DCF Valuation in Emerging Markets AMT Financial Training

Post on: 9 Май, 2015 No Comment

Discounted cash flow valuation for emerging markets companies can be much tougher than valuing companies in developed markets. Two issues typically arise: what currency to use in the forecasts and how to calculate discount rates. In order to cut through these issues, practitioners sometimes use simple rules of thumb. This article provides a robust analytical framework that can be applied to these issues and a free worked example to download.

A standard DCF model requires two basic inputs: cash flow forecasts and a discount rate. Both of these inputs can be problematic when the company to be valued operates in emerging markets.

What currency should be used?

When choosing the currency to use in your analysis, follow a simple rule: use the same currency for both the cash flow projections and the discount rate .

The currency used can be either:

- The local emerging market currency

- A standard currency (e.g. the US$)

When using a standard currency, forward FX rates should be used for the FX conversion. Forward FX rates can be derived using the spot FX rate and the inflation differentials between the two currencies.

Forward FX rate in year 5 = Spot FX rate x (1 + local CCY inflation) 5 / (1 + US$ inflation) 5

A worked example is provided in the Excel spreadsheet (see link at the top of the article).

The same approach can be used to convert WACC from the local currency to the standard currency:

US$ WACC = (1 + Local CCY WACC) x (1 + US$ inflation)/ (1 + Local CCY inflation) 1

Calculating the Cost of Debt

It may be hard to observe a cost of debt for an emerging market company, since these companies often do not have publicly traded bonds. Therefore, the cost of the debt is usually estimated using default spreads:

Kd = Rf + default spread

The default spread can be estimated by establishing a synthetic rating (using credit ratios) for the emerging market company and finding the spreads for rated comparables.

As noted above, the cost of debt should be calculated in the same currency as the cash flows to be discounted.

Cost of debt in local CCY = Risk free rate in local CCY + sovereign default spread + company default spread

Cost of debt in US$ = Risk free rate in US$ + sovereign default spread + company default spread

Calculating the Cost of Equity

A popular approach to estimate the discount rate for emerging markets companies is through estimating a Country Risk Premium (CRP). Once calculated, the CRP is included in the cost of equity calculation.

Estimating the CRP

Three methods are most commonly used to estimate CRP.

1) Sovereign default spread method:

CRP is determined as the spread between a long dated US Treasury bond and a long dated $-denominated emerging sovereign bond.

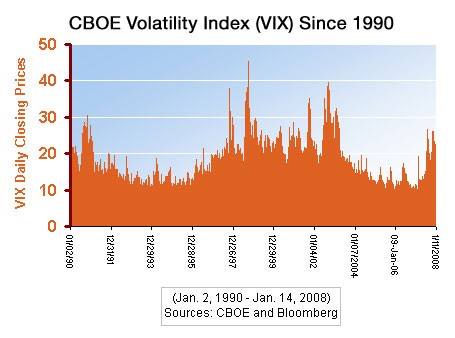

2) Relative equity market volatility method:

(sem / sus ) x ERP ERP

Where:

sem = Standard deviation of emerging equity market

sus = Standard deviation of US market (S&P 500)

EPR = estimated equity risk premium for the US

3) Composite method

(seme / sems ) x sovereign default spread

Where:

seme = Standard deviation of emerging equity market

sems = Standard deviation of local sovereign bonds

which scales up the bond default spread in (1) by the relative volatility of the local equity market relative to local sovereign bonds:

Which CRP estimation is better? This depends on your views. Method 1) only considers the bond market as a reflection of country risk. Method 2) only considers the equity market as a reflection of country risk. Method 3) allows for the possibility that equity market risk may be lower than sovereign risk and accounts for both equity and credit market factors.

A worked example is provided in the Excel spreadsheet (see link at the top of the article).

Two methods are often used to include the CRP in the cost of equity calculation, the Beta approach and the Lambda approach. This article covers the first method.

The Beta Approach

The basis for the Beta approach is the standard CAPM model, which is modified by incorporating the country risk premium within the formula.

Ke = Rf + β x (ERP + CRP)

Where:

Rf is the risk free rate based on the currency of the cash flows to be discounted

β is a levered beta estimated using the industry beta for international comparables relative to a well-diversified global index

ERP is the Equity Risk Premium calculated as the risk premium for the S&P 500 relative to US treasuries

CRP is the Country Risk Premium (described above)

The Beta approach assumes that the company’s exposure to country risk is proportional to its exposure to all other market risk (as measured by beta). Therefore, high beta stocks are be more exposed to country risk than low beta stocks.

A worked example is provided in the Excel spreadsheet (see link at the top of the article).

Calculating WACC

Having determined Cost of Equity and Cost of Debt, calculating WACC is simple:

WACC = Ke x % Equity + Kd x (1-t) x % Debt

It should be noted that emerging market companies typically have lower leverage than developed market companies. Consequently, it may be appropriate to consider a dynamic WACC through time, where leverage increases to an optimal ‘developed’ level at the end of the forecast period.