Differentiating between Cyclical and Noncyclical Stocks Stock Markets Blog

Post on: 29 Апрель, 2015 No Comment

Differentiating between Cyclical and Non-cyclical Stocks

Although it is true that investors have no control over the cycles of a country’s economy. they are able to adjust their investing practices to cope successfully with the economy’s highs and lows. Having a well-balanced investment portfolio is dependent on an understanding of how industries are influenced by the economy before making stock market investments. For this reason it is important for investors to know the fundamental differences between cyclical and non-cyclical stock companies .

Cyclical stocks encompass items that consumers generally buy when the economy is going well and there is high economy confidence. A car manufacturer is a good example of a cyclical stock company. Consumers are more likely to purchase a new car when economic fortunes are rising. This applies to luxury-type products and services as well, such as luxury spas and expensive restaurants. The construction business is also to a large degree a cyclical industry with new homes being built and extensions to existing homes being undertaken during times of prosperity. Businesses expand during good times and equipment and steel manufacturers also benefit from this. Other cyclical industries are travel, electronic goods, large appliances (washing machines, refrigerators etc) and some brand name clothing lines. Of course, when the economy slows down or there is a possibility for interest rate hikes, cyclical stock companies suffer. Consumers put off buying that new car in the hopes of the situation improving, new homes and renovations are put on hold, companies make do with their current equipment and so on.

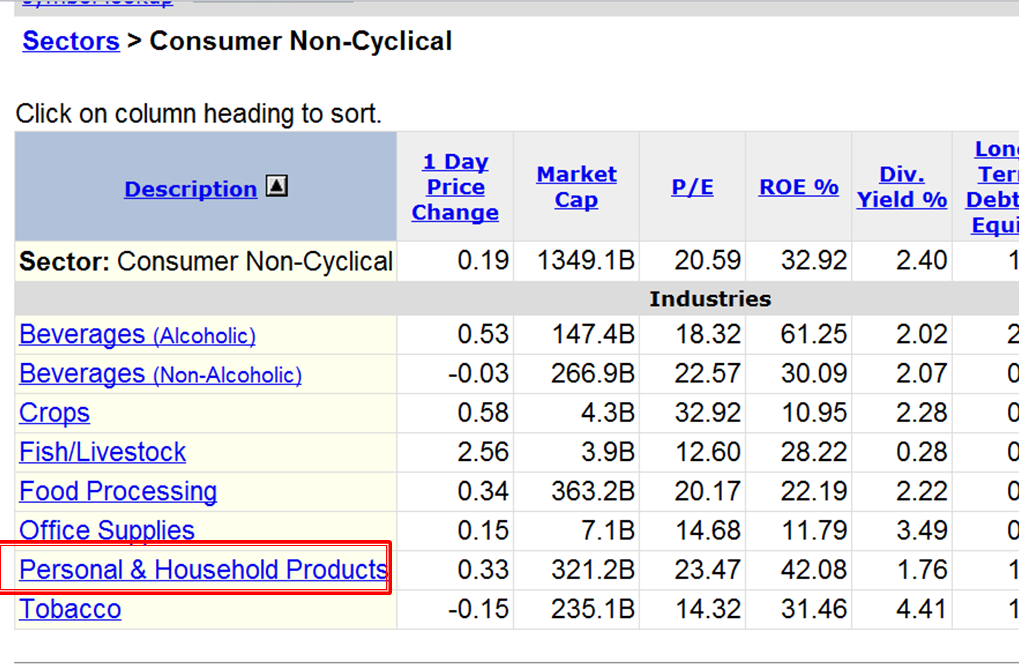

Non-cyclical stocks – also known as defensive stocks due to their low risk – include essential items that people have to buy no matter what state the economy is in. Utilities companies providing basic necessities such as electricity, gas and water, are not really affected by economic fluctuations and are therefore a good example of non-cyclical stock companies. In an economic downturn, investors favor utility companies for a steady return on investment, understanding that non-cyclical investments do not benefit from an upswing in the economy. Other examples of non-cyclical stock companies include tobacco companies and suppliers of consumable goods such as food, basic toiletries, pharmaceuticals and cleaning materials.

An avenue that relatively few investors explore is countercyclical stock companies. These are companies that perform well when the economy is taking a battering. Although there is some dispute as to which industries fit the bill of being a countercyclical stock company, it is generally agreed that suppliers of alcohol, discount retailers and temp agencies fall into this category. Some have suggested that correctional facilities can be included in this list, as desperate times result in people taking desperate measures for survival.

In a nutshell, the difference between cyclical and non-cyclical stock industries can be seen as the difference between necessity and luxury. Investors should explore all options to ensure that their investment portfolio is well balanced.