Discounted cash flow models

Post on: 15 Август, 2015 No Comment

Discounted cash flow models

Introduction

John Burr Williams was one of the first to propose this valuation method. Discounted cash flow-, or Net present value-models have been described extensively and are also used by super-investors like Warren Buffett. You can do this with earnings, owner earnings, or cash flow. Read this section and then try it out yourself with the DCF-calculator. The method is as follows:

A business should generate more cash than it spends. The current value of a business is equal to the total amount of cash it generates from now on until the company goes out of business (to get share value, you divide by number of shares). You can make an educated guess about what the annual growth percentage will be for a number of years in the future (see below), and add it all up. However, you discount the amount of each year by a certain rate.

Why discount

The first reason to discount is that you pay a certain amount now, for money that will be earned in the future, while you could earn interest on the money you have, at almost no risk, by putting it in a savings account or by buying treasury bonds. You forego that, because you hope the stocks will give you a higher return. In the financial world, a return smaller than that is considered a loss, even if the dollar figure increases. Second, you are taking a risk. The discount rate is a way to compensate for the risk you take by putting your money into the business. Banks also charge a higher interest rate for more risky loans. So you increase the discount rate as the investment becomes more risky.

How to determine the total of cash flows

First, determine the average annual growth rate with which cash flow has grown in previous years. Then, make a conservative estimate of what the annual growth will be in the next few years, taking the company’s prospects, growth potential and so on in consideration. Calculate the cash flow for that number of years, using the growth rate you expect. If it looks like the current cash flow is clearly an outlier, adjust it, as it affects values in future years. To make the valuation more realistic, investors often take a two-stage approach, in that they assume there will be an initial stage of strong growth, followed by a stage of weak growth, which lasts until the company goes out of business.

So multiplying by growth rate every year gives you the expected cash flow. Then you basically do the reverse, but with the discount rate, so you divide by the discount rate every year. After that you add it all up and divide by the number of shares.

After many decades, value stabilizes

Often, especially in the final stage of a company’s lifetime, the discount rate is higher than the cash flow growth rate. Because of this, the amount you will be adding to the total discounted cash flow will decrease every year, so the net growth will slow down. After many years, the total discounted cash flow estimate hardly changes anymore with every year you add to the calculation, so at that point you have a clear value-estimate.

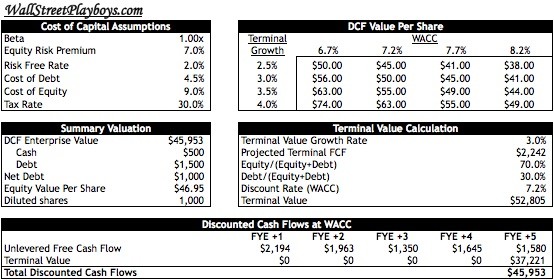

Example (left graph): Cash flow estimate for a large company. Cash flow (blue line) starts at 3 billion today, increases at a rate of 6% each year for 10 years, then slows to 3%, which it maintained until the end of the period of 50 years. The discount rate is 13% for the entire period. Therefore the growth in the total discounted cash flow (green line) gradually becomes smaller and smaller, and at the end of this period it hardly changes anymore. (right graph) The share value estimate is just the green line divided by the number of shares (734.4 million), and it culminates in amore or less stable value of $52.37. If this socalled true value of the stock is more than the current price, then the investor has more reason to buy it.

Earnings, cash flow, or owner earnings?

People differ in their opinion about whether to use cash flow, earnings or other measures. One’s first inclination may be earnings, but earnings can be manipulated using accounting gimmicks. Cash flow is harder to manipulate. Calculate free cash flow, by subtracting capital expenditures from operating cash flow. Instead of cash flow, Warren Buffett uses owner earnings. Owner earnings, free cash flow, and structural free cash flow are very similar. Differences in the value ultimately used by different investors will also depend on their definition of capital expenditures.

How to determine the discount rate

Just to give an idea of what range the discount rate should be in: according to Fool.com. between 9% and 16%. Increasing the discount rate lowers the share value that you get out of the model. At the most basic level discount rate is based on interest rates and risk. The first component of discount rate should be interest rate as set by the federal reserve, or the return on very low risk investments such as long term government bonds. Some people, Warren Buffett for example, take that as their discount rate. Others add points for risk and some other things. The more risky the investment, the higher the discount rate, and the lower you will estimate the true value of the stock. That will cause you to wait until the price is low enough so that you get a sufficient margin of safety.

So setting the discount rate is a way to get a margin of safety. However, Buffett has said he creates a margin of safety by buying low to begin with, without adding points for risk. Moreover, he has said that if one needs a risk assessment to determine whether to buy, it probably is not a good enough stock for his criteria anyway.

You may want the discount rate to reflect how much debt the company has (use debt/equity ratio), because of all the money that comes in, only the amount in excess of interest charges is really gained.

Some investors (professionals in particular) set a target return for their investments, and use that as their discount rate.

Known problems

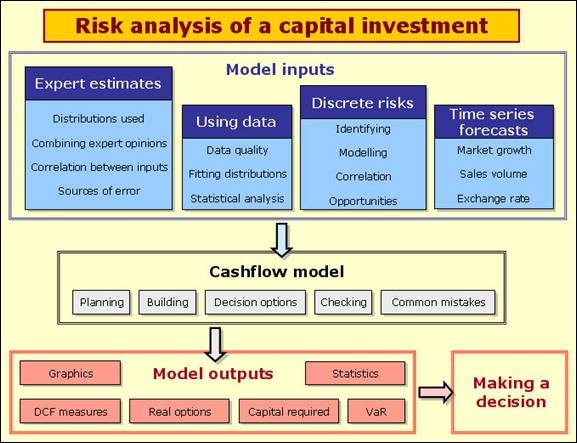

One problem with the model is the adjustment for risk with a discount rate. It is indirect and unrealistic. It probably better to make a separate, explicit estimate of the cost of losses, but that is a lot more work, and it may or may not lead to a radically different outcome. Another problem is that if cash flow becomes negative, one can get paradoxical results. Finally, if the risk varies over time, the model does not deal with that very well, because it is accounted for in the discount rate, and there is a compounding effect because the discount is applied year over year. Thus, a discount on previous years continues to affect all subsequent years. From a conservative point of view, one might say that is good, because that way one has less worry about over-estimating the true value, but of course it is better to have control over the margin of safety one is using, instead of it being a side-effect of inaccuracy.