Dividend Reinvestment Plans A Potential Combination of Capital Gains Cash Flow Investing

Post on: 18 Июль, 2015 No Comment

January 13, 2014 Craig Adeyanju Follow me on Twitter here.

There are scads of options open to investors who are building a portfolio aimed to be beneficial to them in retirement. One of them is having a Dividend Reinvestment Plan – or DRiP, for short. Just to be sure, DRIP involves reinvesting the dividend you receive from a company you own back into the same company.

In essence, this strategy is aimed at growing your position in a given company without putting in additional cash. In this article, I’ll discuss how you can combine both cash flow and capital gains investing in a dividend reinvestment plan.

2 Types of Investments Combined in One

I, personally, like to see DRiP as a way of investing in cash flow as well as investing for capital gains. Here is how. If you reinvested the dividend you received in a given quarter, you become open to two potential advantages:

- The subsequent dividends you’ll receive from the company would be higher, which embodies what cash flow investing is all about.

- The value of your position increases in an event that the stock price of that company rises, which is what investing for capital gains is all about.

Housekeeping matters: This strategy would only be effective if you invest in great businesses. With that, I mean investing in companies that have solid fundamentals and a good track record of pulling surprises.

Dividend vs. Non-Dividend Stocks

The long-standing legacy of dividend stocks outperforming non-dividend stocks validates this idea. Let’s break it down. Take Coca-Cola (NYSE:KO ) for instance. Note that this company has its own DRIP and it currently pays an annualized dividend of $1.12 per share – or $0.28 per share every quarter.

If you own say 1000 shares of Coca-Cola at present, you’d receive $280 in dividend for the first quarter (provided dividend payout remains unchanged). Reinvesting the entire dividend you receive from Coca-Cola will add about 6.92 shares to your position in Coca-Cola, meaning that you’d have 1006.92 shares of Coca-Cola at the end of the first quarter (Note that reinvestment fee of $2 has been deducted). That figure is arrived at using Coca-Cola’s 200-Day Moving Average of $40.18 a share. And the calculation here is fair considering that Coca-Cola traded pretty much in this region all through 2013.

If all parameters remain constant, you’d have additional 6.97 shares of Coca-Cola at the end of the second quarter, additional 7.02 shares of KO at the end of the third quarter and an additional 7.07 shares of KO at the end of the fourth quarter. Hence, by the end of the year, your portfolio would have 1027.98 shares of KO. As one quarter rolls over the other, your income increases without spending a dime. This satisfies what cash flow investing is about.

Now, if Coca-Cola makes a great business decision in future, which ends up or would end up expanding its business, chances are its stock price would be positively affected. Being the world’s largest beverage company, and with its history of springing surprises for more than a century, there are enough reasons to hope for such phenomenal business decision.

In the end, positively affected stock price would translate to an increased value of your position – even higher than you would have attained without a reinvestment plan. I call this a ‘double-win’ situation, where you earn capital gains for positions that didn’t directly affect your cash reserve. This rather represents a better scenario of investing for capital gains.

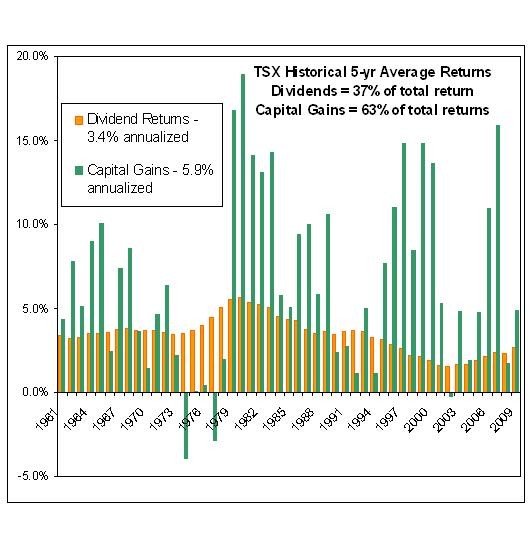

Comparing the history of the total returns of blue-chip dividend stocks with non-dividend ones shows that this could be a more effective strategy of investing for capital gains.

For this comparison, we’ll compare the total returns of Coca-Cola with that of Berkshire Hathaway (NYSE:BRK-A ). We’re choosing Berkshire here because its owner, Warren Buffet, owns shares of Coca-Cola.

Growth of KO compared with BRK-A

Source: Morningstar.com

As seen in the image above, Coca-Cola performs better than BRK over the long-term with regards to total returns. You should note that Coca-Cola’s performance would be better were DRIP taken into consideration in the calculation above.

In Conclusion

Like all things good, a few potential disadvantages exist that you need to come terms with if you must combine capital gains and cash flow investing in DRiP. The biggest one, in my opinion, has to do with stock price movement.

For every business, good or bad, times would always come when things aren’t favorable. Considering that the market usually responds so quickly to such developments, the stock price of the company you own could plummet. You can see this in the case of Coca-Cola.

As such, to be successful with DRIP, you need to look beyond short-term market changes. In essence, you need to have a strong investment discipline. The only thing that should make you panic in such situations is if the ‘great business’ you invested in at the beginning is no longer there.