Does The Dogs Of The Dow Strategy Really Outperform The Market

Post on: 8 Август, 2015 No Comment

In one of my latest articles, a retired Merrill Lynch Financial Consultant who used to recommend to his clients the Dogs of the Dow strategy asked me, in a very detailed comment, to run a back-test of this strategy in comparison to the market benchmarks and to my own strategies. Since I think many investors are familiar with the Dogs of the Dow strategy, I will show in this article the last fourteen years return of the strategy. I used the Portfolio123’s powerful screener to perform the back-test, since Portfolio123’s database starts at the beginning of 1999. The back-tests’ results are from that date.

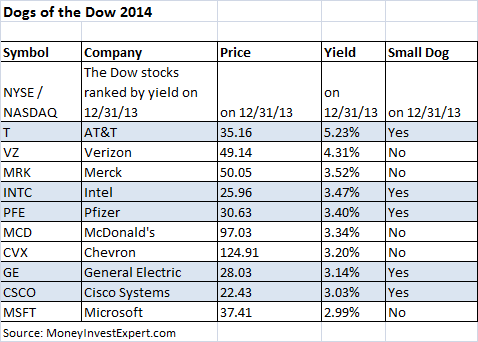

Dogs of the Dow

The Dogs of the Dow is an investing strategy, popularized by Michael B. O’Higgins in 1991, that consists of buying the ten Dow Jones Industrial Average stocks with the highest dividend yield at the beginning of the year. The portfolio should be adjusted at the beginning of each year to include the ten highest yielding stocks.

Back-testing

Ten years back-test

Fourteen years back-test

Summary

The Dogs of the Dow strategy has given better returns during the last five years, the last ten years and the last 14 years than the Dow Jones Industrial Average and the S&P 500 benchmarks. The maximum drawdown of the strategy was much bigger than the maximum drawdown of the benchmarks in all the three tests.

The 10-year average annual return of the strategy was at 6.11%, while the average annual return of the Dow Jones Industrial Average during the same period was at 4.56%, and that of the S&P 500 index was at 4.90%.

The 14-year average annual return of the strategy was at 4.45%, while the average annual return of the Dow Jones Industrial Average during the same period was at 2.75%, and that of the S&P 500 index was at 1.27%. The maximum drawdown of the strategy was at 68.54%, while that of the Dow Jones Industrial Average was at 53.78% and that of the S&P 500 was at 65.01%.

Although the Dogs of the Dow strategy has given better returns than the benchmarks, I have shown in my articles some strategies that have given much better return with much smaller maximum drawdown.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.