Did Quantitative Easing Work

Post on: 5 Май, 2015 No Comment

QE was a success in many ways, but it’s too early to pass a final judgment

Sorbetto / Getty Images

Summary — Updated November 2014

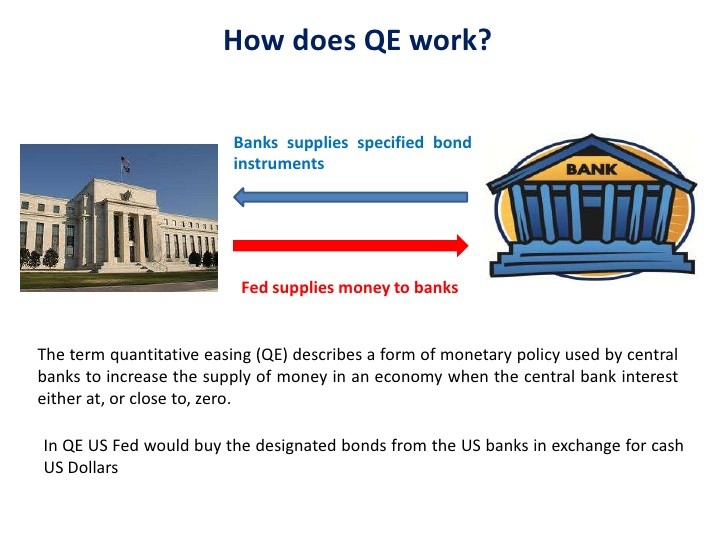

The U.S. Federal Reserve wrapped up the third round of its quantitative easing program, known as “QE” or “QE3,” following its October 28-29 meeting. The goal of quantitative easing, which ran in three separate segments between November, 2008 and October, 2014, was to spur economic growth during the years following the 2008 financial crisis. The Fed accomplished this by buying bonds in the open market, thereby depressing yields and keeping borrowing costs low.* With the program now finished, the key question is: “Did quantitative easing work?”

What Quantitative Easing Achieved

In some ways, quantitative easing was indeed a success. First, it provided relief and helped restore confidence during the depths of the financial crisis. It’s easy to forget now, but when the Fed first announced – and subsequently initiated – the program in late 2008, the markets were in a state of paralysis amid fears that the entire global financial system was in jeopardy of collapse. While it can never be known what would have occurred had the Fed not initiated quantitative easing, we do know now that confidence was indeed restored. and both the economy and the markets eventually moved back to a normal footing after QE began.

This brings us to the next benefit of quantitative easing: a restoration of positive economic growth. After collapsing by 8.2% in the fourth quarter of 2008, U.S. gross domestic growth came in at -5.1% and -0.5% in the first and second quarters of 2009, respectively, and then began to move into positive territory with readings of 1.3% and 3.9% in the third and fourth quarters of that year. Growth has remained in positive territory in the years since despite a host of challenges – including tighter regulations, higher taxes, and economic weakness overseas – indicating that quantitative easing fulfilled its goal of contributing to an economic recovery.

Quantitative easing played a more direct role when it comes to financial market performance. Stocks bottomed on March 9, 2009 – a little over three months after the Fed began its quantitative easing program – and went on to register a gain of 194% (21.6% annualized) in the next five and a half years. Both investment-grade and high yield bonds delivered robust return in this interval, as well. Naturally, these strong returns were also fueled by the Fed’s low-rate policy. favorable economic conditions, and strong corporate earnings, but quantitative easing nonetheless made a key contribution to financial market returns – and, by extension, confidence among consumers, businesses, and investors.

Finally, QE helped keep inflation in positive territory. While one of the initial criticisms of the policy was that “money printing” would fuel inflation, this actually proved to be a positive due to the powerful de flationary forces coming from overseas. Deflation is a destructive condition for a country’s economy and financial markets, as we’ve seen from the events in Japan during the past 20 years. As a result, any policy that helps keep inflation above zero can be viewed in a positive light.

Where Quantitative Easing Fell Short

Unfortunately, it isn’t possible to pass a final judgment on quantitative easing at the present time, and it may not be for several years to come. The true measure of success for QE would be “self-sustaining” economic growth; or in other words, an economy that can register an acceptable level of growth without Fed assistance.

While it has appeared that this would indeed be the case at various points – such as the second half of 2013 and the middle portion of 2014 – the jury is still very much out. Weaker global growth has begun to take a toll on the U.S. economy at the margin, and it has begun to do so just as quantitative easing is set to wind up at the end of October. If the economy weakens considerably and the Fed is forced to consider yet another round (“QE4”), then legitimate questions will arise as to whether the U.S. economy is capable of delivering even modest, 2%-3% growth without Fed assistance. If this proves to be the case, history will look back on quantitative easing as having made conditions “less bad” – not exactly an achievement that qualifies as an outright success.

It’s also necessary to keep in mind that the Fed itself contributed to the situation that brought about the need for quantitative easing in the first place. By cutting rates too aggressively in response to Y2K fears, the Fed set the markets up for the 2001 stock market bubble. The subsequent bursting of that bubble created the need for low interest rates through the middle portion of the last decade, which in turn fueled the housing bubble of 2006-2007. The inevitable end of that bubble brought about the 2008 financial crisis, which precipitated the Fed’s current ultra-low rate policy and the beginning of quantitative easing.

In this sense, the Fed has exacerbated the swings in the economic and market cycle rather than dampening them. If the strong markets of the past few years begin to crumble as we move into 2015, then this entire era of Fed policy – quantitative easing included – will rightly be considered a failure.

The Bottom Line

In the short term, quantitative easing helped heal an ailing economy, and it was a key factor in bringing the financial markets back from their post-crisis lows. However, it’s impossible pass a final judgment on the policy until the U.S. economy can indeed generate a sufficient level of growth without support from the Fed. At this point, that very much remains to be seen.