Day Trading Indicators Advance Decline Line

Post on: 8 Июнь, 2015 No Comment

Not All Day Trading Indicators Are Created Equal

There are dozens if not hundreds of different day trading indicators traders use to help them gauge short term market action. One of the most important and often misunderstood indicators is the (NYSE) Advance Decline Line. The ADL is a different type of indicator; its called an internal market indicator or market breadth indicator because it measures the cumulative sum of the daily difference between the number of issues advancing and the number of issues declining in the NYSE. Thus it moves up when the index contains more advancing than declining issues, and moves down when there are more declining than advancing issues.

How Is The ADL Different From Index Contracts

The ADL measures market strength and weakness differently than the SP 500 Index, NASDAQ or the NYSE Index because these instruments are capitalized weighted, which means they allocate more weight to very large companies and less weight to smaller companies that make up the index. The ADL line is cumulatively weighted which in allocates weight equally to all stocks that make up the index. This provides a more balanced few of market internals than stock indices and offers a different view of the stock market.

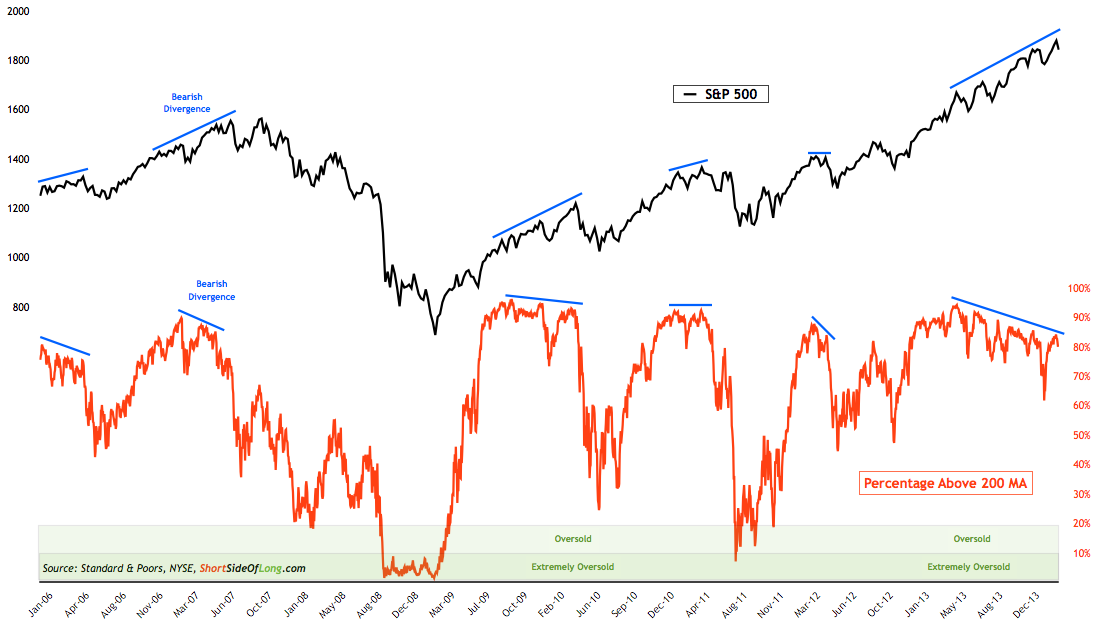

Divergence Between ADL and NYSE Index

Of the most reliable methods professional traders utilize the Advance Decline line is by watching for divergence between the stock market and the ADL. Often times you will notice that the stock index is rallying upwards while the ADL line is beginning to come down, this is sign of divergence between the two instruments and often times signals that the stock market is running out of steam. I find that divergence analysis works especially well for short term price swings or as a confirmation indicator when Im day trading. Let me show you a few divergence examples so you can get a good feel for trading this method and making the Advance Decline Line part of your day trading indicators toolbox.

In this example the NYSE makes two higher peaks during the second week of February of this year. The second high is not substantially higher than the first one but its still higher. When you see patterns similar to this one you should compare it to the Advance Decline Line to see if the momentum is continuing or declining across the entire exchange. This will give a clearer picture of the stock market as a whole instead of a handful of large cap stocks that dictate the majority of the trading action on the NYSE.

Notice The NYSE Made Two Higher Peaks

Notice how the Advance Decline Line is moving down during the same time period. This demonstrates to me that the stock market is running out of steam and setting up for a sell off. I go through this type of exercise each day after the close to see if momentum is across the entire stock market or just a few stocks.

Eventually the NYSE Index catches up to the ADL and begins moving in the same direction. Remember the ADL uses every stock in the index equally and the NYSE is capitalized weighted so large cap stocks that have a lot of institutional buying move before other small stocks get a chance to follow. This creates a lagging response between the large stocks and the smaller stocks and this is what you want exploit by doing divergence analysis. You can see in this example how the NYSE turns down and follows the ADL right after the divergence occurs.

Another Divergence Example

You can see how the NYSE is making higher highs in mid January of this year. I typically measure the divergence between the two instruments between 3 and 5 days. This way I can see if the NYSE and the ADL are catching up to each other or are moving further away. With time you will get a good feel for spotting divergence between the instruments.

The NYSE Is Swinging Higher Earlier This Year

The Advance Decline Line is moving sharply down during the same period of time as the NYSE is making higher highs. You can see how the broad market is beginning to turn down while the large cap stocks driving the NYSE are still being accumulated. It only takes a few days for the NYSE to catch to the ADL so make sure you monitor divergence carefully between the two for short term trading opportunities and confirmation signals for other patterns or indicators.

You can see in this example how the NYSE sells off and begins moving in a downtrend along with the ADL. It doesnt take a long time for the large caps to realize that the smaller stocks are losing momentum and begin moving in the same direction. Therefore you must take advantage of these opportunities as soon as you see them.

NYSE Begins Selling Off Just Like The ADL

Things To Keep In Mind

When using the Advance Decline Line in your analysis always remember to compare it to the NYSE stock index. While there are other advance decline lines for indexes such as the Nasdaq Exchange I highly recommend you stick with the NYSE stock exchange and the Advance Decline Line based on that exchange for the most accurate divergence analysis.

Always remember that the index is driven by a few very large cap stocks and the ADL is driven by all stocks regardless of size. The large cap stocks usually lead the index but eventually they catch up to the rest of the stock market. You need to understand this concept because the concept of divergence between the Advance Decline Line and the Index is based on this concept.

Next time I will demonstrate additional indicators that will help you gauge market strength and weakness with precision. For more on this topic, please go to: Support And Resistance Trading Tactics and Best Technical Indicators Learn The Stair Step Method