Does Higher Risk Really Lead To Higher Returns

Post on: 16 Март, 2015 No Comment

Does Higher Risk Really Lead To Higher Returns?

David Allison

20 Jan, 2012

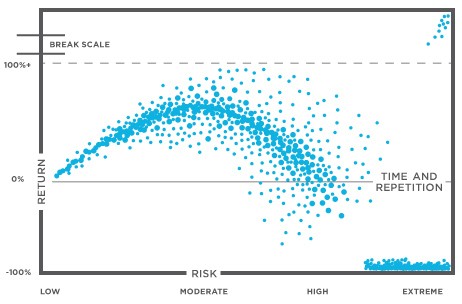

Many widely accepted financial models are built around the premise that investors should expect higher returns if they are willing to accept more risk. However, will investing in a portfolio of risky stocks really help increase your investment returns over time? The answer may surprise you. Read on to learn about what is being dubbed the low-volatility anomaly, why it exists, and what we can learn from it.

The Low Down on Low-Volatility Stocks

If the modern portfolio theory holds true, a portfolio of risky, highly-volatile stocks should have higher returns than a portfolio of safer, less-volatile stocks. However, stock market researchers are discovering that this may not always be the case. A March 2010 study by Malcolm Baker, Brendan Bradley and Jeffrey Wurgler, published in the Jan./Feb. 2011 Financial Analysts Journal and entitled, Benchmarks as Limits to Arbitrage: Understanding the Low-Volatility Anomaly, demonstrated that from Jan. 1968 to Dec. 2008 portfolios of low-risk stocks actually outperformed portfolios of high-risk stocks by a whopping margin.

The study sorted the largest 1,000 U.S. stocks monthly into five different groups, based on two widely accepted measures of investment risk. The authors ran the study once, using trailing total volatility as a proxy for risk, and again using trailing beta. Over the 41-year period, a dollar invested in the lowest-volatility portfolio of stocks grew to $53.81, while a dollar invested in the highest-volatility portfolio grew to only $7.35. The findings were similar when they grouped stocks based on trailing beta. Over the same period, a dollar invested in the lowest-beta portfolio of stocks grew to $78.66, whereas a dollar invested in the highest-beta portfolio grew to a paltry $4.70. The study assumed no transaction costs.

These results fly in the face of the notion that risk (volatility) and investment returns are always joined at the hip. Over the study period, a low-risk stock investor would have benefited from a more consistent compounding scenario with less exposure to the markets most overvalued stocks. (For a related reading on how volatility affects your portfolio, check out this article from Investopedia Volatility’s Impact On Market Returns .)

Fast Money?

Proponents of behavioral finance have presented the idea that low-risk stocks are a bargain over time, because investors irrationally shun them, preferring stocks with a more volatile, lottery style payoff. Backers of this school of thought also believe that investors have a tendency to identify great stories with great stocks. Not surprisingly, these highly touted story stocks tend to be among the markets most expensive and most volatile. Overconfidence plays a role here, too. As a whole, investors misjudge their ability to assess when stocks will pop or drop, making highly volatile stocks appear like a better proposition than they really are. Even the so called smart money has a tendency to gravitate towards risky stocks.

Many institutional investors are compensated based on short-term investment performance and their ability to attract new investors. This gives them an incentive to pass up less volatile stocks for riskier ones, especially in the midst of a raging bull market. Whether it is bad habits or disincentives, investors have a tendency to pile into the market’s riskiest stocks, which drive down their potential for future gains, relative to less volatile ones. Consequently, low-risk stocks tend to outperform over time.