Default Risk in Corporate Bonds

Post on: 18 Май, 2015 No Comment

Identification

Corporations finance themselves by taking out loans, or issuing bonds to creditors. Creditors earn interest payments, until corporate bond principal is repaid at maturity. Bondholders do not own the company, but carry asset claims that are superior to those of shareholders. In the event of bankruptcy, bondholders are paid first from liquidated assets. Bonds, however, may not be repaid in full when the distressed company has limited resources. Default risks increase as earnings power deteriorates. Businesses report slack profits because of recession, increased competition or failed product lines.

Considerations

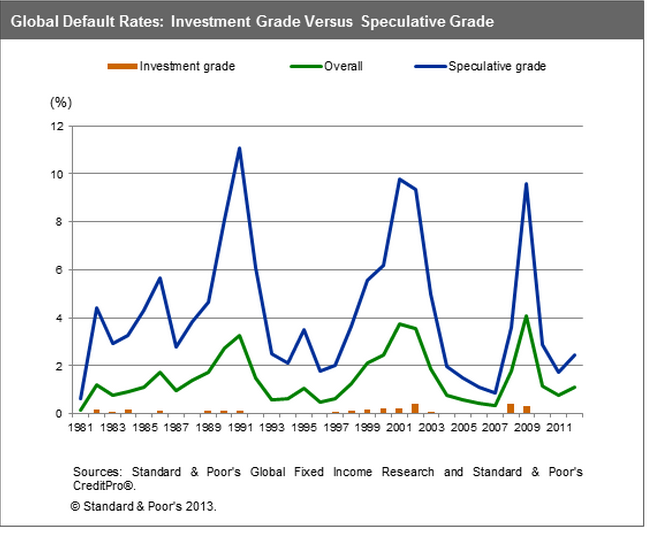

Credit rating agencies, such as Standard and Poor’s and Moody’s, rate individual bonds and corporations according to their abilities to make payments. Compare these ratings against your own research of corporate annual reports, prior to making financial commitments into the bond market. Bonds are categorized into investment grade, non-investment grade, or default. Non-investment grade bonds are often referred to as high-yield, or junk bonds.

Strategy

Structure your bond portfolio to balance risks against rewards. Investors demand higher interest rates from riskier bonds, as compensation for potential losses. Coordinate asset allocation to match your financial goals and station in life. For example, first-time homebuyers saving money for a down payment on property, and retirees looking to preserve retirement income will prefer to limit risk exposure. These savers covet corporate bonds from prime rated companies, such as ExxonMobil and Microsoft. Alternatively, younger savers investing for growth may prefer to add more junk bonds to their respective asset allocation. Investors with long-term time horizons are more so able to recover from potential losses.

References

Resources

More Like This

What Is a Bond Sinking Fund?

What Are Stock and Flow Variables?

How to Issue Corporate Bonds

You May Also Like

There are two ways to invest in a company: stocks and bonds. Bonds represent a debt to the company, and the rate.

Liquidity risk, along with default risk and interest-rate risk, is an important risk factor in determining corporate bond returns. Liquidity risk refers.

Factors Influencing Purchasing Power. Purchasing power is a term used in economics that is defined as the amount of goods and services.

Few investments are considered safer than U.S. Treasury bonds. Buying corporate bonds offers a greater risk of default, which corporations compensate for.