Day Trading Tutorial Technical Analysis 101

Post on: 18 Август, 2015 No Comment

Technical Analysis 101

Ok guys, this day trading tutorial is for beginners, that have little or no knowledge of stock day trading basics. I will be going over some very basic day trading definitions such as, trend, support and resistance, gaps, breakouts, etc. and illustrating them with charts. If you already have a good feel for trading basics, then just move down to the next button on the left. If not, the topics will get more complex as you move down through the buttons, so take your time to understand what’s presented here first.

If you currently have no access to a stock charting program, I recommend using freestockcharts.com or stockcharts.com while you’re in the learning stage. They are both free, however, stockcharts.com’s free charts will not allow you to make intra day charts, only daily and weekly.

For displaying charts on this site I’m using freestockcharts.com for their ease of use, but I highly recommend TradeStation or NinjaTrader for live trading. They’re both excellent charting software. Until you are actually ready to trade, or need additional stuff that freebies can’t provide, might as well save money for your trading account.

So, if you want to learn how to start day trading, you’ve got to learn day trading basics. The following terms are very simple and I’ve illustrated each with a stock chart.

When you’re done here, you can move on to the next day trading tutorial about price indicators.

OK, lets get started.

SUPPORT and RESISTANCE

Think of support and resistance as areas, rather than specific prices. They are important areas in which traders can visualize and trade against the forces of supply and demand in a specific stock. Notice in the chart below, how price respects these areas and even breaks out only to come right back inside resistance.

Support and Resistance can be used effectively not only for entries and stops, but for trailing stop exits as well. You’ll learn more about that later on the trailing stops page.

TREND

An uptrend occurs when a stock’s price makes higher highs and higher lows. A downtrend is the opposite, lower lows and lower highs.

The following chart gives an example of two uptrends and one downtrend.

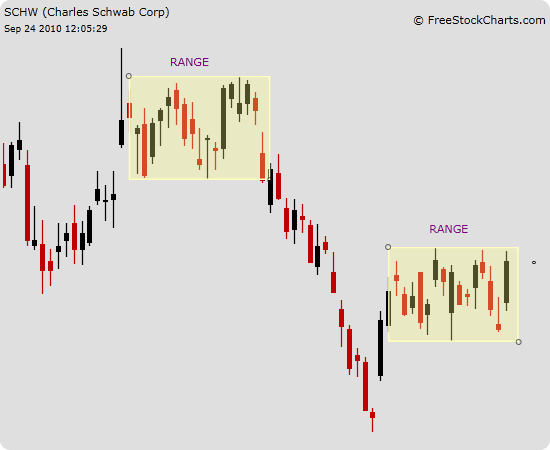

RANGE

Basically ranges are made up of sideways price action. You know you’re in a range when support and resistance is clearly defined. Price will tend to oscillate between these two areas.

CONGESTION

These areas are very difficult to trade. Price action tends to be very chaotic and without either an obvious trend or a range.

TIGHT CONSOLIDATION

These areas on a chart have a very small range of price movement. Due to their relative amount of volatility (which will be explained later) these areas tend to be ripe for trading opportunities.

MOVING AVERAGES

The daily stock chart below has three simple moving averages plotted — 20 day, 50 day and 200 day. These are the most popular averages in use.

Some traders use Fibonacci numbers for their averages and others use more complicated moving average calculations such as EMA, WEIGHTED, HULL, etc.

In my opinion, these other moving averages won’t do anything special for you. I’ve never seen any evidence that one type is consistently better than any other. If you want to use moving averages, keep it simple.

INSIDE BARS

An inside bar has both its high and low within the high and low of the previous bar. Inside bars are areas of lower volatility and can be used to your advantage.

I’ll demonstrate later how they can used as a low volatility, low risk day trading signal.

LATERALS and CONTROL BARS

One of the more important parts of this day trading tutorial, a lateral is sideways price action that is mostly confined within the limits of one wider range bar, that I call a control bar. Notice I said mostly. If price goes slightly out of the range of the control bar and comes back inside, the lateral is still active and the original boundaries can be kept.

Laterals can be a very effective setup to day trade stocks. You’ll learn how to use this valuable chart pattern as a stock trading signal using buy stop orders, later in my site.

RETRACEMENTS

Retracements, otherwise known as pullbacks are price movements in the opposite direction of the immediate price thrust. If you look closely, you will find that almost every price movement on any time frame will form a basic 1-2-3 movement.

These points of retracement make make good areas to preserve profits once in a trade. The purple lines indicate places that a trader might manually place his stop. Notice in this example, a trader could have stayed in the stock until his stop was hit when price went below the 2nd purple line.

TRENDLINES

Traders draw trendlines in many different ways. I draw mine using clear pivot points formed by price retracement. You can also draw them at a steeper or more shallow angle, depending on the acceleration of price action.

As with pivot points and bars, Trendlines offer another method of adjusting stops, called a trailing stop to exit a trade.

Trade exits are a very important part of your trading education and will be discussed later as a major component of day trading systems.

If you’re a beginner, though, please continue learning first from this day trading tutorial and the next lesson on price indicators, before moving on to more complicated subjects.

GAPS

A gap up occurs when a stock’s opening price is higher than the previous day’s high. A stock can either close the gap or it can remain open the entire day.

Gap stock techniques will be discussed in detail starting on the day trading strategies page, as they can provide excellent trading opportunities.

BREAKOUTS and VOLUME

I’m introducing you to stock breakouts in this day trading tutorial, as the method will be used extensively in my day trading blog.

A breakout occurs when a stock’s price moves beyond an established area or line of support or resistance. A breakout can be out of a previous day’s high or low, out of a tight consolidation or lateral, above or below a trendline, etc. In the day trading strategies section, I’ll go into detail on how to use breakouts as a trigger for low risk trade entries.

When a breakout occurs and you’re in a trade, you want to see higher volume relative to the immediately proceeding bars. If you don’t see higher volume, there is a higher chance that the breakout can fail and hit your stop for a loss. It’s a good idea to use a volume tool that can pro rate the volume as it’s happening in real time, that way you can possibly exit the trade early if a breakout is showing weak volume.

Find out more on how to trade using breakouts right here ==> Breakout Trading

Great! You’ve made it through my first Day Trading Tutorial — Technical Analysis 101. The charts and terms above are the building blocks of day trading setups. Later I’ll be going through how to use setups and triggers to find low risk entries.

For now though, I’d like to show you some more day trading basics. If you’re ready, go on to the next day trading tutorial, Price Indicators.