Discount Brokers 5 Tips to Choose the Best Discount Broker

Post on: 28 Март, 2015 No Comment

Discount Brokers are becoming more and more popular as investors feel that their broker’s have failed them over the last couple of years. Discount broker’s are fully aware of this shift and we are seeing mass advisement campaigns by each to increase their market share. Among so many available discount brokerage firms it can be difficult to find the best one for you; these 5 tips can help you picking the right one:

You might also want to check out our Discount Brokers Review

This to me is the number one criteria. How much does each trade cost? How much does the data cost? Cost becomes even more important for smaller investor’s who want to dollar cost average. If you would like to contribute $400/month and it costs you $30 per trade your cost will be 7.5% that is huge! A general rule is that your trading cost shouldn’t be more than 1%. One of the first things you should do is review the schedule of fees and look for any hidden fees. then compare that to your investment plan to see if it is reasonable.

This is very common with discount brokers, they advertise a low rate (ex. $9.99/trade) but when you look closer you need $100,000 in assets to qualify for those rates, or you need to make 30 trades/quarter or a combination of the two. So be sure to check for the minimum requirements and if you qualify for them.

When using a discount broker you will be doing all your own trading online through their platform, but from time to time you will need to get in touch with customer service. Take some time and do a little research to see how other investors feel about the brokers customer service, you can do this through social media like Facebook and Twitter or online forums.

What types of investments does the broker provide? Just stocks or will there be bonds and mutual funds available? This is always an important criteria to look at before you choose your discount broker, although you maybe only interested in ETFs right now maybe in the future you would like to look at bonds and other investment vehicles. Check with the discount broker what types of investments are available and what costs are associated with them.

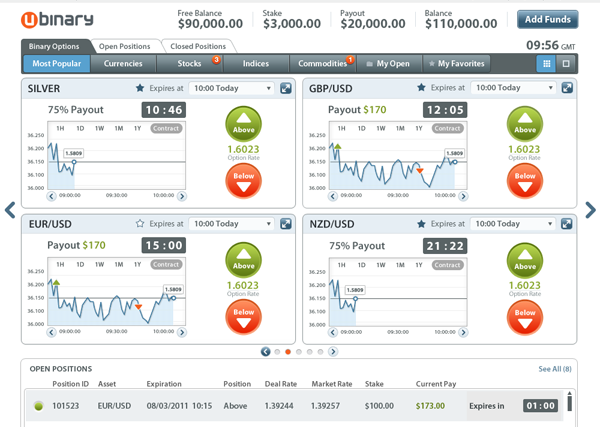

Does the discount broker provide you with research tools and analyst opinions? Although I do not think this is a critical requirement some investors feel it is important to have some research tools available to them. Check with the broker if any tools are available and ask if they have demo’s, most of them will be happy to provide you with a trial period of their tools. Also make sure you know if any costs are associated with any of them.

Finding the right discount broker does not have to be complicated, I believe these are 5 important criteria’s to look at when choosing a discount broker however you may have to consider other issues before deciding on one.