Define Market Capitalization Small Caps Large Cap & Mid Cap Fund Stocks

Post on: 16 Март, 2015 No Comment

Market capitalization, commonly known as market cap, is calculated by multiplying a companys outstanding shares by the companys stock price per share. A companys stock price by itself does not tell you much about the total value or size of a company; a company whose stock price is $60 is not necessarily worth more than a company whose stock price is $25. For example, a company with a stock price of $60 and 100 million shares outstanding (a market cap of $6 billion) is actually smaller in size than a company with a stock price of $25 and 500 million shares outstanding (a market cap of $12.5 billion).

Market capitalization categories

Publicly traded companies are typically grouped into three different market cap categories: large cap, mid cap, and small cap. Not everyone agrees on the same market cap cutoffs for each category, but the categories are often described as follows:

What is a large cap stock?

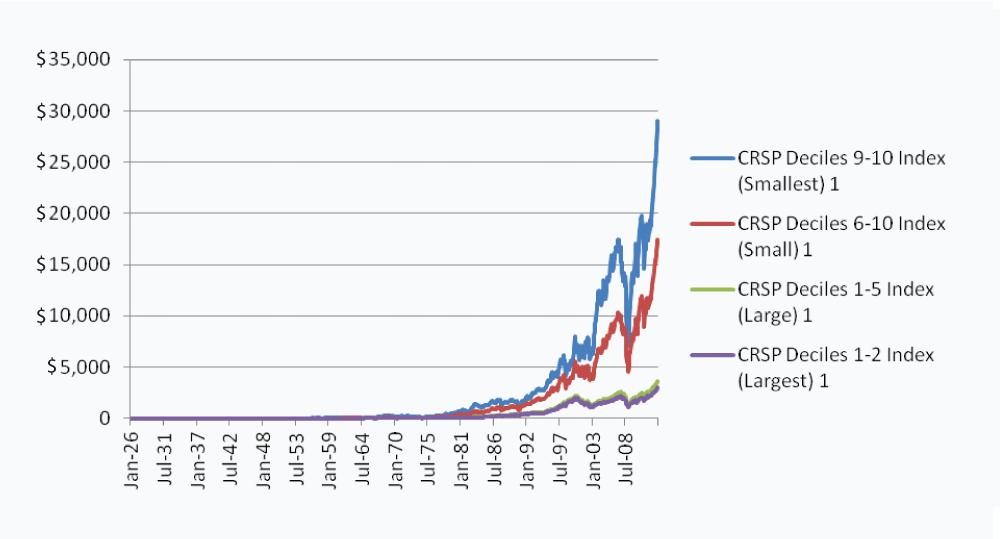

Large caps are typically defined as companies with market caps that are $10 billion or above. Included within large caps are mega caps, which are typically defined as companies with markets caps of $200 billion or above. These tend to be companies that are very stable and dominate their industry. Wal-Mart, the worlds largest retailer, is an example of a mega-cap stock. Large-cap and mega-cap stocks tend to hold up better in recessions, but they also tend to underperform small-cap stocks when the economy emerges from a recession. Large-cap and mega-cap stocks tend to be less volatile than mid-cap and small-cap stocks and are therefore considered less risky.

What is a mid cap stock?

Mid caps are typically defined as companies with market caps that are between $2 billion and $10 billion. Mid-cap stocks tend to be riskier than large-cap stocks but less risky than small-cap stocks. Mid-cap stocks, however, tend to offer more growth potential than large-cap stocks.

What are small cap stocks?

Small caps are typically defined as companies with market caps that are less than $2 billion. Many small caps are young companies with significant growth potential. However, the risk of failure is greater with small-cap stocks than with large-cap and mid-cap stocks. As a result, small-cap stocks tend to be the more volatile (and therefore riskier) than large-cap and mid-cap stocks. Historically, small-cap stocks have typically underperformed large-cap stocks during recessions but have outperformed large-cap stocks as the economy has emerged from recessions.

The smallest of the small-cap stocks are called micro-cap and nano-cap stocks. Micro-cap stocks ($50 million to $2 billion in market capitalization) and nano-cap stocks (market caps less than $50 million) are even riskier than small-cap stocks. While the opportunity for these companies to experience extreme growth is great, the risk to lose a large amount of money is also possible.

Market capitalization and your portfolio

Since its rarely possible to know exactly when the market will favor large cap, mid-cap, or small-cap stocks, its a good idea to include a mix of different sized stocks in your portfolio. An investor with a long time horizon, who is willing to take on more risk in exchange for higher potential returns, may want to hold a larger allocation of small-cap and mid-cap stocks. An investor with a shorter time horizon, who is looking for less volatile stock returns or for stocks that will provide more stable dividends, may want to hold a larger allocation of large-cap stocks. Our investment advisors can help build a portfolio that is appropriate for your given risk tolerance, time horizon, and financial goals.

There are times when a certain market cap category looks particularly attractive to our investment team. For example, there have been times when many small-cap stocks look cheap (and therefore attractive) compared to large-cap stocks and vice versa. Additionally, large-cap, mid-cap, and small-cap stocks tend to vary their performance through different parts of the economic cycle. Our investment advisors can help you determine which market cap category may look particularly attractive and help you adjust your portfolio accordingly.

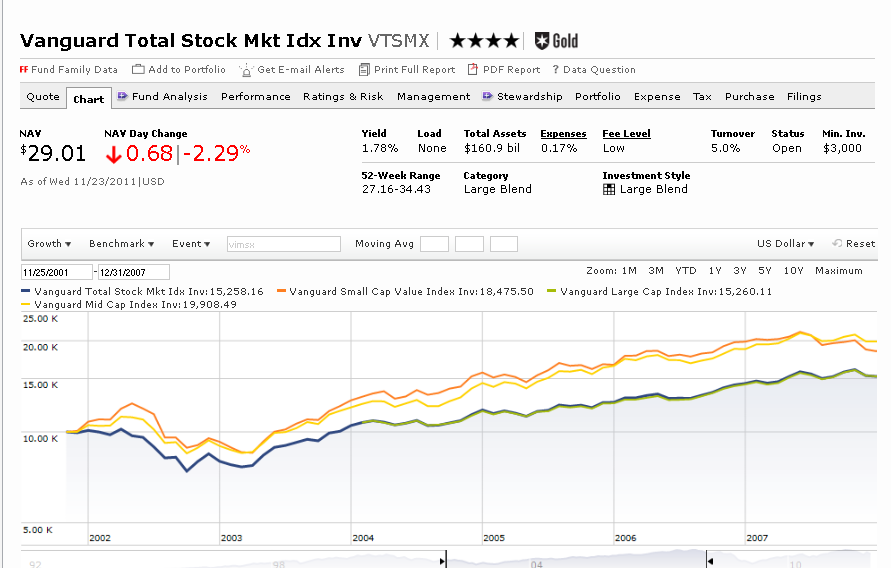

Mutual funds and market cap

Mutual funds that invest in stocks are typically categorized as large-cap, mid-cap, or small-cap funds. A mutual fund that is described as a large-cap fund is usually invested mainly in large-cap stocks. However, it is important to understand that not all mutual funds remain true to their categorizations. A large-cap fund may also invest in small cap stocks and other riskier types of securities. When you buy a fund that is categorized as a large-cap fund, you may be buying some securities that arent large-cap stocks, thus introducing more risk to your portfolio than you intended. Our research team is able to identify what is actually in a mutual funds portfolio and determine which funds are right for your investment portfolio.