Dividend Growth Stocks How To Manage Your Dividend Portfolio In A Downturn

Post on: 20 Апрель, 2015 No Comment

Tuesday, August 16, 2011

How To Manage Your Dividend Portfolio In A Downturn

The recent turbulence in the market has provided income investors first hand experience in managing their dividend growth portfolio in a declining market . How have you reacted to this downturn? Has it been a source of despair and gloom, or has it been a source of excitement?

Here are some things that will help you succeed and thrive when the bear puts his paw print on the market:

I. Remember Why You Are An Income Investor

The goals of an income portfolio are different than those of a capital-appreciation-based portfolio. The good news is an income portfolio consisting of dividend stocks can not only succeed, but excel during a down market.

The goal of dividend investors is to build a steady stream of rising income from solid companies. While everyone else is panicked about their portfolios decline, income investors see the downturn as an incredible buying opportunity.

II. When The Chips Are Down, Go For The Blue Ones

In what seems to be a perpetually declining market, one of the true bright spots is the ability to strategically pickup some bargains in the bluest of blue chip stocks. Normally, these stocks are difficult to buy due to a built in safety premium for times like these.

Over-allocate safe stocks and save the risker investments for when they are needed (more later). Here are some traditional low risk dividend stocks that with a RQ rating of A3 or better trading below their calculated fair value:

Lowe’s Companies, Inc. (LOW) | Yield: 2.7%

RQ: A1 | Discount %: 28.5%

Lowe’s Companies, Inc. sells retail building materials and supplies, lumber, hardware and appliances through more than 1,700 stores in the U.S. and Canada.

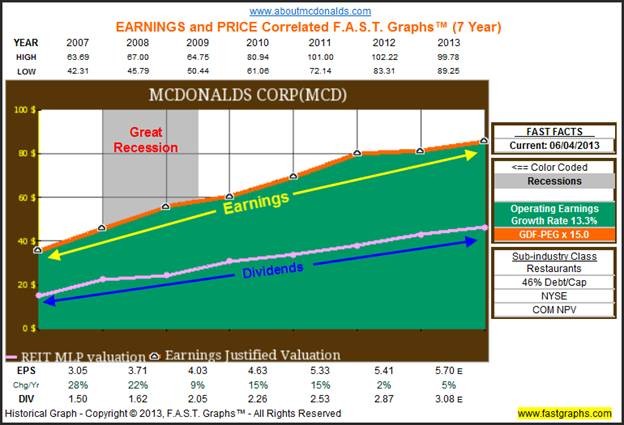

McDonald’s Corporation (MCD) | Yield: 2.8%

RQ: A3 | Discount %: 9.4%

McDonald’s Corporation is the largest fast-food restaurant company in the world, with about 32,500 restaurants in 117 countries.

Wal-Mart Stores,Inc. (WMT) | Yield: 2.9%

RQ: A1 | Discount %: 30.7%

Wal-Mart Stores, Inc. is the largest retailer in North America and operates a chain of discount department stores, wholesale clubs, and combination discount stores and supermarkets.

Medtronic Inc. (MDT) | Yield: 3.1%

RQ: A1 | Discount %: 10.9%

Medtronic Inc.is a global medical device manufacturer has leadership positions in the pacemaker, defibrillator, orthopedic, diabetes management, and other medical markets.

Eaton Vance Corp. (EV) | Yield: 3.1%

RQ: A3 | Discount %: 0.2%

Eaton Vance Corp. is a Boston-based holding company that is primarily engaged in investment management.

Questar Corporation (STR) | Yield: 3.2%

RQ: A3 | Discount %: 7.4%

Questar Corp is engaged in gas transportation and storage, and retail gas distribution primarily in Utah. Its exploration and production unit was spun off in mid-2010.

AFLAC Incorporated (AFL) | Yield: 3.2%

RQ: A1 | Discount %: 35.5%

Aflac Incorporated provides supplemental health and life insurance in the U.S. and Japan. Products are marketed at work sites and help fill gaps in primary insurance coverage. Approximately 80% of earnings comes from Japan and 20% from the U.S.

Procter & Gamble (PG) | Yield: 3.2%

RQ: A1 | Discount %: 23.8%

The Procter & Gamble Company is a leading consumer products company that markets household and personal care products in more than 180 countries.

Abbott Laboratories (ABT) | Yield: 3.8%

RQ: A2 | Discount %: 27.9%

Abbott Laboratories is a diversified life science company and is a leading maker of drugs, nutritional products, diabetes monitoring devices, and diagnostics.

Community Trust Bank Corp. (CTBI) | Yield: 4.9%

RQ: A1 | Discount %: 2.9%

Community Trust Bank Corp. owns and operates Community Trust Bank, Inc. of Pikeville, KY, which provides commercial banking services in Kentucky and West Virginia; and a trust company.

Vectren Corporation (VVC) | Yield: 5.5%

RQ: A3 | Discount %: 1.0%

Vectren Corp. is an energy holding company that delivers gas and/or electricity to more than one million utility customers in Indiana and Ohio, and offers other energy related products and services.

Cincinnati Financial Corp. (CINF) | Yield: 6.3%

RQ: A1 | Discount %: 9.3%

Cincinnati Financial Corp. markets primarily property and casualty coverage. It also conducts life insurance and asset management operations.

III. Sometimes You Will Misfire

As hard as we may try to pick all winners, sometimes a good stock will go bad, cut its dividend, and well have to sell it. Often it is one of our higher yielding stocks, leaving a large void in our annual dividend income. How do we manage this? Here is what I do:

1. First, when you suspect a stock might cut its dividend put it On the Shelf and dont make any future purchases, until you are convinced the dividend will not be cut.

2. Manage the risk of a dividend cut by limiting your allocation to any single stock to a maximum of 5%.

3. Keep some high risk/high yield allocation in reserve. As mentioned above, when the market goes south, we need to under-allocate high risk/high yield stocks. This will allow room in our allocation to selectively purchase these types of stocks when we choose to sell a past performer that is no longer meeting our expectations.

As your income portfolio grows, you will not always be able to replace the lost income, but the above principles will help you minimize the decline.

IV. Dont Let Fear Derail Your Long-Term Plan

Someone once said, Your emotions are the best inverse indicator of what you should be doing in the market. Many people are selling it all and walking away from the market. Theyll be back though when the market is reaching all time highs, only to get out when it falls with no end in sight. This is a long-term recipe for disaster. For those of us who still have time before retirement . the market is presenting us with a golden opportunity; what are we going to do with it?

Full Disclosure: Long CINF, ABT, PG, MDT, WMT, MCD. See a list of all my dividend growth holdings here.