Dogs of the Dow Top Investing Strategy or Brilliant Marketing

Post on: 16 Апрель, 2015 No Comment

by Silicon Valley Blogger on 2010-04-25 12

In the mid to late 90s I remember seeing an investment strategy that stood out from the rest. The Dogs of the Dow strategy offered a pretty straightforward and easy-to-understand approach, had a solid historical performance, and seemed to be one that would outperform the market consistently going forward. Isn’t that what all investors want? Doesn’t it sound like the golden nugget that all investors scour online broker forums and financial magazines for? Fast forward to today and investors are still drawn to this strategy for the same reasons I had back then. And, there is already much talk about 2010’s Dogs of the Dow and how it will do.

Dogs of the Dow: Top Investing Strategy or Brilliant Marketing?

I guess you may think that Im the perpetual cynic, but I hate to tell you that the Dogs of the Dow really do not perform the way many would lead you to believe. Looking around the internet, many of the titles and jargon certainly would have you thinking otherwise:

“Try Dogs of the Dow. Read on and you will discover a technique that would have given you a 17.7% average annual return since 1973! Thats not bad, especially considering that the Dow Jones Industrial Average overall return was 11.9% during that same period.”

“During the tech bubble of the late 90s, the high dividend stocks of the Dogs of the Dow were up 28.6% in 1996, up 22.2% in 1997, up 10.7% in 1998, and up 4.0% in 1999.

”During the difficult bear market years of 2000-2002, the Dogs of the Dow were up 6.4% in 2000, down 4.9% in 2001, and down 8.9% in 2002, and that was enough to significantly outperform the Dow, S&P 500, and Nasdaq.”

”In 2003, the high dividend stocks of the Dogs of the Dow gained 28.7% and made new, all-time highs despite the massive bear market of 2000-2002!”

“In 2006, the Dogs of the Dow surged to new record highs with a gain of 30.3%. The Small Dogs of the Dow did even better with a gain of 42%!”

As an investor, especially in uncertain times, it sure sounds appealing to me. And, even popular financial media outlets today consider it a strategy that outperforms the market even if the strategy has underperformed lately.

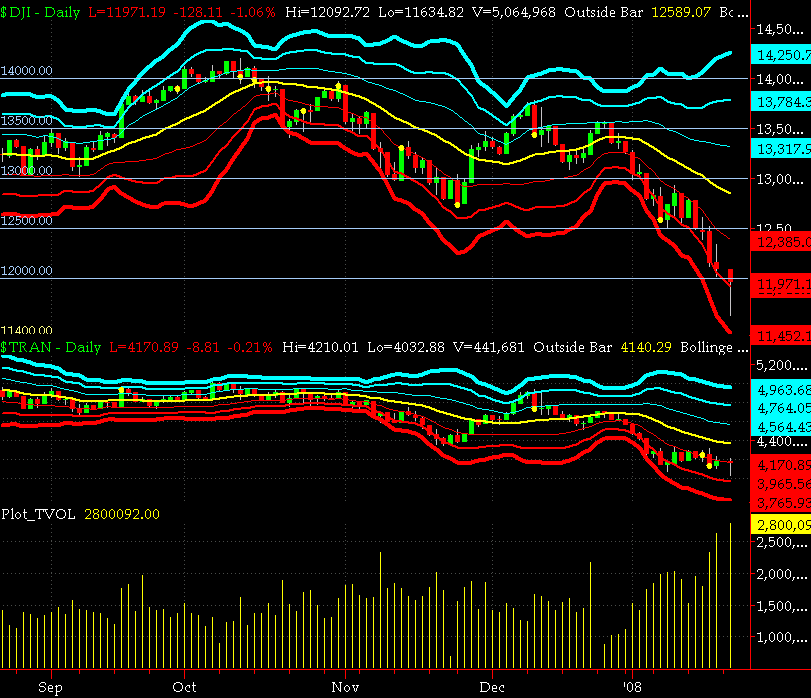

Chart legend applies from left to right (Dogs of the Dow, S&P 500, Fidelity Magellan, Small Dogs of the Dow, Dow Jones Industrial Average, Vanguard Index 500). Image from dogsofthedow.com.

Headlines such as those above and the excitement by industry professionals have created an almost cult following. The Dogs of the Dow still seems to be a popular strategy even when it has been underperforming in recent years. And honestly, I think we all have been misled.

A Deeper Look At The Dogs of the Dow

If you haven’t heard of this before, the strategy entails buying and holding the 10 highest yielding stocks of the Dow 30 Industrials. And its been said that this strategy alone will help you outperform the market itself. One of the underlying premises is that these stocks have a higher yield because as Dogs, their prices have gone down. So, in essence, when you buy the highest yielding stocks that provide a good income yield, youre participating in a value play by buying stocks for cheaper prices than they are actually worth on paper.

Here is the list of the Dogs of the Dow stocks for 2010: