Decline in s value helps the United States but threatens competitors

Post on: 25 Май, 2015 No Comment

By Anthony Faiola

Washington Post Foreign Service

Thursday, October 29, 2009

LONDON — The dramatic decline of the U.S. dollar is aiding the American economic recovery but setting off alarm bells overseas, with corporate executives, politicians and pundits calling it among the biggest threats to the rebounds underway in Europe and Japan.

Mounting concern abroad over the shrinking dollar underscores how exchange rates have emerged as a growing source of friction, with many countries jockeying for the weakest currency to boost exports and protect their markets from foreign competition.

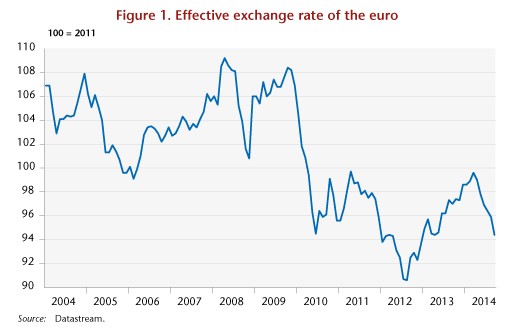

The U.S. dollar has taken a steep tumble — down 18 percent against the euro in the past 12 months, and more than 40 percent against the South African rand and Australian dollar — as U.S. officials have effectively diluted its value, printing money and adopting near-zero interest rates, to jump-start the economy.

The moves have sharply improved the U.S. trade deficit, as everything from American-made cellular phones to furniture suddenly become more competitive both at home and overseas while giving foreign manufacturers more incentives to create jobs in the United States. Analysts say the severity of the downturn in the United States as well as the unemployment rate would be markedly worse without the weak dollar.

Yet it has had just the opposite effect on German washing machines and Japanese cars, making them less price competitive in the world’s largest market — the United States. Moreover, those same Japanese cars and German washing machines are also less competitive in the world’s fastest growing market — China. That’s because the Chinese yuan, still closely pegged to the value of the U.S. currency, has fallen just as much as the dollar on world markets, serving up a double whammy to countries with fast-appreciating currencies like the euro. It also means that China, the country that enjoys the single biggest trade surplus with the United States, has actually seen that surplus grow during the recession.

Developing countries

Other developing countries whose currencies are not pegged to the dollar, such as Brazil, have grown so concerned about the soaring values that they have recently enacted new investment controls to stem the U.S. dollar’s fall. European companies including Nestle, based in Switzerland where the franc has appreciated 13 percent against the dollar in the past 12 months, cite exchange rates as a bigger factor in recent revenue declines than weak global demand.

We’re losing competitiveness globally because of this, complained Jose Manuel Rodriguez Bordillo, director general of Spain’s Agrosevilla, one of the world’s largest olive exporters. There’s no way this can continue; we’re losing 15 percent [in revenue] this year just because of the exchange rate.

The weak dollar is becoming a source of international tension, particularly in U.S.-European relations. Officials in the 16 countries that use the euro warn a continued slide of the dollar may pose long-term structural problems for Europe, forcing down wages and hurting employment in the months and years ahead. This week, a top aide to French President Nicolas Sarkozy called the value of the dollar a disaster for Europe, warning of dire consequences to the global economy if it remains at its current levels. In some circles, the dollar’s decline is seen as a protectionist move by the United States — something U.S. officials have strongly denied.

If the dollar is going down this way, it is because that is what the Americans want, economic commentator Yves de Kerdrel wrote in the French newspaper Le Figaro this week. In a globalized economy where national egoisms persist but where customs barriers have almost disappeared, the best protection consists in playing on exchange rates.

Yet analysts say the fall of the dollar reflects a basic economic truth: the U.S. financial situation is no longer as solid as it once was. Rather than being undervalued, many argue that the dollar has room to fall further.

The dollar is weaker not so much because people are buying yen because they think Japan is suddenly going to be the next hot thing again, said Stephen King, chief economist at HSBC in London. Instead, there is a sense that in some very defined and critical way, the dollar and the U.S. have lost their way. The U.S. has borrowed so much from foreigners. They’ve got a rising budget deficit and few ways to bring it under control that investors see as viable. Those are things that affect the value of a currency.

Investor confidence

The dollar has also fallen because investors are feeling more confident about the global economy. During the height of the crisis, the greenback was viewed as the safest port in the storm. As the storm subsides, investors are charting a course again for emerging markets which, given the poor fiscal position and fragile recovery in the United States, no longer seem quite as risky as they once did.

It has generated a mild snowball effect. As the dollar weakens, it becomes less attractive to hold, so investors increasingly are dumping the currency and moving into oil, gold and stocks. That, in turn, has helped fuel a strong recovery in commodity prices and recent stock market surges.

The risk remains of a full-blown run on the dollar that could force the Federal Reserve to suddenly raise interest rates, dealing a potentially severe blow to the U.S. recovery. That could happen if major holders of dollars, such as China and Japan, begin to sell off their holdings. China in particular has made statements on the need to move away from the dollar as a reserve currency, though analysts say they have so far backed up those calls with only minor moves to divest their holdings. There are also rising concerns that the U.S. policy of flooding the economy with cheap money could drive up inflation, as it has already begun to do in Britain, a country where the once-mighty pound has been humbled, tumbling against the euro as well as the dollar.

But for now, the weak dollar is one problem the United States loves to have.

Right now, you’re getting an economic bump from it, said C. Fred Bergsten, director of the Peterson Institute for International Economics in Washington. Our conclusion is that the dollar’s value is just about right where it should be.

Correspondent Edward Cody in Paris contributed to this report.