Dip Into Deere ETF Alternatives for Hot Stock Picks

Post on: 9 Апрель, 2015 No Comment

Recent Posts:

Dip Into Deere: ETF Alternatives for Hot Stock Picks

The major indices are coming off their second consecutive week in the red, and in the past five trading days alone, the S&P 500 shed 2.1% as investors fretted about higher bond yields. Could 2013s gains be coming to an end? Perhaps. But perhaps thats all the more reason you should consider bundling some recent stock picks into exchange-traded funds and reap the rewards of diversity:

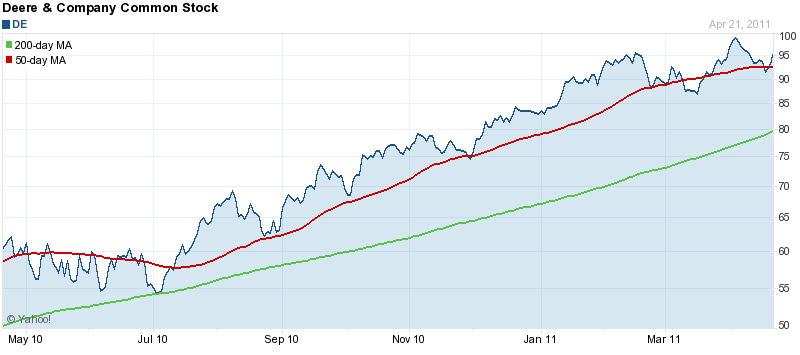

Deere & Co.

Dan Burrows sees some difficult times ahead for Deere & Co. (DE ) given prices for agricultural commodities are imploding. When farmers make less, they spend less, resulting in fewer combine orders. Deere stock has been moribund so far in 2013, up just 2% year-to-date. Long-term, Big Green will do just fine, but with no catalysts in sight, youll likely have to put up with some iffy quarters in the meantime.

When picking ETF alternatives, I like to go with broader funds where possible. Here, Im less inclined to go after ag, and instead suggest the Guggenheim S&P 500 Equal Weight Industrials ETF (RGI ), which is the 61 industrial stocks from the S&P 500, equally weighted. DE is weighted at 1.56%, and RGI charges 0.5% in expenses, or $50 for every $10,000 invested.

Royal Dutch Shell

On Aug. 15, Tom Taulli explored the pros and cons of investing in Royal Dutch Shell (RDS.B ), and he concluded that improving economies in both the U.S. and Europe will lead to higher oil prices, substantially increasing RDSs operating cash flow. Right now, its barely covering its capital expenditures and dividend. Based on $100 oil, Shell expects to generate $200 billion in cash flow from operations in the three years from 2012 and 2015 $64 billion greater than the three years prior to 2012.

A good way to benefit from RDS and some of its ADR brethren is to invest in the PowerShares BLDRS Developed Markets 100 ADR Index Fund (ADRD ). With exactly 100 holdings, RDS (Class A and Class B) weighs in at 4.9%. Combining both classes of stock, RDS is the largest of the funds holdings. Although Euro-centric in composition, its actually a very good proxy for a global, large-cap fund. With a 30-day SEC yield of 2.8% and an annual expense ratio of 0.3%, its attractive to both dividend investors and those focused on lower fees.

Kraft Foods

InvestorPlace Assistant Editor Adam Benjamin likes Kraft Foods (KRFT ), and recently laid out the reasons why its recent decline in share price makes it a buy rather than a sell. Despite Warren Buffett dumping KRFT, Adam sees a company with great cash flow, fantastic brands and a solid dividend. Its hard to argue with his logic. Personally, I prefer General Mills (GIS ) to Kraft, but theyre both good companies. Purchasing an ETF allows you to own both.