Day Trading Strategies

Post on: 30 Апрель, 2015 No Comment

What is day trading?

Day trading also known as intraday trading, is a way for traders to buy and sell stocks during the same day. There are traders who make millions from day trading in the stock market, and there are other traders who go broke with day trading. Day trading is both an art and a science. It takes time and patience to master day trading skills. How long does it take? It differs for every individual. Some day traders are able to make a good profit in the first few months and day trading for a living within a few years while it takes much longer for others.

How to day trade online?

In order to day trade online, you need to first open an account with a stock broker. The following online stock brokers are pretty good that you may consider.

1. OptionsHouse With $3.95 per trade, they offers the cheapest commission cost among all online stock brokers.

2. Zecoo $4.95 per stock trade.

3. TradeMonster $7.50 per stock trade.

You need to open a margin account with your stock broker and a minimum deposit of $25,000 for day trading online. However, if you dont have $25,000 to start with, you can still day trade 3 times a week with a margin account.

Whats the day trading secret?

Is there a day trading secret? The answer to this question is no. So why do some traders make money while others lose money? There are many reasons, it could be the losers are too greedy or scared, it could be that they are using the wrong software or following the wrong expert advices. In fact, day trading is not as hard as some people imagine, but there are certain rules that every day trader should follow because these could become the break or make for their trading career.

Day Trading Strategies

If you are new to trading, I dont suggest you to day trade immediately. You should start with swing trading and move on to day trade when you gain more experiences and confidences. Swing trading is when traders buy their stocks and hold it anywhere from a few days to a few weeks. The reason why you should first start with swing trading is day trading requires more skills, discipline and experiences. Also, there is much more risk involved with day trading than swing trading. If you are ready to day trade online, here are some day trading strategies that you can use to make money.

1. Learn Technical Analysis

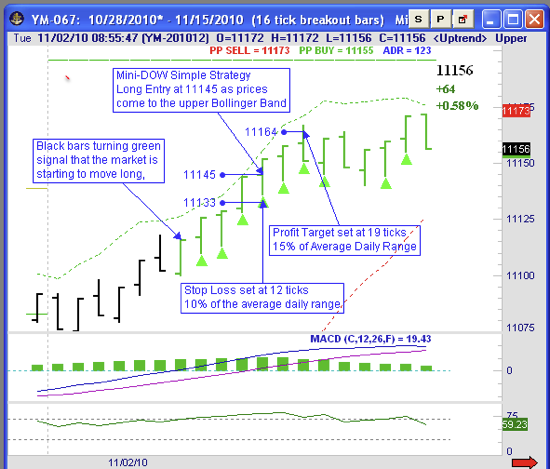

- You must learn technical analysis and how to apply technical indicators. You must be able to recognize support & resistance. The general rule is try to buy stocks at the support level and sell them when it reaches resistance.

2. Learn to Read Stock Charts

- You must be able to read stock charts and recognize profitable stock patterns so you can buy when the pattern looks bullish and sell when a stock looks bearish. Candlestick charts are especially important as they are very powerful in stock trading.

3. Set Stop Loss

- You must have a very narrow stop loss, usually within 0.5%. Whenever you enter a trade, you must first calculate the risk, if the risk is greater than 0.5%, then you skip that trade. Remember, there are thousands and thousands of entry point out there, if you miss this one, there is always a next.

4. Discipline

- You must be discipline and follow your rules 100% of the time. The number 1 reason why traders lose money in the stock market is that they are not discipline. For example, if your stop loss is 0.5%, then you should always follow the rule. Whenever, your stop loss is hit, you should sell or cover your stock. Remember, you dont have to be right 100% of the time to make a living day trading stocks. Your discipline will get paid off in the run long.

5. Read or Listen to Market News

- You must be alert to economic news. There are certain news that will affect the stock market such as the weekly jobs report (Thursday 8:30am), the month unemployed data (first Friday of every month at 8:30am). These news will shake the stock market from time to time, and you must watch out for them in order to avoid big losses or missing profitable trades. You should watch CNBC or listen to the Bloomberg radio everyday so you can learn whats going on in the stock market.

6. Read a lot of trading books Learn from the successful traders and investors. It never hurts to learn more, and you should keep reading books on the stock market or day trading strategies. This is the way how I learn to trade stocks and eventually turn myself into a profitable day trader.

Day Trading Softwares

There are a bunch of day trading softwares out there, but the only two I like and are currently using are

1. MarketClub It uses an advanced triangle technology to scan the stock market and gives me signals on what stocks to buy.

2. Stock Assault It is a 100% automated artificial intelligence stock picking software.

The above two softwares have helped me found a bunch of stocks that made big profits in the past and I believe they will continue to do so in the future. Remember, if you are investing $5,000 in the stock market, a 5% lost will cost you $250. Why not invest your $250 in a software that can potentially turn your $5,000 into $10,000.