Dollar Cost Averaging A Poor Way To Reduce Risk

Post on: 5 Май, 2015 No Comment

Dollar Cost Averaging (DCA) involves investing a fixed amount at a regular interval. Lump-Sum Investing (LSI) involves putting in all the money you have available to invest at once. These are not mutually exclusive! If you are investing a portion of your paycheck every month, you are both Dollar Cost Averaging and Lump Sum Investing. The following is not about such habitual savings.

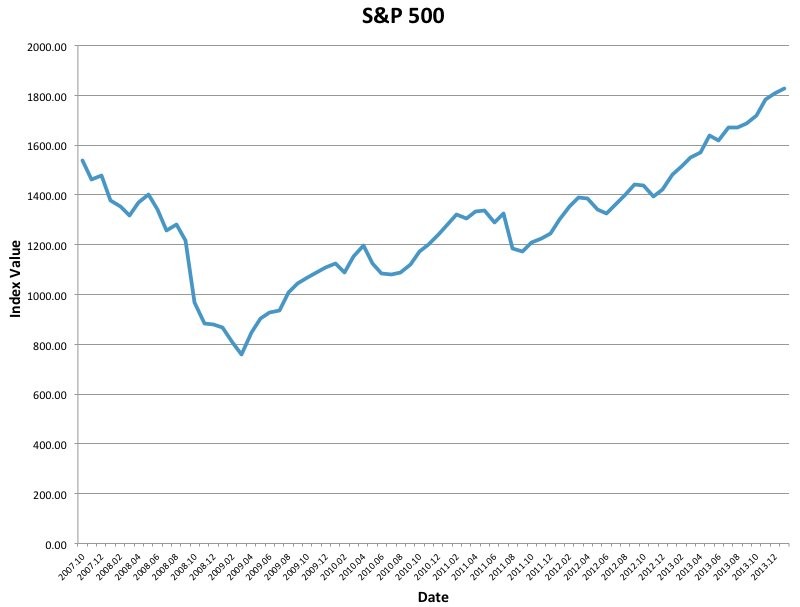

However, a different situation arises if you have a larger amount of money. Maybe you received an inheritance, an early retirement payout, or you just sold your house. Do you invest the entire amount immediately, or buy a little at a time? Due to the overall upward trend of the markets, lump-sum investing outperforms DCA about 2/3rd of the time. The argument then, is that DCA is a risk-reduction mechanism; You get less performance, but also less exposure to those ups and downs. But is DCA the best way to lower risk?

This question was examined in this academic paper titled Nobody Gains from Dollar Cost Averaging by Knight and Mandell. Heres a sample of their results. Lets say you have $100,000 to invest, and you want to achieve a portfolio of 90% stocks (modeled as the S&P 500) and 10% bonds (T-Bills). But that sounds risky to you. You decide to instead invest gradually over 10 years, every month putting a little bit more in, until you finally put $90,000 into stocks.

But what if you instead put everything at once into 50% stocks and 50% bonds, and kept those 50/50 proportions for the entire 10 years instead? That would also reduce your risk. You may be surprised to find out that historically the 50/50 rebalanced portfolio actually had the same amount of volatility than the 90/10 dollar cost averaged portfolio, but with a higher average return (8.37% vs. 8.05%).

So if you are keeping money out of the market because you dont want to be exposed to a crash, it may simply be better to invest in a less aggressive investment mix. But if you are already regularly investing what you can each month, keep it up! This doesnt apply to you.

For more academic papers on why DCA is not the best way to reduce risk, see this AltruistFA reading list. Thanks to reader Craig for sending me this article.

For my overall thoughts on investing for beginners, please see my Rough Guide to Investing .