Day Trading Strategies Swing Trading Strategies

Post on: 29 Апрель, 2015 No Comment

The stock will be thoroughly analyzed using a combination of technical analysis and fundamental analysis.

What is day trading?

Day trading is when you buy and sell stocks during intraday. The time frame that you hold your stock can be as short as 1 minute. Day traders close out their positions before the market close each day.

Whats the requirement for day trading?

You should open a margin account to start day trading. A margin account is a brokerage account that allows the broker to lend you cash to purchase stocks meaning you can try with more money than you have in your account.

Is day trading right for you?

If you are a beginner, then day trading is not right for you as it can be really risky. One reason is that now you are buying more shares than you can afford by using margin account. Using margin account to trade doubles your gains and losses.

Day Trading Strategies

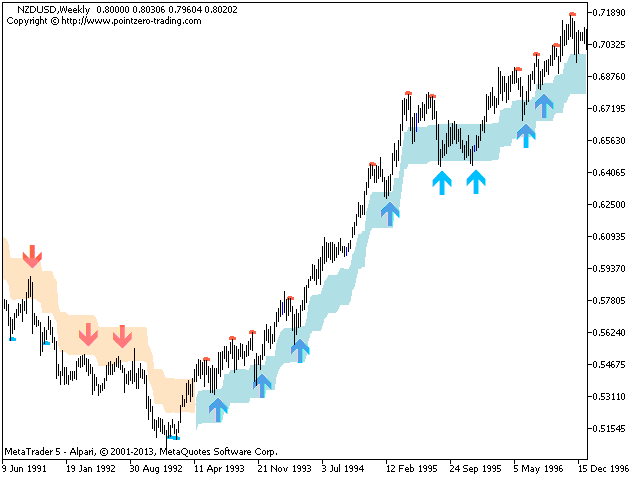

1. Trend Trading - When you day trade, you no longer buy low and sell high. You usually buy high and sell higher. This is is the concept that day traders uses to predict the trend. They believe that a stock that is rising will continue to go up and a stock that is falling will continue to go down.

2. Learn to short stocks Do you notice that stocks go down in a faster rate than for it to go back up? The reason is people are more panic when stocks go down than when they go up. It takes much longer for people to finally decide to buy a stock when the stock is rallying, they always wanted to wait for the stock to pull back and buy at a cheaper price. On the other hand, if the stock is down 5% and the general stock market is falling, people just want to get out the market and sell as quickly as they can. For this reason, shorting stocks is profitable for day trading.

3. Discipline — Day traders require a much stricter discipline than swing traders or longer term investors. You must follow your trading rules and never break it.

4. Stop Loss Day traders have a much smaller stop loss than swing traders or longer term investors. You should test it out yourself, but should limit your stop loss to less than 1%.

5. Risk versus Reward Every time you enter a trade, you must analyze the risk and reward. The risk-reward ratio must be at least 1:3 for you to enter the trade.

6. Analyze Chart You must be good at reading stock charts and have a good understanding of technical analysis. You will be analyzing stock charts to make entry and exit decisions.

7. Stay Alert You must stay alert and listen to stock market news from CNBC or bloomberg. In addition, you must know what kind of news that will affect the stock market before the market opens for the day. For example, jobless claims are reported every Thursday at 8:30am and have huge impact on the stock market. You must have a plan before you trade on that day.

If you like what you read, you may want to subscribe to my newsletters for free. Just fill out the form below, and you will receive stock picks and trading strategies from me in the future.