Does NAV of mutual fund really matter

Post on: 27 Март, 2015 No Comment

Before buying anything, we all have a tendency to check the price of that particular product. Be it household items, apparels or even stocks. And to get the best deal possible we also do bargain. Don’t we? Unfortunately this tendency of checking the price (NAV) has also creped into many of you investors while investing in mutual funds. But have you thought — does that really matter while investing in mutual funds?

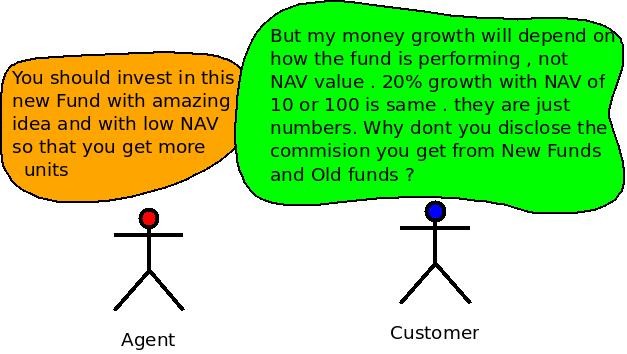

Checking a fund’s NAV before investing is absolutely a futile and a baseless exercise, in our opinion.

Well you may not believe it instantly; as the habit of first checking the price of a product runs in your nervous system. It always plays on your minds that lesser the NAV, the cheaper the mutual fund scheme.

Even in case when an New Fund Offer (NFO) hits the market, a large section (going by the “habit”) of you investors rush into investing in the fund without even assessing what is its mandate, where and how would it invest the corpus collected and whether does it really suits your risk profile. This is because the offer price of 10 excites you. Similarly, when an existing mutual fund scheme’s NAV is low, you all tend to again perceiving it to be a buying opportunity.

But please recognise that, the approach of investing in mutual funds by judging its price – the NAV, cannot be followed just as the same manner while investing in stocks. This is because when you invest in a mutual fund, you buy units at its NAV. Thus you buy the units at a price (i.e. NAV), the calculation of which is based on the current market price of all the assets that the mutual fund owns. In other words, the NAV represents the fund’s intrinsic worth.

However in case of the stock market investing, the stock price of a company is usually different from its intrinsic worth, or what is called the book value of the share. The stock price could be higher (premium) or lower (discount) as compared to the book value of the company. A relatively lower share price would, other things being positive, make it an attractive purchase (as the share seems undervalued).

The reason for such a ‘mis-pricing’ could be that you investors evaluate the company’s future profitability and suitably pay a higher or lower price as compared to its book value. This does not hold true for open-ended mutual funds – they always, always, trade at their book value; so you never buy them cheap or expensive in that sense.

Remember, increase or decrease in the NAV of a mutual fund scheme is a function of how well the fund manager makes his investments bets in the market as well as how long the fund has been in the industry.

The illustration present in the table below will also clearly help you establish the irrelevance of NAV while making an investment decision.