Definitions ETF Portfolio Management

Post on: 7 Апрель, 2015 No Comment

Absolute Return Strategies - investment portfolios that seek to deliver positive returns in both up and down market environments.

Alpha a measure of excess return, or value added on a risk-adjusted basis, versus the benchmark index. A positive alpha of 1.0 means the investment has outperformed its benchmark index by 1%.

Beta - a measure of the volatility, or risk, of an investment versus the market as a whole. A beta of 1 suggests that an investments price may move in synch with the overall market.

Correlation and Correlation Coefficient correlation measures the degree that two investments move in relation to each other. The correlation coefficient ranges between -1 and +1. Two investments that move in lockstep would have correlation coefficient of +1.

Dow Jones Credit Suisse Hedge Fund Index (HFI) includes approximately 8,000 funds that each have a minimum of $50mm under management, a 12-month track record, and audited financial statements. The index is asset weighted and excludes separate accounts.

Exchange -Traded Funds (ETFs) typically described as index funds that trade like stocks. When employed passively, ETFs may offer investors low costs and tax efficiency.

Drawdown the percentage peak-to-trough decline of an investment measured on a month-end basis.

Investable Benchmarks a strategic range of diversified portfolios of passive exchange-traded funds (ETFs) designed to show investors core multi-asset class diversification.

Rules-Based Strategy an investment strategy based on various pre-determined investment rules. Indexing is a passive form of rules-based investing while quantitative strategies would be an active example. Fundamental discretionary strategies differ in that they may be influenced by investor opinion and/or emotion to a greater degree.

S&P 500 Index a passive index of common stocks that represents the U.S. stock market. The index is mainly comprised of large cap companies and reflects roughly two-thirds of the total domestic stock market value.

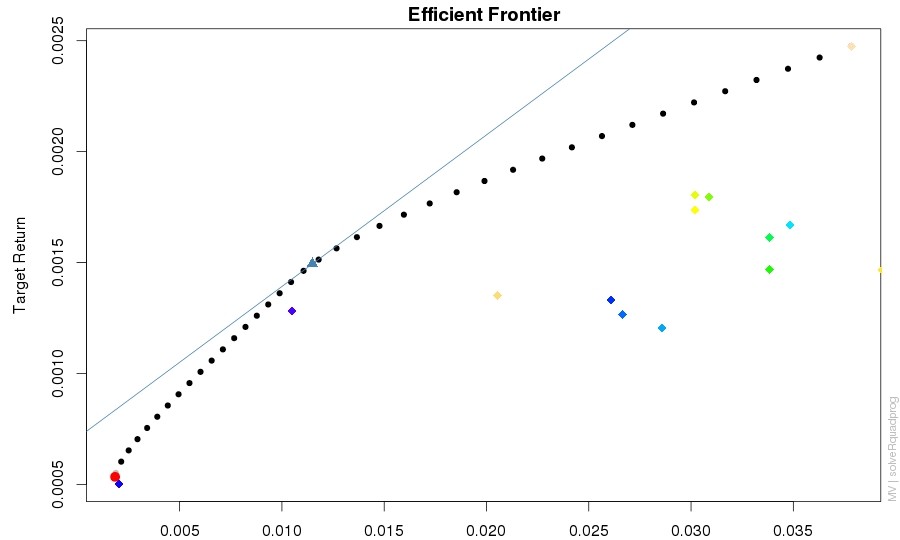

Sharpe Ratio a measure of risk-adjusted performance in order to differentiate performance between portfolio management skill and excess risk. A larger Sharpe ratio indicates better risk-adjusted performance.

Standard Deviation the dispersion of a set of data from its mean which measures the volatility or risk of an investment. The higher the volatility of the investment returns, the higher the standard deviation.

Trend Following an intensely active rules-based investment strategy that reacts to existing trends in the price and volatility of securities across multiple asset classes.

Value Added Monthly Index (VAMI) a value or a chart reflecting the monthly growth of a hypothetical $1,000 in a given investment over time.