Dividend Cuts Why They Cause Stocks to Outperform the Market

Post on: 6 Июнь, 2015 No Comment

Dividend Cuts: Why They Cause Stocks to Outperform the Market

Weve seen a slew of companies cut dividends over the last few months, especially in the energy space. In fact, its hard to name oil producers that havent cut their dividend yet. The last quarter saw companies like Canadian Oil Sands Ltd. , Bonterra Energy Corp. , Baytex Energy Corp.. and Surge Energy Inc. slash their dividends. And those are just some companies off the top of my head.

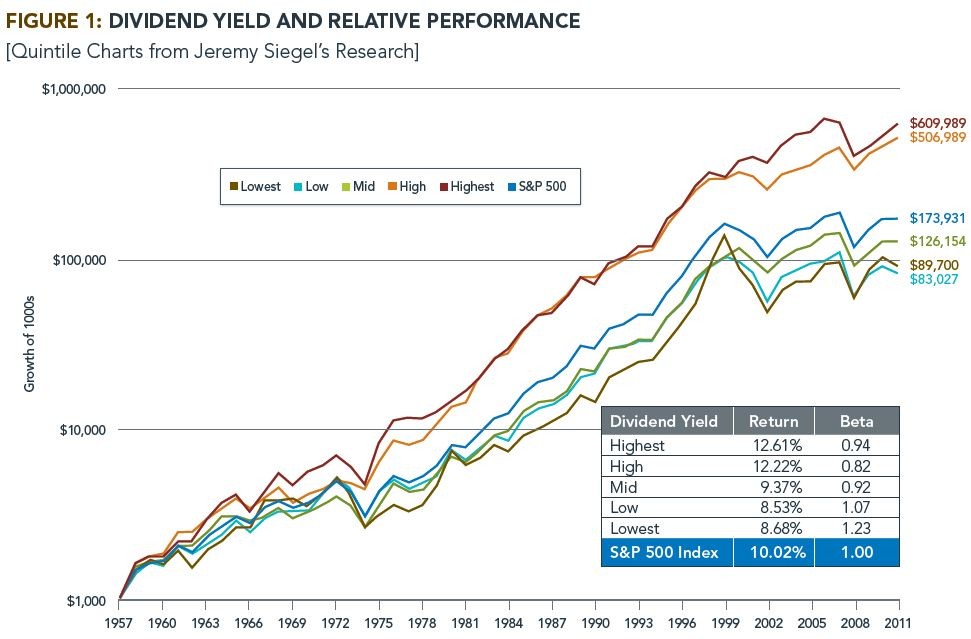

Investors should not feel concerned by this. Such cuts are natural and inevitable given the current market environment and uncertainty in oil prices. The initial reaction most investors have is to sell a stock when a company cuts its dividend, similar to how investors tend to sell when the market is down and buy when the market is up. But long-term investors should try to focus on the big picture and think twice before dumping dividend cutters in the bad camp. This is because a new study has found that dividend cutters tend to outperform the market by roughly 10% in the long run.

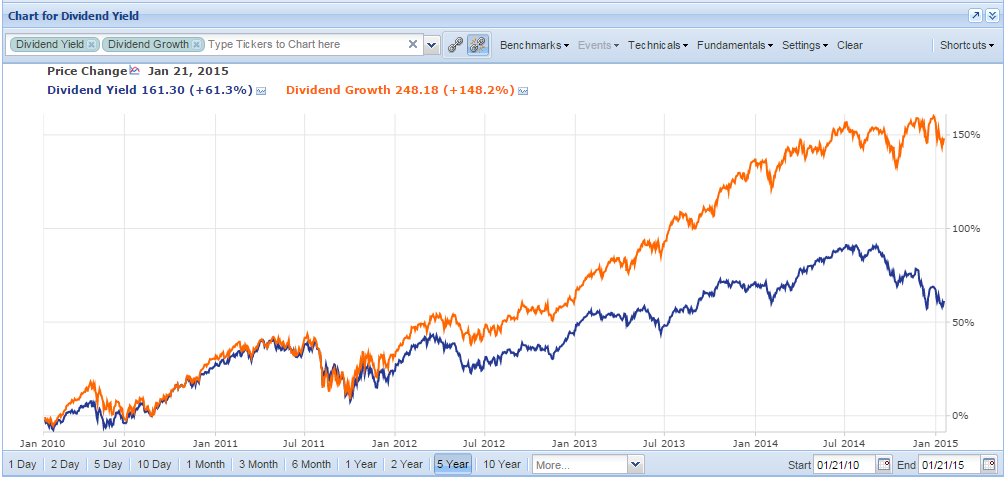

The study, conducted by an analyst at CIBC. looked at the relationship between dividend cuts and market performance over the last 15 years. The analyst focused on companies that cut their dividend by at least 10% or more and then looked at the relative performance of those companies over time.

He found that shares started outperforming the market by about 10% approximately two months after the dividend cut. The study also found that those investors who already owned the stock before (and after) the dividend cut also seemed to benefit overall on the stock.

Long-term focus

At Motley Fool Canada, we encourage investors to block out the short-term panic, noise, and market movements. Instead, we advise shareholders to focus on long-term trends and look for value creation and growth.

The current energy market will provide some great opportunities to buy companies with strong balance sheets, talented management, and great growth prospects. Once oil prices stabilize, these companies will likely be at rock-bottom valuations, which will be the perfect time to buy. Thats when investors should grab the opportunity and buy companies like Suncor Energy Inc. and Canadian Natural Resources Ltd. (TSX:CNQ) (NYSE:CNQ). Both of these companies are strong oil producers and are expected to come out of this oil market successfully because of their solid positions.

But for now, try to look beyond the energy sector to find value and stable dividends. Motley Fool Canada has found three top companies that have delivered dividends to shareholders for years. We’ve written a special report titled 3 Dividend Stocks to Buy and Hold Forever. Click here now to get the full story!