Direct Access Trading Systems

Post on: 2 Май, 2015 No Comment

Online brokers are the most accessible, and often least expensive, trading system available today; after all, they are available to virtually anyone with a credit card and an internet connection. The problem with average, run-of-the-mill online brokers, however, is that they suffer from atrociously slow order execution. In fact, novice traders who are serious about their profession will soon recognize that speed can be a key factor in turning a profit. The system in which orders are placed and trades are executed is an essential tool for traders. This article will provide an overview of direct access trading systems (DATs).

By the nature of the business, the individual trader must compete against all of his or her fellow traders, whether they are individuals or professional traders employed by North America’s largest financial institutions. Obviously, professional traders will always have access to the latest and best tools and training, including the fastest buy and sell orders. Therefore, individual traders need the absolute best system that they can afford in order to compete — anything less can put them at an immediate and perpetual disadvantage in respect to buy and sell orders.

The difference between the professional trader’s order system and an online broker is that the trader’s system eliminates the middleman (the human broker). Direct access trading systems allow traders to trade stock (or virtually any other financial instrument) directly with a market maker or a specialist on the floor of the exchange, or immediate order execution. The absence of a middleman can save a trader several seconds to several minutes of time. (For more on this, see Understanding Order Execution and Brokers And Online Trading Tutorial .)

Despite the inherent advantage of DATs as compared to lower level systems, not all order execution systems are created equal. Even amongst all of the existing direct access trading systems, there is considerable variety in speed and accuracy of execution, as well as in the commission price charged for each trade. As a result, traders must be careful to choose the system that most closely approximates their needs in terms of speed, performance and price.

Let’s take a detailed look at how certain features of particular DATs might meet a trader’s individual style and needs. Note that this discussion refers specifically to stocks — other financial instruments are traded using similar methods, but they may require slight modification in order to fall under the following general guidelines.

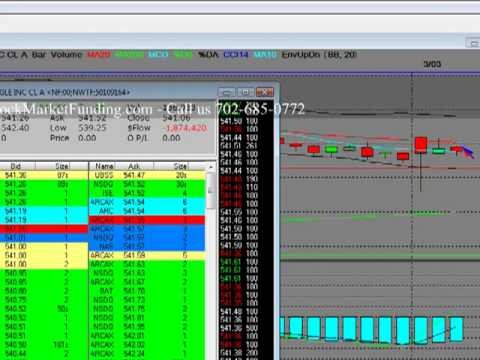

Level II Quotes

With a Level II screen, the trader will be able, for each individual stock that he or she is watching, to see a complete list of bid and ask prices at a single glance, as well as the sizes of these orders. The trader will decide at which price the order will be placed and needs to click only once on that price in order to commence the trade. The only other decision the trader will then have to make is the number of shares for the order. The order size is entered in a window that pops up on the DAT immediately after the chosen price is clicked on. Some direct access systems allow a default value to be pasted automatically into this space, thereby enabling the trader to order, say, 1,000 shares without actually inputting the extra four keystrokes. Many traders will have a typical order size, and the default value can be a significant convenience and time saver.

Electronic Communication Networks (ECNs)

Direct access trading systems also give traders the ability to trade on the electronic communication networks (ECNs). The simplest way to describe an ECN is to think of a completely electronic stock exchange: buyers and sellers are matched by computer without the need for a human middleman. Orders are executed directly from the trader’s DAT and transmitted electronically to the ECN almost instantaneously — within a fraction of a second. (To learn more, check out Electronic Trading Tutorial .)