DFA Emerging Markets Value Portfolio (DFEVX)

Post on: 9 Май, 2015 No Comment

# 54 Diversified Emerging Mkts

U.S. News evaluated 235 Diversified Emerging Mkts Funds. Our list highlights the top-rated funds for long-term investors based on the ratings of leading fund industry researchers.

Summary

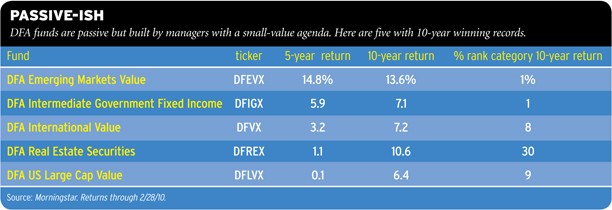

By investing in the cheapest 25 percent of emerging market stocks, the passively managed DFA Emerging Markets Value Fund attempts to exploit the potential of value stocks around the globe. This strategy, which tilts toward mid-cap stocks with lower price-to-book ratios than its benchmark MSCI Emerging Markets Index, has created a respectable, if sometimes volatile, fund designed for long-term investors.

As of February 04, 2015, the fund has assets totaling almost $17.06 billion invested in 2,171 different holdings. Its portfolio consists primarily of passive investments in stocks from about 20 emerging market countries. Fund managers look for equities that offer a value premium in their respective markets and possibly produce higher expected returns over longer investment time horizons. Some top holdings include Gazprom OAO, China Construction Bank and Bank of China. Thirty-four percent of the fund is allocated to financials. Returns have been on an upward trajectory since the crash of 2008-09 but it took a large hit in 2011 as emerging markets fell out of favor. Since then performance has been volatile with a slight upward trend in 2013. The DFA Emerging Markets Value Fund is managed by senior portfolio manager Karen Umland along with three other managers who meet twice a month to ensure the fund is following its mandate. The fund has returned 1.93 percent over the past year and -1.49 percent over the past three years.

Originally, the DFA Emerging Markets Value Fund was conceived in 1998 as a no-load fund designed to achieve long-term capital appreciation. The greatest period of volatility for the fund came between 2011 and 2013 with a more than 25 percent loss in 2011, a gain of more than 19 percent in 2012 and again a drop of nearly four percent in 2013. The fund has returned 0.94 percent over the past five years and 8.51 percent over the past decade.

Investment Strategy

Management locates the cheapest 25 percent of stocks, based on price-to-book ratio, in all emerging markets. Then they cut out companies with regulated profits like utilities. Management also only buys American or Global Depositary Shares. They only sell a stock once it no longer fits the fund’s value criteria. Managers don’t sell positions themselves. Instead, they give a separate group of traders a large selling window — as much as four months — to exit a position in order to reduce trading costs.

Role in Portfolio

Morningstar recommends the fund play a supporting role in your portfolio.