Diversify Your Portfolio With International Stocks

Post on: 18 Июль, 2015 No Comment

Put 20% to 40% of Your Portfolio in Non-U.S. Shares

ENLARGE

Tim Bower

The U.S. stock market has outperformed most foreign markets over the last several years, leading many investors to question the benefits of international investing, says Paul Jacobs, chief investment officer of Palisades Hudson Financial Group, an independent investment advisory firm that manages $1.2 billion in assets.

But where others see risk, Mr. Jacobs sees opportunity.

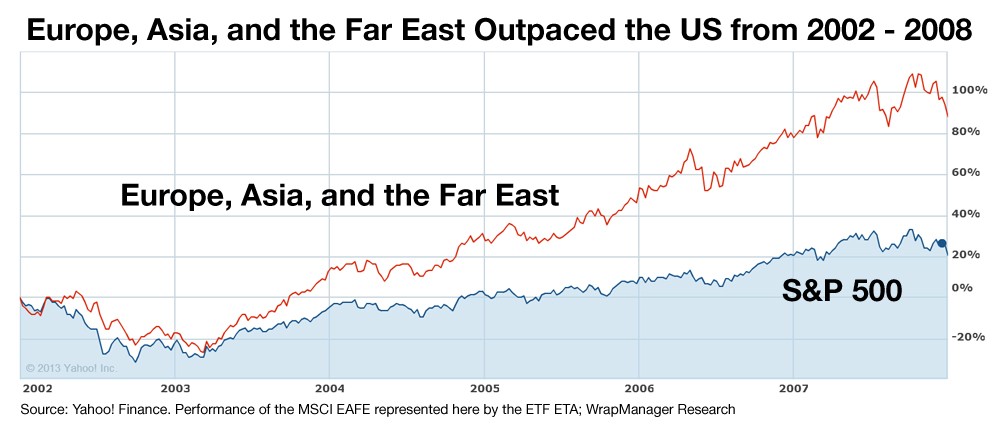

The U.S. can’t outperform forever, he says. Just 10 years ago, foreign stocks were outperforming. These things really do move in cycles.

U.S. stocks account for just under half of the global stock market, as measured by market value, or share price times the number of shares outstanding. Studies have shown that you can get the benefits of global diversification by devoting 20% to 40% of your stock portfolio to international equities. Others suggest a mix that more closely resembles the actual weightings of U.S. and foreign stocks in the world economy. Vanguard Total World Stock ETF, which seeks to track the performance of the FTSE Global All Cap Index, had 49.2% of its assets invested in U.S. stocks as of July 31.

T. Rowe Price’s new Global Allocation Fund, the firm’s first global multi-asset fund, aims to have about 50% of its stock investments outside of the U.S. At Rebalance IRA, a portfolio for someone at least five years from retirement also would have its stock portion evenly split between U.S. and foreign equities, with the foreign portion divided equally among developed and developing markets.

Given that U.S. stocks today are considered by many to be fully valued while foreign stocks are still relatively cheap, it wouldn’t be unreasonable to devote slightly more of your holdings to foreign stocks now than you typically would. In any case, the relative outperformance of U.S. equities in recent years probably means your portfolio needs rebalancing.

Mr. Jacobs has been busy selling U.S. equities and buying foreign equities just to maintain the 35% allocation to international stocks he typically targets in clients’ stock portfolios.

We don’t use a one-size-fits-all approach for foreign investing, he explains. For some markets, we prefer actively managed mutual funds and for other markets we prefer low-cost index funds.

For Europe—which, at 40%, represents the biggest piece of Palisades Hudson Financial’s international equity allocation—Mr. Jacobs is comfortable using index funds because of the quality and transparency of the markets, he says. One favorite: Vanguard European Stock Index Fund.

The same goes for Japan and Australia. A lot of international funds will not allocate a meaningful amount to Australia, which is rich in natural resources, Mr. Jacobs says. So a few years ago, the firm added iShares MSCI Australia ETF, for exposure to large Australian stocks.

For the more than 30% of the international stock portfolio that it devotes to the Pacific Rim (not including Japan), Palisades Hudson Financial uses T. Rowe Price New Asia Fund and Matthews Pacific Tiger Fund. For the 5% it allocates to Latin America, it often uses T. Rowe Price Latin America Fund.

As for international small-cap stocks, the firm likes actively managed Oakmark International Small Cap Fund and Matthews Asia Small Companies Fund—for both the higher expected returns and diversification of small-cap stocks.

It’s a lot of moving parts, Mr. Jacobs admits, but holding different funds for different regions can produce better after-tax returns. If some markets are up and others are down, the firm can sell a fund that has declined in value to realize a tax loss, which can offset a gain elsewhere in the portfolio.

For investors with equity portfolios under $100,000, Mr. Jacobs sometimes uses just one actively managed mutual fund for the international portion: American Funds’ EuroPacific Growth Fund.