Do Stock Broker Commissions And Fees Really Matter

Post on: 26 Май, 2015 No Comment

In this article I am going to discuss the topic of stock broker commissions and if they make a significant difference to your bottom line when trading.

If you have read other parts of this site, you may be aware that I only ever trade with discount stock brokers. I never use full service stock brokers for my personal trading.

This video I made talks about the differences between discount brokers and full service brokers, and how they can effect your bottom line.

If you have a few minutes, it may be worth your time to watch the video as I discuss many reasons why I prefer to use discount brokers over other types of brokerages.

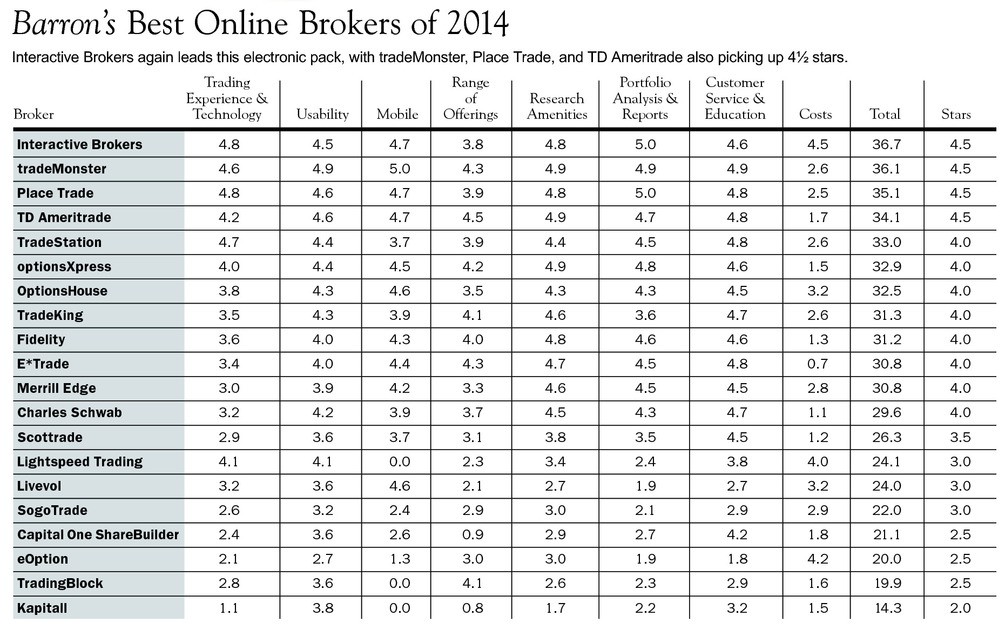

There are quite a few brokers that charge less than $5 a trade including Zecco. Tradeking and Optionshouse. and the difference in fees compared to a full service brokerage is considerable, and can really add up and effect your capital.

There are many full service brokers that charge over $100 per trade that is executed. For many people, this is an exorbitantly high commission to pay for trades, and it is easy to see how this can quickly eat away at most peoples money, and make investing cost-prohibitive for most investors.

There are two main factors that will determine the significance of stock broker fees. First of all, the size of your account and secondly the number of trades you make. Lets look at an example with this scenario below:

Trading Account size $25,000

20 trades per month/240 a year

If we use this scenario and pay $5 for each trade, our trading commissions for the year would equate to $1,200 (240 trades * $5). This equates to 4.8% of our account balance.

If we use this same scenario, but pay $20 per trade, the annual trading fees would rise to $4,800. This equates to 19.2% of our account balance. This is a significant amount of money you would have to earn just to break even .

It would make less of a difference with a bigger account balance with fewer trades. Lets look at this scenario:

Trading Account size $100,000

100 trades per month/100 a year

At $5 per trade, the stock trading fees would be $500. This is just 0.5% of the account balance.

At $20 per trade, the stock broker fees would be $2,000. This is 2% of the account.

Whilst on a larger account with fewer trades, the chunk you pay your broker in commissions is much lower. It can still make quite a difference, especially if you consider the added loss of future earnings on the money if you had retained it, making the actual amount of money lost to commissions much greater than just the initial 2%.

Conclusion

In conclusion, shopping around for your broker is always a good idea. The more trades you make the more you could potentially save, and the greater your chances of realizing real gains in your investment account.

It is also worth making sure you are aware of any hidden charges your broker may have. Some brokers have extra charges if your account is inactive for a period of time, some have extra charges for penny stocks . Always familiarize yourself with your brokers policies prior to investing any capital.

My Discount Stock Brokers and Penny Stock Brokers page can help you learn more about these and other important considerations when choosing a stock broker.