Direxion Daily Small Cap Bear 3X Shares ProShares Short Dow30 ETF The Best ETFs For A Stock Market

Post on: 16 Март, 2015 No Comment

Have you ever wondered how billionaires continue to get RICHER, while the rest of the world is struggling?

I study billionaires for a living. To be more specific, I study how these investors generate such huge and consistent profits in the stock markets — year-in and year-out.

CLICK HERE to get your Free E-Book, “The Little Black Book Of Billionaires Secrets”

Here are some of the best investments to make when the markets about to slide.

The Best Investments for a Sell-Off

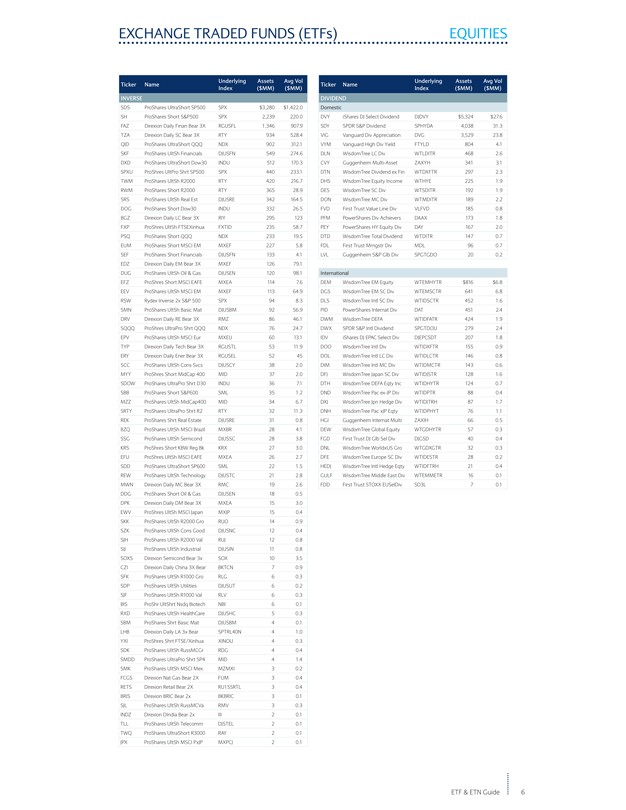

Investing in Inverse Funds & ETFs: The Rydex Inverse S&P 500 Strategy Fund (MUTF:RYURX) is the inverse fund recommended by Money Morning Chief Investment Strategist Keith Fitz-Gerald.

This mutual fund seeks to provide investment results that match the opposite return of the S&P 500. It has an expense ratio of 1.41%, which is not exactly cheap, but Fitz-Gerald says its worth it because of the strength of its management and because its been active since 1994.

If youre looking for a cheaper inverse fund, check out the ProShares Short S&P 500 ETF (NYSEARCA:SH), which tries to do what the Rydex fund does but with a lower expense ratio, 0.89%. Note SH has existed only since 2006.

For more of a bang for your bearish buck, check out the ProShares UltraShort S&P 500 (NYSEARCA:SDS), which seeks to move opposite twice (200%) the daily movement of the S&P 500.

If you think the Dow Jones Industrial Average will sell off from its new highs, consider theProShares Short Dow30 ETF (NYSEARCA:DOG), which moves in the opposite direction of the Dow. You can double down on that bet with the ProShares UltraShort Dow30 ETF (NYSEARCA:DXD), which tries to move 200% opposite the Dow.

Other funds include the ProShares Short QQQ ETF (NASDAQ:PSQ), which moves inverse the Nasdaq 100, and the ProShares UltraShort QQQ ETF (NYSEARCA:QID), which seeks to move opposite twice the Nasdaq 100, an index of the 100 largest non-financial companies on the Nasdaq.

And to really bet on a crash, consider the ProShares UltraPro Short S&P 500 ETF (NYSEARCA:SPXU), the ProShares UltraPro Short Dow30 ETF (NYSEARCA:SDOW) and the ProShares Trust UltraPro Short QQQ ETF (NASDAQ:SQQQ) — all of which try to move three times the opposite of their respective indexes.

Finally, iShares Barclays 20+ Year Treasury Bond ETF (NYSEARCA:TLT) tracks U.S Treasury bonds with 20 or more years remaining until maturity. Historically, TLT has risen sharply when stocks sell off as investors seek safer returns.

But these arent the only good investments to protect against a market sell-off.

In fact, Money Morning Capital Wave Strategist Shah Gilani highlighted one in our Private Briefing investment service special report, The Seven Investments You Have to Make in 2013.

As Gilani explains, a market sell-off doesnt mean your profit stream is dry if you know where to turn.

Successful investors understand that its possible to make money in every single kind of markettheres always a way, said Gilani.

Money Morning Executive Editor and Private Briefing Editor William Patalon III explains why a crash insurance pick like Gilanis is necessary in this market environment. Check out the following video to learn more.