Difference Between Portfolio Beta Standard Deviation

Post on: 18 Апрель, 2015 No Comment

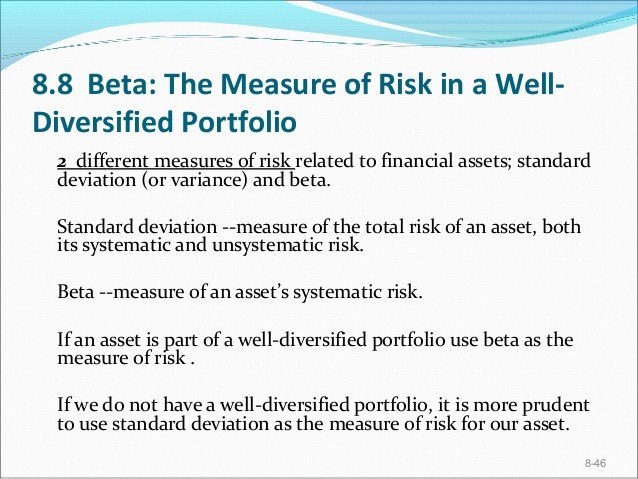

Modern portfolio statistics attempt to show how an investment’s volatility and return measure against a given benchmark, such as U.S. Treasury bills. Beta and standard deviation are measures by which a portfolio or fund’s level of risk is calculated. Beta compares the volatility of an investment to a relevant benchmark while standard deviation compares an investment’s volatility to the average return over a period of time. Standard deviation tells an investor a more general story about the security’s tendency to move up and down abruptly, while beta tells the investor how much higher or lower a security will likely trade in relation to an index.

Other People Are Reading

Standard Deviation Defined

Standard deviation is a statistical measurement that looks at historical volatility, indicating the tendency of the returns to rise or fall considerably in a short period of time. A volatile investment has a higher risk because its performance may change rapidly in either direction at any moment. A higher standard deviation means an investment is highly volatile, more risky and tends to yield higher returns. A lower standard deviation means the investment is more consistent and moves less choppily. It tends to yield more modest returns and presents a lower risk.

How Standard Deviation Works

How Beta Works

References

More Like This

How to Calculate Beta

How to Calculate Portfolio Returns & Deviations

How to Calculate Standard Deviation

You May Also Like

Difference Between Portfolio Beta & Standard Deviation. Standard deviation shows how numbers in a set of data are bunched together.

Difference Between Portfolio Beta & Standard Deviation; Historical Returns & Standard Deviation for Stocks, Bonds & Commodities; About Standard Deviation; Comments

Standard deviation of a mutual fund is a mathematical measure of the. Investors use a statistical regression analysis to calculate the.

Sigma, or standard deviation, is a widely used measure of the variability inherent in a population or sample. The difference between three.

A standard deviation is a unit of measurement that is used in statistics to determine how close results are to the average;.

Standard deviation is a measure of variability within a set of figures. A data set with a small amount of difference between.

Difference Between Portfolio Beta & Standard Deviation; What Are the Top Three Benefits of Designing a Portfolio? How to Buy Shares at.

The standard deviation is often referred to as the average of the averages.. then finding the difference of each value from.

Portfolio standard deviation is an important part of understanding volatility and risk. It allows an investor to understand how vulnerable he is.

Create a filter for stocks with high beta. the 52-week-range high from the low. Beta Portfolios; What Is Standard Deviation.

Many college programs require statistics. A key concept presented in a typical statistics class is the normal distribution of data or a.

Risk difference is an important tool that can help you decide whether an experimental. The beta or beta coefficient is a.

SEC Standards: Fiduciary Vs. Suitability. Definition of Option Contract Shares. Our question today is the difference between beta and implied volatility.

The sum of the differences between each data value (or test point) taken and the mean is equal to zero. How.

A stock's beta theoretically measures price sensitivity compared with the market. Investors with multiple positions should consider their portfolio's beta.

Beta and correlation have a tight linear relationship. Solve for the Correlation Coefficient by inserting Beta and standard deviation figures..5 =.