Diversification and Portfolio Risk Management Strategies

Post on: 30 Май, 2015 No Comment

Diversification It is said “do not put all eggs in one basket”. The reason behind is that if basket falls all eggs will be broken. Similar is the motive behind the concept of diversification. Diversification is a way to reduce risk by investing in different asset classes. So even if one sector fails to generate expected profit, the impact can be nullify or reduced by gains of investments in other assets. It is similar to the saying that even if one basket slips all eggs will not be broken and one will not go hungry.

Portfolio Theory – it was Harry Markowitz (‘Portfolio Selection’ 1952) who drew attention towards importance of diversification in managing portfolio. He emphasized that by means of diversification an investor can generate similar returns but at reduced exposure to risk or greater return at similar risk.

Understanding Risk and Types of Risk

In simple term risk is probability associated with the investment, losing its value in adverse condition. Risk is nothing but the measurement of expectation failure. If you expect a certain percentage of return from the invested stock and if actual return differs from the expected one then your risk is much, much more. It is calculated on the basis of variance in the investment value from its mean over a period of time. There are two types of risk associated with investment-

Also termed as ‘systematic risk’ or ‘undiversifiable risk ’, is the risk which affects the portfolio mainly by macro economic factors viz. – inflation, interest rates, foreign exchange rates. economic recession, growth of economy etc. Due to change in these factors, overall market is effected thus the value of the portfolio changes down or up accordingly. This type of risk is associated with every company .We can call market risk as macro risk, as it affects the whole market instead of a single firm. This risk can’t be reduced by diversification.

Also called ‘ unsystematic risk ’ or ‘diversifiable risk ’, is the risk only related to the specific company, i.e. by taking up the stock of any particular company, the amount of risk investor is exposed to, is related to the company’s operations, finance, management etc. In other terms it can be termed as micro risk. as it’s just depicting the risk associated with a particular firm. This unique risk can be reduced by diversification of stocks.

The main aim in managing portfolio is to optimize returns keeping the risk as low as possible. We can reduce the unique risk but not market risk as we can control the unique risk by picking up different stock with different risks, but we can’t take charge of the market risk.

Does Diversification Help

Yes diversification does reduce risk. This can be understood by simple example –

Suppose there are only two telecom player in the market ‘X’ and ‘Y’. The gain of ‘X’ will be at the cost of ‘Y’ and vice versa. In which company should a person invest? If the investor decides to invest in company ‘X’. But due to certain reasons the market share of ‘X’ is decreased thereby market share of company ‘Y’ increased. Thus the revenue and profit of ‘Y’ will increase at the expense of ‘X’, so the value of their shares. So the investor will lose money. But if the investor invests equally in both the company, only part of the investment will suffer and the loss will be recovered with the gain from ‘Y’ share.

Why Diversification

An intelligent and smart investor strives for better returns on his investment with lower exposure to risk. Risk and returns are correlated; higher the risk higher is expected return. If an investor allocates all his investment to high risk stocks, though he might get higher return but at the same time probability of erosion in the investment value is also high in adverse condition. Alternatively, if allocation is made in low risk stock, risk is low at the same time returns will also be lower.

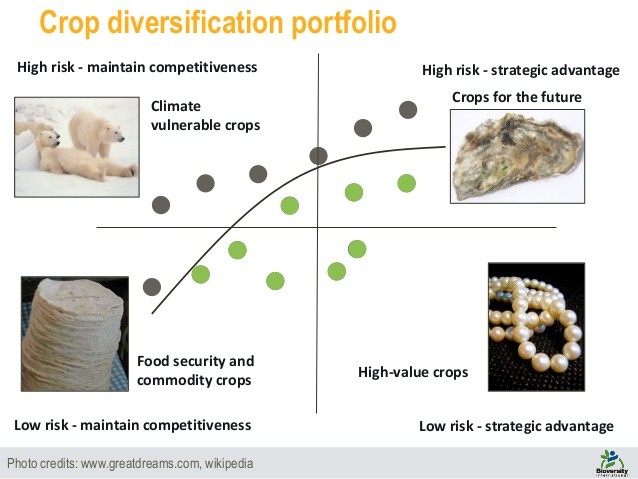

Diversification Strategy

Diversification doesn’t mean that one will just go for different stocks; it means a lot more than that. The real financial market is more complex, so the diversification strategy. If we take above example, consider if the whole telecom sector suffers than investor’s portfolio will see overall erosion in value. Therefore, the diversification strategy should include allocation of assets not among different shares of same sector but also among various sectors, industries, varied financial instruments and among various asset classes. Also lesser the shares are correlated among themselves better is the diversification of portfolio.

Diversification is not a panacea. It doesn’t guarantee against loss however it facilitates in decreasing the risk for an investor and targets to maximize return at the same time. Some key points in managing portfolio are allocate investments

- In different shares of similar sector

- In different sectors and industries

- If possible among different geographies

- Instruments of varied risk level

- Among different asset class viz. share market, fixed income instruments, commodities, real estate etc.

- It is always helpful to take professional advice if unable to identify right investment opportunity.

- Do own research as well and proper due diligence, after all it is hard earned money which is under consideration.

How Many Stocks in Portfolio

Of course, ten stocks are better than one stock. But according to the trend and market assessment we can pick up 15-20 stocks spread over different sectors. Now the question is why not going for more than 20 stocks. Would that not help?

Caution: Too Much Diversification

We all think that more is better. But in this case more is not better at all. Too much diversification would not help the investor; here comes the concept of diminishing marginal return . By adding more to the 15-20 stocks might increase your income and decrease your risk but in decreasing rate and after a point it would not help at all. Thus it’s better to stick to the 15-20 stocks of portfolio.

In Conclusion

Greed is not good. Though diversification helps in reducing the risk but we should not be too greedy to target of more return. Be reasonable. Some one said so well when he observed – Do measurable progress in reasonable time. I think this is a good idea while managing portfolio.