Diamond Chart Pattern

Post on: 16 Июнь, 2015 No Comment

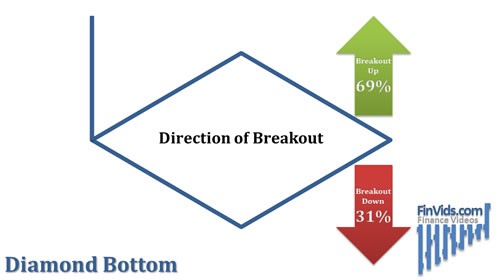

At first glance, a diamond pattern may look like little more than head and shoulders top patterns with crooked necklines but this only tells half of the story. In reality diamond patterns are more like broadening top formations because they normally only reverse upward trends. In this sense, they are always about distribution. The patterns begin when a very strong stock with stellar growth trends moves to a new high and consolidates after a lengthy advance.

For several sessions the stock meanders in a narrow consolidation as pundits discuss the longer-term fundamental merits of the stock but eventually there is an upside breakout. In most cases, the cause of the upside breakout will be an analyst preview of an upcoming earnings report or positive comments from the company regarding new products or clients. As the news breaks the stock surges to new highs on very strong volume.

In fact, the upside breakout usually proves legitimate because the stock continues to move higher for several sessions. Then, abruptly the stock begins to fall. Volume is light and there is no corporate news to account for the weakness but as bullish investors rationalize that the stock is merely correcting some of the recent gains, many investors that bought the stock at lower prices are using the weakness to unwind long positions. The stock continues to drift lower on relatively light volume until there is a sector event that raises doubt about the most recent upside breakout. Although all of the news from the stock in question has been positive investors understand that the current share price carries a great deal of risk because it has been priced for perfection. As selling continues volume accelerates and when the stock falls through the previous upside breakout level recent buyers panic leading to further weakness.

Analysts continue to reiterate buy recommendations but within days the share price is devastated, moving far below even the most recent consolidation. As panic subsides steps are taken by the company to reassure investors that all is still well. Very often press releases are issued or leading Wall Street analysts come to the defense of the stock, suggesting that it is a compelling value at current levels. All of this leads to a reaction low and slowly the stock begins to move higher. In the days ahead more positive corporate news is disseminated, suddenly investors are reinvigorated and the share price soars. Investors rationalize that the recent scare was a giant overreaction and the stock offers great opportunity but as the rally progresses volume is stubbornly average. Finally, the company releases more good news and analysts pound the table with new buy recommendations but despite this the stock does not come close to reaching the recent new high. To make matters worse, on the day of the good news the stock opens higher but closes at or near its low on heavy volume. The increase in volume and weaker stock price suggests distribution, someone is selling into the good news. As the stock price falls puzzled analysts and investors wonder how the stock could be falling on such good news but investors that bought the stock at much lower prices continue to use every rally to sell. Days later the stock breaks sharply lower. Weeks later news is released suggesting that the fundamental outlook has deteriorated.

How are Technical Targets Derived?

Because diamonds are very large patterns, the technical implications are often extremely large. Technical targets are derived by subtracting the difference between the record high and the reaction low from the eventual breakout level. The breakout level will be determined by a trend line drawn from the reaction low to the first significant low on the right side of the pattern.

Diamond Reversal for ADC Telecom

In 2000 ADC Telecom (ADCT) stock rallied to $45.50 where it proceeded to consolidate for several sessions. On July 20 the ADC received a three year contract from German electronics conglomerate Siemens and the future seemed bright. ADC rallied through $45.50 on huge volume and by July 27 the stock had reached a record high at $49. That is when the selling began. The following day Nortel (NT) announced that it would spend billions to purchase Alteon Websystems.

The aggressive nature of this transaction meant that competitors would have to get bigger or perish. As investors fretted about dilution, stock prices for the sector plummeted and ADC sank to a reaction low of $33 on August 3. In the aftermath of the Alteon deal analysts once again began to recommend telecom equipment stocks and it was not long before ADC was moving sharply higher. On August 17 the ADC reported third quarter sales rose a remarkable 67-percent and earnings beat estimates by 2-cents. On that good news the stock spiked higher and briefly traded at $47.25 before closing near the session low at $42.38. To make matters worse, competitor Visual Networks (VNWK) tumbled 43-percent on August 23 after warning that sales would be about half of what was expected due to a weakened spending environment. Eight sessions later ADC traded as low as $34.38.

On that day, August 29, ADC company officials said they were comfortable with Wall Street estimates and vowed not to make dilutive acquisitions. The stock rebounded smartly on a NASDAQ-leading 39.68 million shares but the gains proved short lived — and so too was the corporate promise not make dilutive acquisitions. The stock plummeted $31.31 on September 9 after announcing it would acquire money- losing Broadband Access for $2.5 billion in stock. That announcement marked the downside technical breakout for ADC. By late October of that year the stock was changing hands at just $15.88.

Vital Signs

Diamonds are complex reversal patterns because volume trends often suggest accumulation. Volume is heaviest at lows and upside breakouts but moves to new and relative highs are always characterized by one day reversals.

Although the spike to the reaction low may be violent, the fact that stock holders are willing to surrender their stock at drastically lower prices without substantive fundamental news portends lower prices.

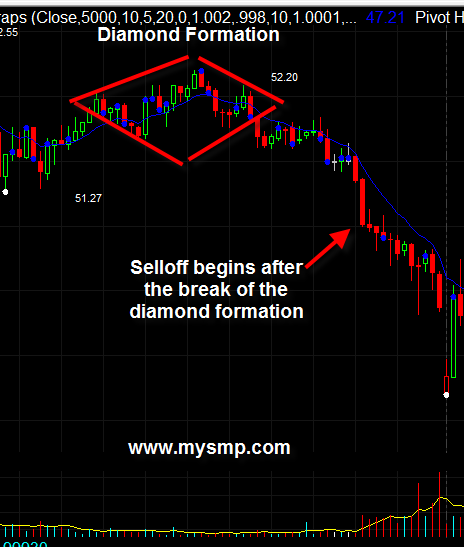

Diamonds are large patterns and the technical implications are often dire. It is important to let the pattern reach completion. This means establishing short positions only after the downside breakout.

Downside breakouts often lead to small 2-3% declines followed by an immediate test of the breakout level. If the stock closes above this level (now resistance) for any reason the pattern becomes invalid.

Diamonds are tough patterns because there are many mixed signals. Our understanding of the diamond will definitely help with the rounding top.

head and shoulders top rounding top