Diversify Your Investment Portfolio

Post on: 3 Май, 2015 No Comment

Diversification of Investments Reduces Overall Risk and Protects Your Wealth

A great piece of financial advice! It means, don’t put all your eggs in one basket. If you work for an insurance company, have all of your 401K and stock options invested in that same company, you’re not diversified. A good diversification strategy involves spreading your investments and wealth across many different asset classes. By doing so, you reduce the risk of losing a large percentage of your wealth by events that only affect one asset class.

The right diversification strategy for you depends on how much wealth you have, your age range, your risk profile and many other factors. Although we can’t recommend specific strategies for diversification, I can offer some simplified guidelines:

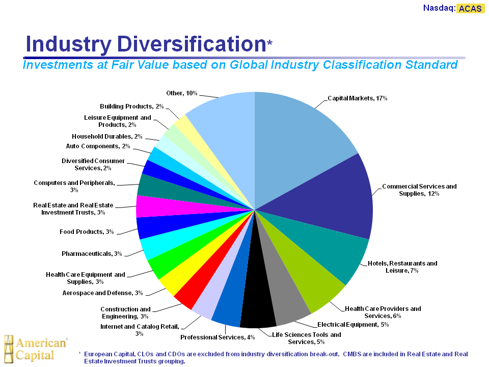

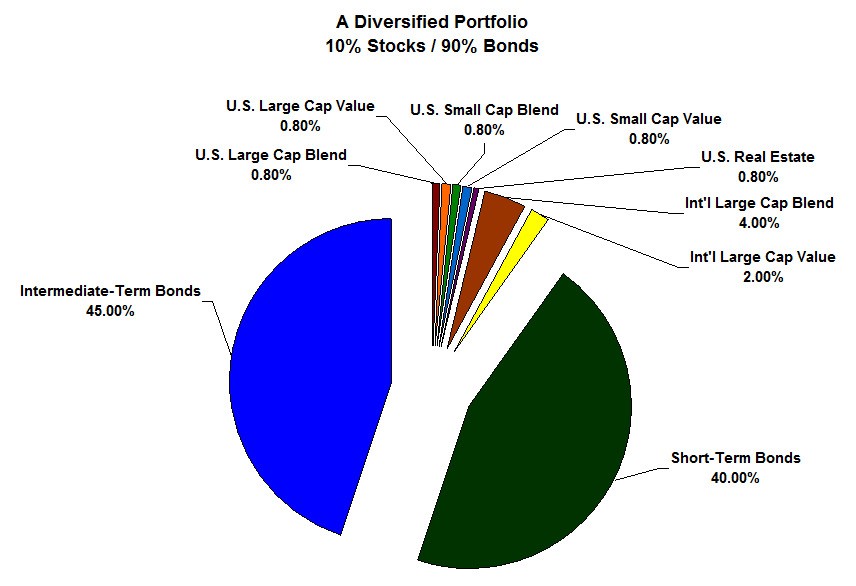

- Diversify across the following categories: real estate, stocks, savings or money market accounts, bonds, other investments

- Diversify within each category above.

- If you invest in stocks, try not to let any one stock account for more than 5-10% of your portfolio.

- Use mutual funds to diversify stock risk. Buy different mutual funds from different fund companies.

- Keep 3-6 months of income in liquid assets including cash, savings or money market accounts. As you approach retirement, increase this amount dramatically.

- Although bonds are often a staple to a well-diversified portfolio, we wouldn’t recommend investing in them unless your portfolio is large (over $200k) or unless you are close to retirement (within 5-15 years). To invest in bonds despite these circumstances, you can buy mutual funds that specialize in bonds, also known as bond funds.

- If all of your wealth is in the value of your home (real estate) and you can afford a higher mortgage payment, you may want to diversify by taking a home equity loan (when interest rates are low) and investing it in another asset class. Only do this if you are comfortable taking on added financial responsibility, but doing so can sometimes increase your diversification and add to your long-term returns.

- If you own your own small business or online business you should consider mitigating your risks by learning about Incorporation. If something bad happens this can protect your personal assets. Many people forget to think about the risks that they could encounter, but mitigating your risks can be important as diversifying your assets.

This was the last financial rule and all of the basic financial concepts you need to know to get ahead financially. Make sure you have a firm understanding of each and every rule. And more importantly, make sure that you apply the rules to your financial life going forward.