Describe in detail a major hedge fund trading strategy University Business and Administrative

Post on: 1 Июль, 2015 No Comment

Extracts from this document.

Introduction

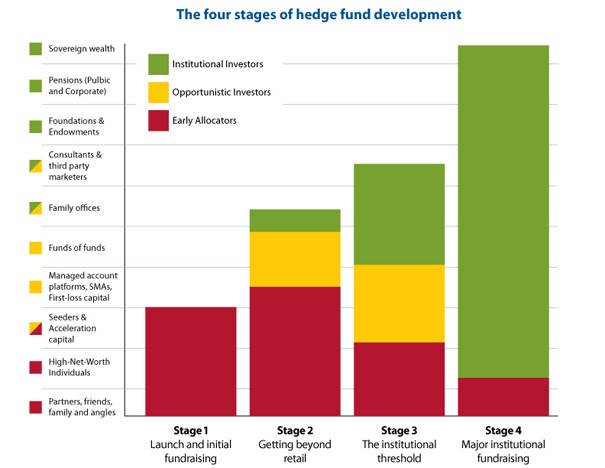

Describe in detail a major hedge fund trading strategy NAME: STUDENT ID: UNIT: TUTOR NAME: DATE OF SUBMISSION: WORD COUNT: 3520 HEDGE FUND TRADING STRATEGY. LONG ?SHORT EQUITY STRATEGIES TABLE OF CONTENTS: S.NO. PARTICULARS PAGE NO. 1 WHAT IS A HEDGE FUND. AN INTRODUCTION 2 2 GROWTH OF HEDGE FUND INDUSTRY 2 3 WHAT IS LONG SHORT EQUITY HEDGE STRATEGY 3 4 GENERATION OF RETURNS & COSTS INVOLVED 8 5 RISKS INVOLVED 9 6 MEASURING RISK 10 7 PERFORMANCE MEASUREMENT 11 8 CONCLUSION 12 9 REFERENCES 13 1. WHAT IS A HEDGE FUND. AN INTRODUCTION To ?hedge? means to take on an asset position such that it lowers overall risk to offset an existing source of risk (Connor et al, 2003). A hedge fund can be explained to be a private partnership which invests in heterogeneous investments with an aim to maximise expected returns while reducing risk (Kourbetis, 2010). They are speculative investment vehicles which are designed to utilize the high-quality information that is possessed by their managers. It is also generally defined to be an ?actively managed, pooled investment vehicle? which is open to only a limited set of investors and that which generates absolute kind of returns. (Connor et al, 2003). 1. GROWTH OF HEDGE FUND INDUSTRY 2013 was a year of strong return of investor confidence in the hedge funds industry. The Prequin Report (2014) reports that the most established country in the hedge fund industry is the USA followed by UK. 60% of the fund managers of the world are located in USA and approaximately 21% of the managers are in the U.K. Hedge fund assets have grown more than $ 360 Billion over the year taking the total assets number past the $ 2.6 Trillion mark (Prequin Report, 2014). Assets Under Management (AUM) of UK approximates to a total of $ 440 Billion (17% of world-wide total). . read more.

Middle

due to occurrence of a pricing irregularity not relating to company fundamentals (Connor et al, 2005). It results in a positive pay-off as and when the market contracts and corrects itself, resulting in both the stocks to converge themselves irrespective of the movements in the market. This kind of trading strategy is not limited to only the equities market, but can deal in any type of securities. 1. Dedicated Short Bias: Another variant of this kind of strategy is the dedicated Short bias. This works very well when markets show a declining trend, since in this kind of strategy the managers concentrate on the short more (Connor et al, 2005). This results in sacrificing the market neutrality feature. 1. GENERATION OF RETURNS & COSTS INVOLVED: Long-short equity hedge funds have historically been known to generate equity ?like returns with lower volatility and shallower high to low declines. Returns generated on long-short equity hedge strategies come from directional or spread bets on the market. Other factors influencing returns are price momentum, market activity, etc. In this kind of long-short equity hedge strategy, the manager targets to make returns from falling stock prices too. He re-purchases the sold stock at a price which is ideally lesser than the price that he sold the stock for, thus generating profits on it. This method is commonly referred to as Short Selling. Thus, in this type of strategy, the manager generates returns when the stock prices of under-valued long positions rise and when the stock prices of over-valued short positions fall. Per Eurekahedge (2004), there could be three types of potential outcomes or returns by investing in a long-short equity hedge. In the first case, if the long positioned stock rises in terms of value and the short positioned one declines, it is called the most favourable outcome termed as ?double alpha. In the second case, only one side of the portfolio moves favourable and generates a net positive return. . read more.

Thus the research finds that volatility cannot be considered as a relevant measure of hedge funds risk and hence Sharpe ratio cannot be considered for measuring performance, since it has a tendency to overestimate it. She finds that instead of Sharpe Ratio, performance measurement by using Downside Risk and Sortino ratio would prove helpful. Downside Risk indicator takes into account asymmetric risk and concentrates only those returns that are below are certain threshold as acceptable. By replacing volatility by downside risk in Sharpe ratio, we derive the Sortino ratio. It is the return which the portfolio generates above the threshold performance, adjusted for risk, measured by downside risk. The other performance measurement models include the Capital Asset Pricing model (CAPM), multi-factor models, Carhart?s model, etc as discussed by Capocci et al(2004) 1. CONCLUSION The introduction of hedge funds has made the investment markets more exciting, innovative and competitive. It has resulted in exploring and exploiting a lot of talented managers who have been compensated with lucrative packages and heavy capital inflows. Over the last 20 years, the market risk (Beta) of HFRI Equity Hedge Index to the S&P 500 has been approximately 0.45, signifying that it normally moves around half of that of the broad market. This gives elasticity to the managers to take advantage of more efficient exposure to equities. Thus, for long-short managers, the challenge is to determine the optimal level of market participation, through using tools such as Shorts, leverage etc. to overcome the volatile trends in equity pricing (Blackstone, 2013). Given the helpful environment for stock-pickers, the forecast for the performance of Long-Short Equity strategies in the hedge fund industry has been positive (Durden, 2014). This view is also supported by Neuberger Berman Report (2014) which provides a positive strategic outlook for long-short equity hedge trading strategies. They say that lower stock correlations and greater valuation spread will enable such strategies to generate more ?alpha. It further states that in case there is market pull-down, a fine short position of this kind of strategy would ideally help in minimizing the downside impact of the market conditions. 1. . read more.

The above preview is unformatted text