Does Owning International Stocks Really Help Diversify my Portfolio

Post on: 4 Май, 2015 No Comment

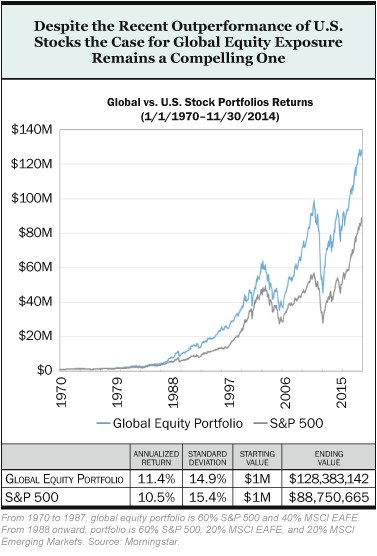

Diversification is hailed as an all-important tenant of successfully investing. Many talking heads and basic beginners books advocate owning international stocks as a great way to diversify ones holdings. A growing number are advocating international equities because they see an immanent downfall in the United States markets or government. Im here to tell you, that they really shouldnt be treated as a diversification tool.

The Problem I see with International Stocks versus Domestic Stocks

What a lot of these old guys forget is that we live in the 21st century. Even in the 20th century they should have seen this coming: a given company is likely to be producing goods and services in a different currency than its home country and catering to a completely different customer base in another country.

Think about that one second. Im making the argument that a a group of companies like McDonalds, Ford, Wal-Mart, etc. is just as good of an international holding as a random ETF of European stocks. Why? Because these businesses cater to an international audience just as much if not more than their American one.

How Should I Invest in International Stocks?

Thus, I feel it is not necessary to own international stocks for the sake of diversifying into international asset classes. Its a matter of you doing the math and figuring out how much exposure you want to the world. Conceivably, advisers are correct in why they want you to buy international stocks but, that is just such a blind recommendation.

Rather, investors need to say, for example, BP is a great company because they have exposure to the following markets Now it is all about exposure, exposure to customers, governments and foreign currencies. You could build an entire portfolio of only American based companies that do business almost exclusively outside of the United States.

What Percentage of my Portfolio should International Stocks be?

International equities have been recommended by more conservative investors to comprise somewhere between 10-20% of a given portfolio. More radical investors have suggested more than 50% in international equities. I would say 50% is more appropriate but, dont force owning international stocks.

Whatever you do, dont just pick up an ETF of Russia or a mutual fund that matches South America, without having a goal and a reason. Not all of the world is worth investing in or appropriate for your goals. You might make an assessment like, Eaton has great exposure to North America, Europe and Eastern Europe. You could contribute that holding to your international equity.

Please Buy International Stocks!

Im not saying avoid international holding all together, just saying double check your efforts. Its incredibly frustrating to hear about someone who buys an international mutual fund to find out later that a general S&P500 or broad based index already holds the majority of the securities in it.

Its really a matter of being informed. Yes, owning international stocks really does help your diversification. But, you need to be smart about it. Dont go foreign just for the sake of being exotic or chasing high growth. Go because you understand your domestic stocks, their international exposure and you like what you see in a given part of the world.