Direxion Value Line Team Up For Three New ETFs

Post on: 6 Август, 2015 No Comment

Direxion, Value Line Team Up For Three New ETFs

March 12, 2015 Jeff Schlegel

Direxion Investments yesterday rolled out three smart beta, or strategic beta exchange-traded funds tied to indexes from investment information provider Value Line.

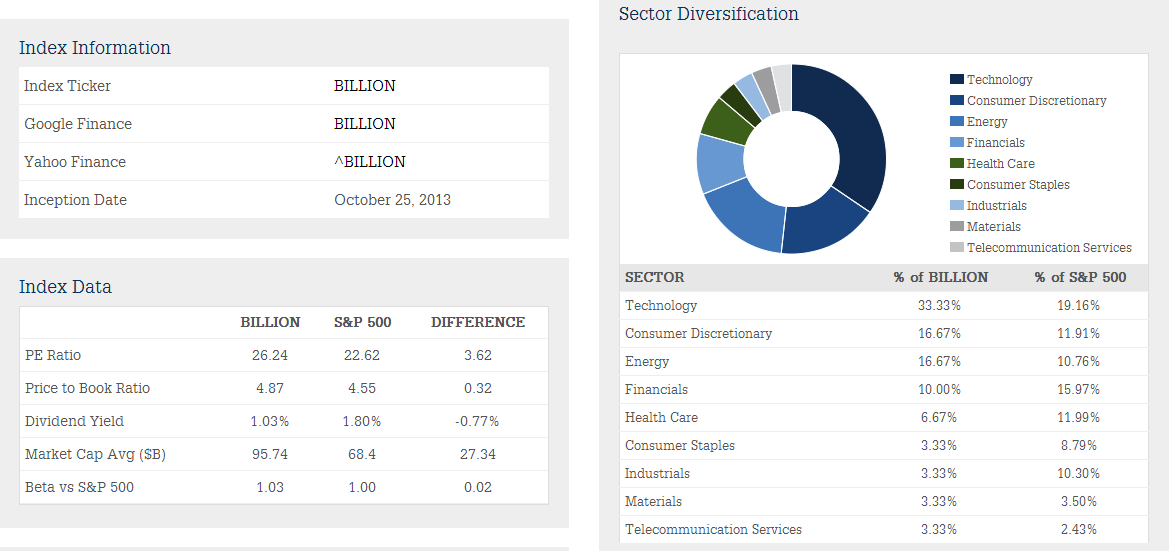

The Direxion Value Line Small- and Mid-Cap High Dividend ETF (VLSM), Direxion Value Line Mid- and Large-Cap High Dividend ETF (VLML) and Direxion Value Line Conservative Equity ETF (VLLV) track indexes that employ Value Line rankings based on performance, timeliness and safety to find high-dividend-yielding stocks across the three market capitalization categories, along with lower-volatility stocks in the conservative equity strategy.

All three ETFs carry a net expense ratio of 0.58 percent.

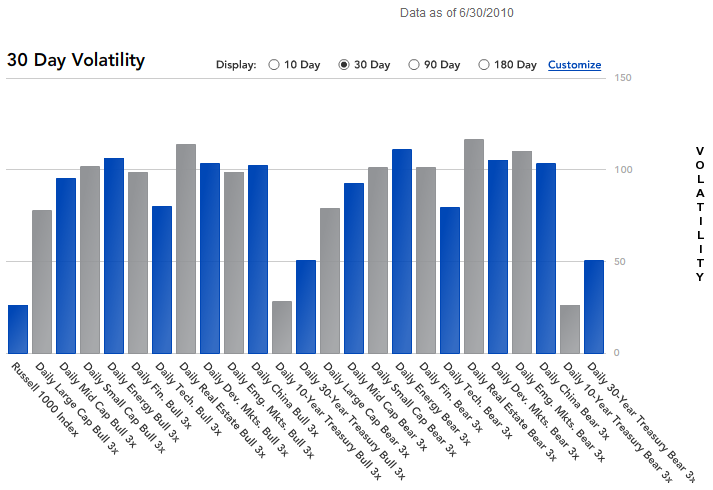

Direxion sponsors 63 ETFs with more than $9 billion in assets under management, with most of that associated with its roster of leveraged and inverse funds. The three new funds join the companys existing lineup of five smart-beta ETFs.

Smart-beta investing uses rules-based indexes that arent market cap-weighted, such as equal-weighted or dividend-weighted strategies. The aim is to get a better return versus a passive, market cap-weighted index.

One of the trends were seeing is active managers taking their quantitative capabilities and reconstituting them into a rules-based approach that allows us to a create a smart, or strategic beta [fund] based on those indexes, says Brian Jacobs, president of Direxion Investments in New York City.

With Value Line, we saw eight decades or investment research, 150,000 subscribers to its service and a firm with a great reputation, he adds, noting Direxion wanted to plug into Value Lines research capabilities to identify the best securities that will generate attractive income levels while reducing risk.

Were finding advisors are using smart-beta strategies more often because theyre a more precise tool that allows them to help build a better portfolio outcome, Jacobs says. If you can generate an extra 1 percent or 2 percent return, thats the equivalent of the fee an advisor might charge. Or for clients who want exposure to equities, this can do it in a less risky way.

Jacobs says he expects funds based on smart-beta strategies will fuel the ETF industrys next growth phase.

Were going out and finding great index providers that can help us create these strategic-beta ideas, and we were a little surprised nobody had yet done that with Value Line, he says.