Dividends Matter

Post on: 16 Март, 2015 No Comment

Many investors harbor the notion that dividend-paying stocks do not enjoy competitive total returns. But, the facts tell a different story.

Historical Returns of Stocks

Source: ThomasPartners Research

Growth matters too

While this data suggests that dividend-paying stocks, as a group, have historically outperformed non-payers, it also suggests that stocks that regularly grow their dividends do best and they have.

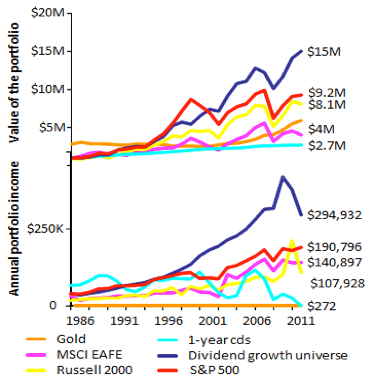

There are presently about 250 dividend-growth stocks; i.e. stocks that have a minimum ten-year record of uninterrupted annual dividend growth. The top chart reveals the growth of a portfolio invested only in dividend-growers each year compared to other common strategies; the lower chart offers a relative portfolio income comparison.

Dividend-Growth Stocks vs. Others

Source: ThomasPartners Research*

More is better than less

The historical performance of dividend-growing stocks, as a group, is often attributed to biased selection; a suggestion that the ability to deliver regular dividend growth identifies better companies, better business models, and, therefore, better investments.

Of course, quality matters and so does growth. But does the absolute amount of dividend income, itself, impact total returns? In other words, will stocks with higher current yields have better total returns, over time, than stocks with low current yields, regardless of growth rate?

The following chart is hard to decipher, but worth the effort. It goes back to 1971 and annually segregates all dividend-paying stocks into five portfolios according to relative current yield. Each blue portfolio represents 20% of the total number of dividend-paying stocks and each was started with an initial value of $1 million.

Total Returns of Dividend-Paying Stocks

$1M invested in 1972 through 2011

Source: ThomasPartners Research

This chart reaffirms the historical fact that dividend-paying stocks, in general, have outperformed non dividend-payers. It also shows that rising current yields bred rising total returns, but only to a point. The highest current yields (quintile #5) signaled impending problems.

It suggests, too, that the 4 th quintile of dividend-paying stocks in any given year has performed relatively best, as a group and over time. It should come as no surprise to learn, therefore, that ThomasPartners portfolios are predominately populated by 4 th quintile stocks.

Dividends are always positive

Investment risk is complicated. It is defined, by most accounts, as the occurrence of the unexpected. Of course, stock price movements are frequently unexpected, so most investors attempt to manage risk by managing stock prices, not dividends (which are rarely unexpected).

But, in actual practice, dividends are a very effective method of mitigating the risk of price volatility. The return from dividends is always positive. It never creates losses and it can never be taken back by future market downturns. Historically, stocks that pay dividends have also experienced less relative price volatility, particularly when general markets are in decline.

But this tempering impact on the volatility of total returns is not fully appreciated, largely because the returns from dividends seem so small. Factually, they are relatively small in any given year, but over a series of years, the impact of dividends adds up.

Observe the recurring impact of dividends on the general markets’ total returns, by decade, since 1900:

Contribution of Dividends to Total Returns

Unless otherwise indicated, data is as of 12/31/2011

Source: Ned Davis and ThomasPartners Research*

Why Dividends? is a proprietary publication and the property of ThomasPartners;, Inc. Any reproduction or other unauthorized use is strictly prohibited. All information contained from sources other than ThomasPartners in Why Dividends? was obtained from sources deemed qualified and reliable; however ThomasPartners, Inc. makes no representation or warranty as to the accuracy of the information contained herein.

Past performance is no indication of future results, the value of investments and income derived from them can go down as well as up. Future returns are not guaranteed and the value of principal may go down.