Difference between an investor and a trader

Post on: 15 Апрель, 2015 No Comment

Are You an Investor or a Trader?

Written By: admin — Feb 0612

Now that you have decided to participate in the stock market, you should ask yourself if you are going to be an investor or are you going to be a trader. What is the difference between the two? Both are actually investing in the stock market. They also have their stocks traded whenever they buy or sell a stock. The difference is in their approach.

An investor typically puts his money into something that he or she believes will grow over time. An investor uses what is called fundamental analysis. Here, the investor looks at the financial statements of the company, the nature of its business, the economy and how it operates. The investor then, after carefully examining all the data, would put a value on a company. After reaching a figure, the investor then compares it with the current stock price and if the estimated value is more than the current price of the stock, that is a signal that the stock is a good buy. If you want to know someone who did very well with this approach, then study about this man.

This is Warren Buffet. Talk about patience and vision, this guy is a master. He is known for his value investing approach and holding on to his stocks as long as the company is doing well and that its current stock price is not overvalued.

The trader on the other hand uses what they call technical analysis. Here, the trader looks at charts and determines where the price of the stock will go by looking at patterns. You will hear from them terms such as fibonacci retracement, price support and resistance, MACD and so on. The idea in technical analysis is that by studying previous patterns, you are more likely to predict the outcome of future events. They are not really concerned with the real value of the company but are more concerned on whether people would be buying or selling those stocks and at what price it would likely end. Quick profits are usually achieved through this strategy but so are the losses. In and out the market and buying and selling as quickly as possible is the name of the game here.

The good side of technical analysis is that when you do well, profits are quicker so your money grows faster. That means the more you increase your capital, the more you can invest it to make a bigger profit then the last one. The bad side is can anyone really predict where the prices of the stocks would go. Wouldnt that be a great gift to have. Unfortunately, not even the greatest of the mathematicians can predict where the price of a stock will be heading even after crunching all the numbers and simulating patterns.

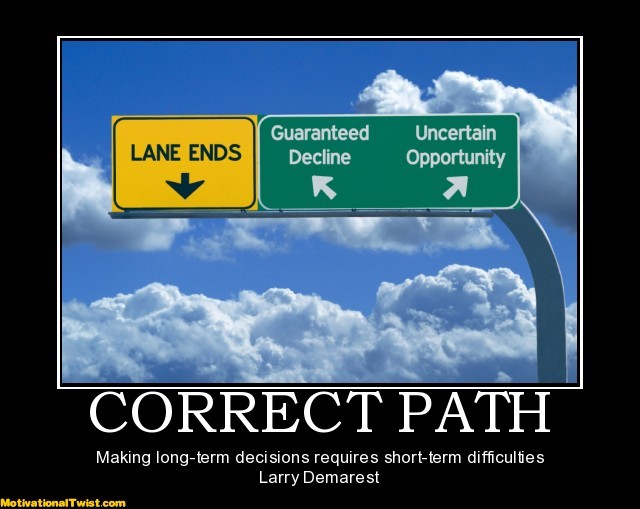

The bad side of fundamental analysis is that it takes too long. You do not realize your profits immediately and maybe after studying the company for quite some time, the price has already gone up which will make you think again whether to buy it or not. The good side of it is that it is a safer way to invest and that when you really did your homework with the company, its real value will be reflected by the price of the stock later on and that is when you will see the profit that you have made.

To learn more about Warren Buffet and the lessons you can learn from him, try this book: