatically reinvest your dividends without charging a transaction fee), you can build your wealth gradually, benefiting from the fact that you are consistently buying shares. For most of us regular folks, thats the best we can hope for and its a fairly tried and true way to build wealth while limiting risks.

There is still risk involved in investing, of course, and you still need to be careful. However, you can reduce some of your risk, and build a consistent nest egg, if you follow a dollar cost averaging strategy.