Dividends Dividend Investing

Post on: 30 Май, 2015 No Comment

A dividend is a payment made by corporation to its shareholders, usually as a distribution of profits. Essentially, you buy an investment that pays you for owning it.

All investors, regardless of how novice or experienced they may be, need to understand the value of dividend investing. However, many miss out, especially during periods of rapid stock market growth, when even high-yielding dividends lose their appeal in comparison to double- and triple-digit stock market returns.

But the markets that deliver 100% stock returns are temporary and unpredictable. Most dividends, on the other hand, are paid regularly, are often predictable and are a terrific measure of a company’s success and its commitment to its shareholders.

Investors should prioritize dividends – and today there are many terrific ways to invest in dividend paying stocks, collect dividends, and grow your wealth. Most investors first become familiar with common stocks that pay dividends. And the better dividend stocks pay every year, often on a quarterly basis, with the best increasing the amount they pay regularly.

Dividend Investing Tips

Knowing a company’s record of dividend increases, and calculating a statistic known as dividend growth, is important for investors to determine whether or not to buy, or keep, a dividend stock.

A very popular dividend stock is called a REIT (pronounced “reet”). REIT stands for real estate investment trust. REITs invest in real estate – commercial and residential – and are required to pay its shareholders the majority of its income.

Like REITs, master limited partnerships, known as MLPs, are required by contract to pay its income to its shareholders, although MLPs invest in natural resource businesses like oil and natural gas as opposed to real estate. Bonds are also popular with investors for their income, but they pay interest, not dividends.

You see, stocks are “equity” – owning shares means you own part of the company – while bonds are “debt” – the company pays you interest for borrowing your money which will be paid back upon maturity.

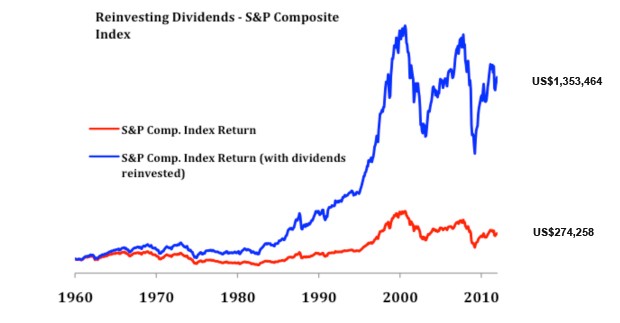

Dividend stock investors also need to know many other terms like “ex-dividend date”, the date before which an investor needs to buy a stock in order to be entitled to the next dividend and “high yield” – once referred to as “junk” – that can be an indicator of the riskiness of an investment. Those interesting in dividend investing should also be aware of other acronym’s like DRIP, which stands for “Dividend Reinvestment Program. DRIP can be a great way for investors to systematically grow their wealth.

Dividend investing is an expansive topic and its worth taking the time to do your research to ensure success as a dividend stock investor. Familiarizing yourself with the many types of dividend stocks and the terminology associated with them can help you get on, and stay on, the path towards wealth.