Does International Investing Still Add Value Greenspring Wealth Management

Post on: 4 Май, 2015 No Comment

Greenspring Blog

J. Patrick Collins Jr. CFP®, EA

Does International Investing Still Add Value?

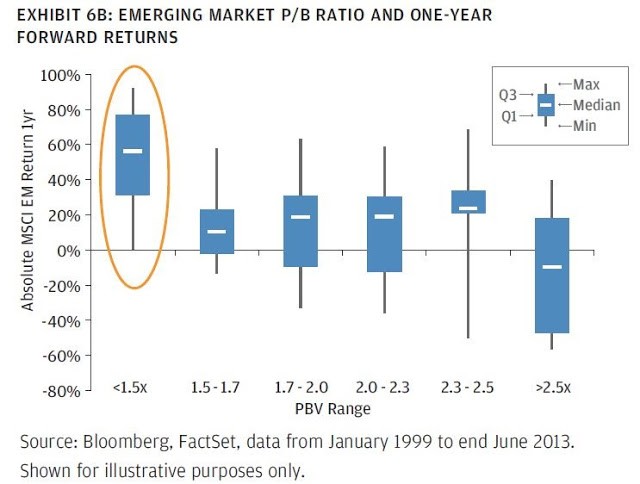

For those of you keeping score, the US stock market has been trouncing its foreign brethern for the last 5 years. The S&P 500 has generated a return of 15.96% for the 5 years ending on 11/30/2014. Conversely, the MSCI EAFE and MSCI Emerging Market Indices have returned a meager 6.38% and 3.88%, respectively. To put it another way $1 million invested in each of these three markets would have produced the following results:

- US (S&P 500)- $2.22 million

- International (MSCI EAFE)- $1.39 million

- Emerging Markets (MSCI EM)- $1.26 million

While all have been positive, the US is the clear winner and these results are causing some to question whether international diversification is really necessary. The argument is typically something along the lines of US companies sell globally now, so does it really matter where a company is domiciled. I think it is a fair statement and one that is worth exploring in more depth. Because of that we went back for the past 44 years to see if this is a common occurance or one we should be concerned about. Here are the results (click on image):

The highlighted cells show the years where each market was the best performer. At first glance what you see is that each market has had its day in the sun and there doesnt seem to be any rhyme or reason for which market is going to outperform. In fact, over the past 44 years the US stock market and Emerging markets have both outperformed 16 of those years, while the International stock market has outperformed 12 of those years. In addition, there was a time from around 2001 until 2007 where many were questioning whether investors should have exposure to US stocks, since Emerging Markets seemed to be the place to be. Like always, that trend reversed and the pendulum has swung the opposite direction. Instead of trying to guess which market is going to outperform in the future, we continue to stress that it is important to own some of each. Youll always be happy (that you have the best performer in your portfolio) and upset (that you have the worst performer in your portfolio). If you are interested in what that balance of US/International/Emerging Markets should be, please read our thoughts on the topic.

Information contained herein has been obtained from sources considered reliable, but its accuracy and completeness are not guaranteed. It is not intended as the primary basis for financial planning or investment decisions and should not be construed as advice meeting the particular investment needs of any investor. This material has been prepared for information purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Past performance is no guarantee of future results.