Diversifying Assets Within Classes

Post on: 3 Май, 2015 No Comment

You can see style charts on many investing Web sites, like this one from Yahoo! Finance. Or you can make them yourself

Diversifying Assets Within Classes

Diversification within each asset class is the key to a successful, balanced portfolio. Through careful research, you need to find assets that work well with each other. True diversification means having your money in as many different sectors of the economy as possible.

With stocks, for example, you don’t want to invest exclusively in big established companies or small start-ups. You want a little but of both (and something in-between, too). Mostly, you don’t want to restrict your investments to related or correlated industries. An example might be auto manufacturing and steel. The problem is that if one industry goes down, so will the other.

With bonds, you also don’t want to buy too much of the same thing. Buying tons of 30-year Treasury Bills is fine, but it’s not the way to maximize your return on investment. Instead, you’ll want to buy bonds with different maturity dates, interest rates and credit ratings.

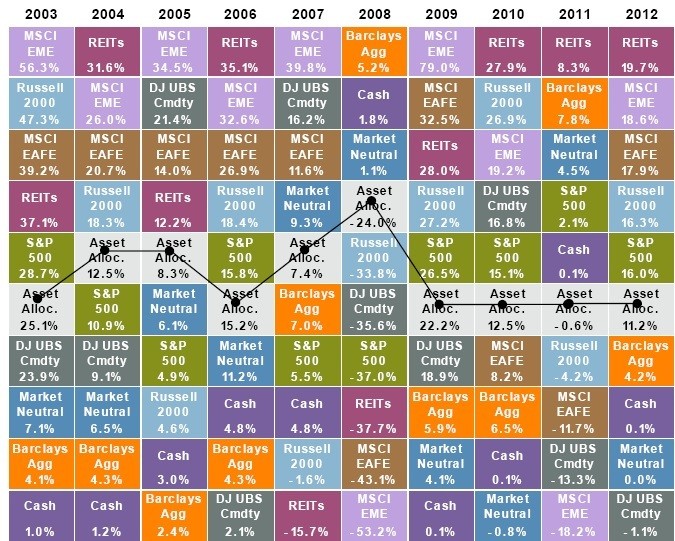

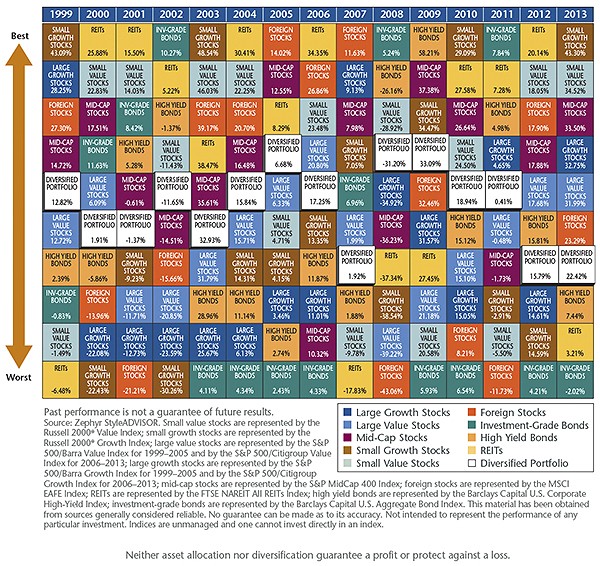

A good way to diversify your holdings within an asset class is to use something called a style chart [source: Wells Fargo ]. A style chart is a simple table you can make with pencil and paper or with a spreadsheet program like Excel.

To make a stock style chart, for example, you’d create a table with market cap on the horizontal axis and style on the vertical. Under market cap, create three columns labeled small cap, mid cap and large cap. Under style, create three rows labeled value, blend and growth.

Now look for stocks that satisfy each section of the chart; for example, a small-cap value stock or a mid-cap blend stock. It’s an easy way to see that you’ve covered all of your bases. You can do the same with bonds, using maturity dates and credit ratings as criteria.

Obviously, it requires a serious amount of research to figure out which stocks and bonds to buy. If you’re new to investing, it might be worth it to consult with an investment counselor or money manager before you make any big decisions with your money.

Congratulations! You’ve created a diversified investment portfolio. If only your work stopped there. Keep reading to learn about an important investment diversification concept called rebalancing .